AlphaSense

Founded Year

2011Stage

Series F | AliveTotal Raised

$1.397BValuation

$0000Last Raised

$650M | 3 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+21 points in the past 30 days

About AlphaSense

AlphaSense develops a market intelligence platform. Its Artificial Intelligence (AI) technology aims to help professionals make business decisions by offering insights from private content, such as company filings, event transcripts, expert call transcripts, news, trade journals, and equity research. It serves consulting, energy, financial services, life science, and other sectors. It was founded in 2011 and is based in New York, New York.

Loading...

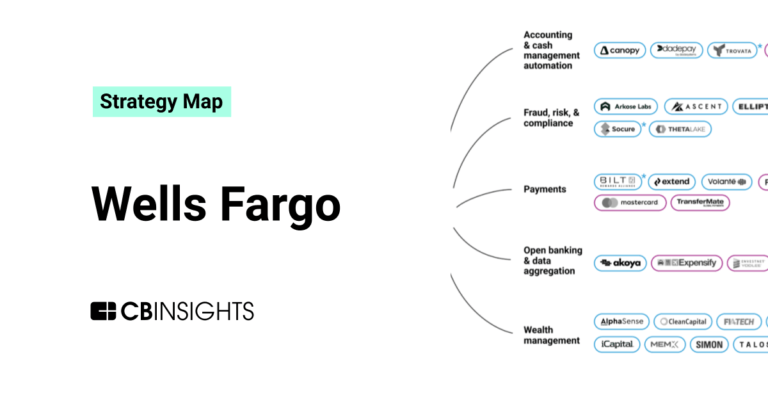

ESPs containing AlphaSense

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The institutional investment analytics and insights market refers to a range of software and services that provide investment managers with tools to help them make informed investment decisions and optimize their portfolios. These solutions typically include investment research, data analysis, risk management, and performance attribution capabilities. The market for institutional investment analyt…

AlphaSense named as Leader among 9 other companies, including S&P Global, SESAMm, and Incorta.

AlphaSense's Products & Differentiators

AlphaSense Core Search (newest release: AlphaSense X)

AlphaSense is the leading market intelligence platform leveraging cutting-edge technology to continuously filter and analyze billions of fragmented pieces of information. We apply the power of AI to an extensive library of high value unstructured and structured data-sets, enabling business professionals to make critical decisions with confidence.

Loading...

Research containing AlphaSense

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned AlphaSense in 6 CB Insights research briefs, most recently on Jul 16, 2024.

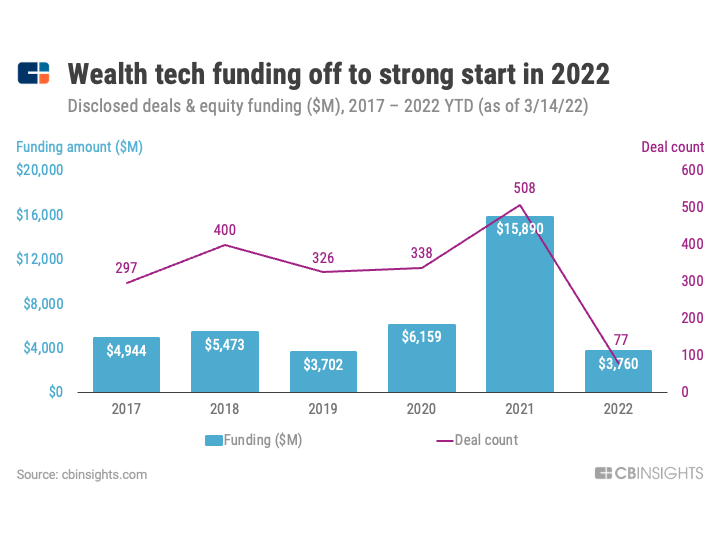

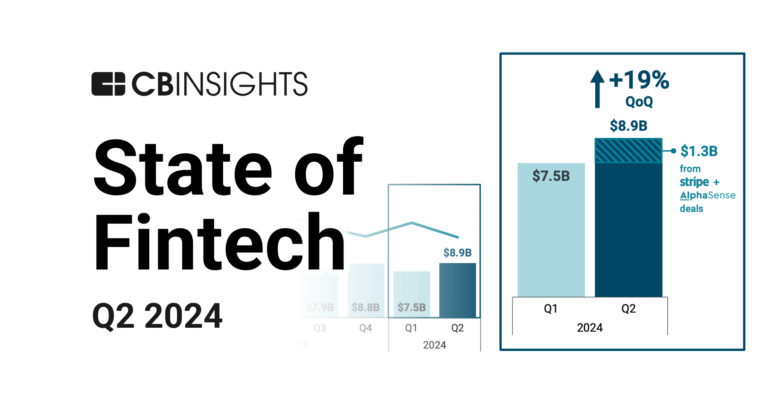

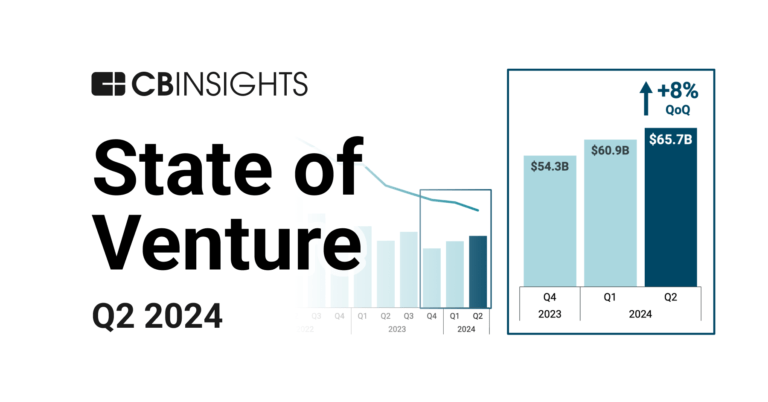

Jul 16, 2024 report

State of Fintech Q2’24 Report

Jul 3, 2024 report

State of Venture Q2’24 Report

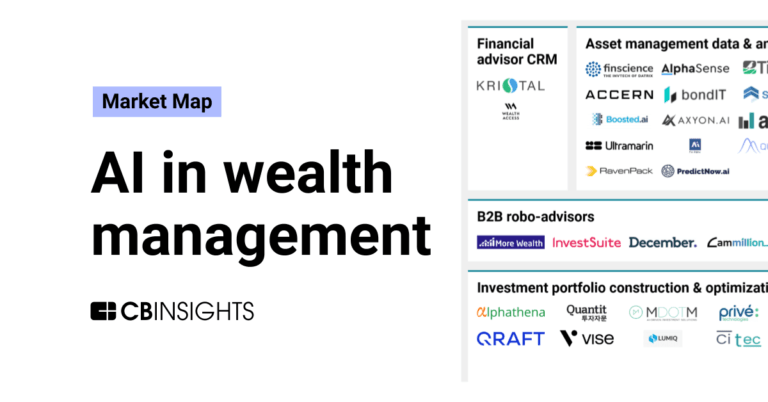

Oct 6, 2023

The AI in wealth management market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing AlphaSense

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

AlphaSense is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Fintech 100

1,097 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Capital Markets Tech

1,001 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Artificial Intelligence

14,769 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

9,295 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

AlphaSense Patents

AlphaSense has filed 32 patents.

The 3 most popular patent topics include:

- computational linguistics

- natural language processing

- data management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/20/2023 | 7/2/2024 | Natural language processing, Computational linguistics, Data management, Database management systems, Information retrieval genres | Grant |

Application Date | 9/20/2023 |

|---|---|

Grant Date | 7/2/2024 |

Title | |

Related Topics | Natural language processing, Computational linguistics, Data management, Database management systems, Information retrieval genres |

Status | Grant |

Latest AlphaSense News

Sep 16, 2024

Startup Buying Power — VC-Backed Companies Are Hunting For More Startups Views: 1 It’s not exactly a shopping spree, but with overall M&A down, more startups are hunting for other VC-backed companies in the U.S. In fact, startups buying other startups is on pace to make up the largest slice of the M&A pie in years when it comes to overall VC-backed, U.S.-based startup dealmaking. This is a noteworthy development in the current environment where venture capitalists and their limited partners are thirsting for liquidity amid a frozen IPO pipeline and quiet M&A market. Through the first two-thirds of the year, 252 deals were consummated involving startups buying other startups in the states, per Crunchbase data . That number represents 39% of all M&A deals for U.S.-based startups — the highest percentage in at least a decade. The percentage is especially striking when considering from 2015 to 2020, startups buying other startups in the states never made up more than 29% of all M&A deals for U.S.-based startups. Last year, that number was 35%. Such deals this year also are outpacing 2023’s deal count numbers — which saw only 296 deals total. Biggest deals Of course, representing a larger portion of M&A in a year when dealmaking is down won’t make most investment bankers turn their heads. However, it is important to note that aside from the aberration of 2021 and then 2022, startups are on pace to buy more startups in the U.S. than in any other year in the past decade. Also, while there have yet to be any billion-dollar deals of startups buying U.S.-based startups this year like Databricks ’ $1.3 billion acquisition of OpenAI competitor MosaicML in 2023, there have been some notable ones. The three biggest acquisitions dollar-wise to date are: In June, AI-driven market intelligence platform AlphaSense raised $650 million in funding at a $4 billion valuation while also announcing it had acquired expert research startup Tegus for $930 million. Just last month, unicorn LetsGetChecked acquired digital pharmacy startup Truepill for $525 million. It was reported LetsGetChecked plans to raise approximately $150 million via a convertible note offering to help finance the deal. In March, cloud cybersecurity firm Wiz bought cloud threat prevention startup Gem Security for $350 million in a cash deal. Just two months later, Wiz locked up the biggest cybersecurity round of the year thus far as it raised $1 billion at a $12 billion valuation. More buying power Those deals also likely illustrate some trends as to why more startups are buying startups domestically. First off — and likely most obviously — is the size of many VC-backed companies now. All three acquirers are unicorns — $1 billion valuation or more — and Wiz’s valuation is a whopping $12 billion. Companies can reach such high valuations more easily than ever as venture has poured into the market — it is now a significant asset class — and allows startups to stay private longer and get bigger. As those companies grow, they simply begin to act more as we expect large public companies, including their desire for inorganic growth for innovation, talent or even revenue. In fact, LetsGetChecked’s deal reportedly was mainly through stock — a very public company-like move. The other common trait of the above three deals — which relates to the first — is these companies’ ability to raise capital when necessary to complete a deal. Both AlphaSense and LetsGetChecked raised (or reportedly raised) cash in connection with consummating their deals. Wiz raised a massive round just months after its Gem acquisition. Of course, there are other reasons too. Valuations on many startups have dropped in recent quarters as the venture market has cooled, which likely has made some VC-backed companies in the U.S. more easily persuaded to sell. However, the trends of more mature, venture-backed companies hitting high valuations and looking to become bigger, and those companies being able to raise large sums of cash when necessary, likely is not changing anytime soon. With that being the case, you can expect more startups eyeing their brethren for dealmaking in the future. Related Crunchbase Pro lists:

AlphaSense Frequently Asked Questions (FAQ)

When was AlphaSense founded?

AlphaSense was founded in 2011.

Where is AlphaSense's headquarters?

AlphaSense's headquarters is located at 24 Union Square East, New York.

What is AlphaSense's latest funding round?

AlphaSense's latest funding round is Series F.

How much did AlphaSense raise?

AlphaSense raised a total of $1.397B.

Who are the investors of AlphaSense?

Investors of AlphaSense include Viking Global Investors, Goldman Sachs, CapitalG, SoftBank, Blue Owl Capital and 33 more.

Who are AlphaSense's competitors?

Competitors of AlphaSense include Preqin, Hebbia, Auquan, SESAMm, Amenity Analytics and 7 more.

What products does AlphaSense offer?

AlphaSense's products include AlphaSense Core Search (newest release: AlphaSense X) and 3 more.

Loading...

Compare AlphaSense to Competitors

YCharts operates as a financial research and proposal platform within the financial services industry. The company provides inclusive data, visualization tools, and analytics for equity, mutual fund, and exchange traded fund (ETF) data and analysis, enabling investment professionals to improve client engagements and simplify complex financial topics. YCharts primarily serves the financial advisory and asset management sectors. It was founded in 2009 and is based in Chicago, Illinois.

Prosights specializes in providing a research platform tailored for private equity investors within the financial services domain. The company offers tools for private investment analysis, including financial data aggregation and insights into market trends. It primarily serves professionals in the private equity and investment sectors. The company was founded in 2024 and is based in San Francisco, California.

Koyfin is a financial data and analytics platform focused on equipping investors with comprehensive market insights and analysis tools across various asset classes. The company offers live market data, advanced graphing, customizable dashboards, and a suite of features to support investment decisions for a range of financial instruments including stocks, mutual funds, and more. Koyfin primarily serves independent investors, financial advisors, traders, research analysts, students, and enterprise clients with its data-driven solutions. It was founded in 2016 and is based in Miami, Florida.

280First is a financial services platform operating in the financial technology sector. The company's main service involves analyzing unstructured data from various sources to produce actionable insights from financial documents for investment professionals. The primary customer base of 280First includes investment professionals. It is based in Redwood City, California.

Canoe focuses on alternative investment technology, particularly on automating document and data workflows for the financial sector. The company offers cloud-based machine learning solutions for document collection, data extraction, and data science initiatives, transforming complex documents into actionable intelligence. Canoe primarily serves institutional investors, asset servicers, capital allocators, and wealth managers with its technology. It was founded in 2017 and is based in New York, New York.

Slingshot Insights is a company that focuses on the financial services sector, specifically in the area of investment research. The company provides a platform where investors can conduct due diligence on stocks by interacting with experts, management teams, and through surveys. It also offers a feature for tracking upcoming strategic initiatives and catalysts. It is based in New York, New York.

Loading...