Uplift

Founded Year

2014Stage

Acquired | AcquiredTotal Raised

$292.7MValuation

$0000About Uplift

Uplift develops a fintech marketing platform for traveling purposes. The platform offers a buy now pay later scheme for travel through its partner websites and avails a range of payment plans. The company was founded in 2014 and is based in Sunnyvale, California. In July 2023, Uplift was acquired by Upgrade.

Loading...

Uplift's Product Videos

ESPs containing Uplift

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Uplift named as Challenger among 15 other companies, including PayPal, Affirm, and Klarna.

Uplift's Products & Differentiators

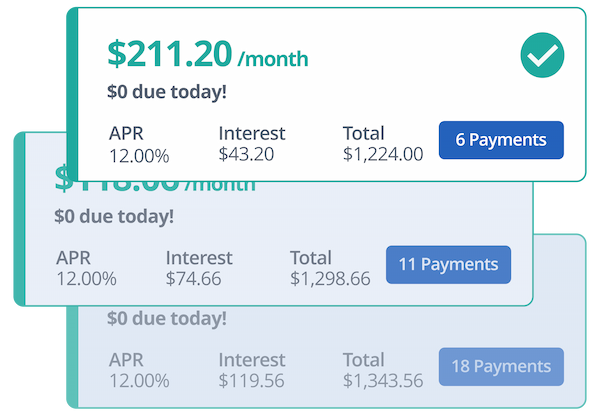

Pay Over Time

Monthly installment plan from 3 - 24 months with consumer funded interest from 7% - 36%. Min installment amount $100, maximum installment amount $25,000.

Loading...

Research containing Uplift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uplift in 1 CB Insights research brief, most recently on Oct 3, 2023.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Uplift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uplift is included in 5 Expert Collections, including Travel Technology (Travel Tech).

Travel Technology (Travel Tech)

2,715 items

The travel tech collection includes companies offering tech-enabled services and products for tourists and travel players (hotels, airlines, airports, cruises, etc.). It excludes financial services and micro-mobility solutions.

Digital Lending

2,470 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,034 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,295 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Uplift Patents

Uplift has filed 13 patents.

The 3 most popular patent topics include:

- analog circuits

- electric power conversion

- electronic amplifiers

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/15/2021 | 9/3/2024 | Semiconductor lasers, Total solar eclipses, Solar phenomena, Machine learning, Irregular military | Grant |

Application Date | 4/15/2021 |

|---|---|

Grant Date | 9/3/2024 |

Title | |

Related Topics | Semiconductor lasers, Total solar eclipses, Solar phenomena, Machine learning, Irregular military |

Status | Grant |

Latest Uplift News

Jun 6, 2024

The global market for BNPL services has grown rapidly over the past five years, spurred on in part by the strong growth in e-commerce during the pandemic years. In 2023, Gross Merchandise Value using BNPL services exceeded $300 billion (USD) worldwide, up from $128.6 billion (USD) in 2019. Canadian BNPL expenditure on online purchases amounted to $12.3 billion (CAD) in 2023, representing 16.2% of online sales and 1.6% of retail sales. Growth in BNPL GMV for e-commerce purchases in Canada is expected to exceed 30% p.a. (CAGR) over the period 2023 to 2028. By 2028, Canadian online BNPL will account for 4.1% of global online GMV. More than 70% of all online BNPL users in Canada were from the Gen Z and Millennial generational segments in 2023, according to the report, but adoption in the older segments is increasing suggesting significant headroom for growth across all segments. Competition in the online BNPL space in Canada is intense, with most of the large global fintech BNPL service providers having entered the Canadian market in the past few years. Major credit card issuers in Canada have also started offering online BNPL services and have captured a significant share of the market in a relatively short time span, according to the report. The Canadian Tire Triangle Card BNPL offering has gained the most traction in Canada. The report examines the financial metrics of three key players in the fintech BNPL space and highlights some of the challenges facing the industry in terms of profitability, credit losses and funding costs. It goes on to predict that BNPL product innovation will play an important role in shaping the future of online BNPL in Canada and, while Canadian regulatory authorities have adopted a 'wait and see' approach, a strong regulatory response could have a dampening impact on the market. Growth in the market is being driven by increasing adoption, higher frequency of use, and higher average order values. This is being stimulated by intense competition, especially between fintech BNPL service providers and traditional credit BNPL providers, with product innovation playing a major role in the battle for both consumers and merchants. Additional highlights from the study are: Millennials account for the largest share of online BNPL expenditure in Canada Electronics dominates online BNPL expenditure by category, while Clothing, Footwear and Accessories has the highest proportion of BNPL users making purchase in that category Four online BNPL service providers in Canada have a GMV of more than $1 billion The Prospects for Online BNPL in Canada 2024 report provides a deep dive into the Canadian online BNPL market, examining key players, market segments and trends, the supply structure, delivery mechanisms, the competitive environment, regulatory developments, and the implications for both consumers and businesses. The central aim of this report is to provide actionable insights into the current state of the online BNPL market in Canada and the most important factors shaping its future trajectory. The forecast horizon is the five year period to 2028, with 2023 as the base year. Drawing on survey research from more than 2,000 Canadian consumers, the report is a critical strategic resource for payment professionals active in the BNPL market, providing in-depth insights and forecasts to facilitate effective strategic planning, competitive positioning and product development in this highly dynamic marketplace. Companies Featured The Evolution of BNPL

Uplift Frequently Asked Questions (FAQ)

When was Uplift founded?

Uplift was founded in 2014.

Where is Uplift's headquarters?

Uplift's headquarters is located at 440 N. Wolfe Road, Sunnyvale.

What is Uplift's latest funding round?

Uplift's latest funding round is Acquired.

How much did Uplift raise?

Uplift raised a total of $292.7M.

Who are the investors of Uplift?

Investors of Uplift include Upgrade, Atalaya Capital Management, Paycheck Protection Program, PAR Capital, Ridge Ventures and 11 more.

Who are Uplift's competitors?

Competitors of Uplift include Kadogo and 7 more.

What products does Uplift offer?

Uplift's products include Pay Over Time and 1 more.

Loading...

Compare Uplift to Competitors

Zilch is a financial services company specializing in consumer credit and payment solutions. The company offers a 'Buy Now, Pay Later' service that allows customers to make purchases and pay for them over a six-week period in four installments, with the option to pay upfront and receive cashback rewards. Zilch provides a virtual Mastercard to facilitate transactions and promotes responsible spending with features like payment notifications and tailored spending limits. It was founded in 2018 and is based in London, United Kingdom.

Klarna specializes in providing payment solutions and services within the e-commerce sector. The company offers a platform for online shopping that includes price comparisons, deals, and various payment options to facilitate purchases for consumers. Klarna primarily serves the e-commerce industry by enabling a seamless shopping experience through its payment and financing services. It was founded in 2005 and is based in Stockholm, Sweden.

PayItLater is a financial services company specializing in deferred payment solutions for the e-commerce sector. The company offers consumers the ability to make online purchases and pay for them over time through interest-free installment plans, with instant credit approvals and no impact on credit scores. PayItLater also provides merchants with plugins for major e-commerce platforms, enabling them to offer live deferred payments to customers. It is based in New South Wales, Australia.

Butter is a company that focuses on financial services in the ecommerce sector. It offers a service that allows customers to make online purchases and pay for them over time, including for items such as travel, fashion, tech, and home goods. The company primarily serves the ecommerce industry. Butter was formerly known as Awaymo. It was founded in 2017 and is based in London, England.

Partial.ly is a company specializing in payment plan software within the e-commerce and invoicing sectors. They provide a platform that enables merchants to offer flexible, automated installment payments for products and services, catering to both e-commerce businesses and service providers with large invoices. The software integrates with various e-commerce and invoicing systems, allowing businesses to offer custom payment terms to their customers. It was founded in 2015 and is based in Tampa, Florida.

Anyday provides payment splitting services within the financial services sector. It offers consumers the ability to split their online shopping payments into interest-free installments, enhancing the shopping experience with flexible payment options. The company primarily caters to the e-commerce industry, offering a payment solution that allows shoppers to buy now and pay later without incurring additional fees. It was founded in 2020 and is based in Aarhus N, Denmark.

Loading...