Banked

Founded Year

2018Stage

Series A - II | AliveTotal Raised

$39.81MLast Raised

$15M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-63 points in the past 30 days

About Banked

Banked is a financial technology company specializing in real-time payments for consumers, businesses, and banks within the fintech sector. The company offers a suite of products that facilitate fast, secure, and simple account-to-account payments, including a modular checkout solution, payment links, and QR codes, as well as services for payouts, refunds, and fraud management. Banked's solutions are designed to improve payment security, enhance business efficiency, and reduce costs associated with traditional payment methods. Banked was formerly known as StudioH67. It was founded in 2018 and is based in London, England.

Loading...

Banked's Product Videos

ESPs containing Banked

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The account-to-account (A2A) payments infrastructure market focuses on facilitating secure and direct electronic transfers of funds between bank accounts. This market offers a range of solutions and technologies that enable seamless, real-time, and cost-effective transactions without the need for intermediaries or traditional payment methods. By embracing A2A payments infrastructure, businesses an…

Banked named as Challenger among 15 other companies, including Visa, Stripe, and PayPal.

Banked's Products & Differentiators

Payments

Checkout Button, QRC, Paymentlink

Loading...

Research containing Banked

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Banked in 3 CB Insights research briefs, most recently on Aug 23, 2024.

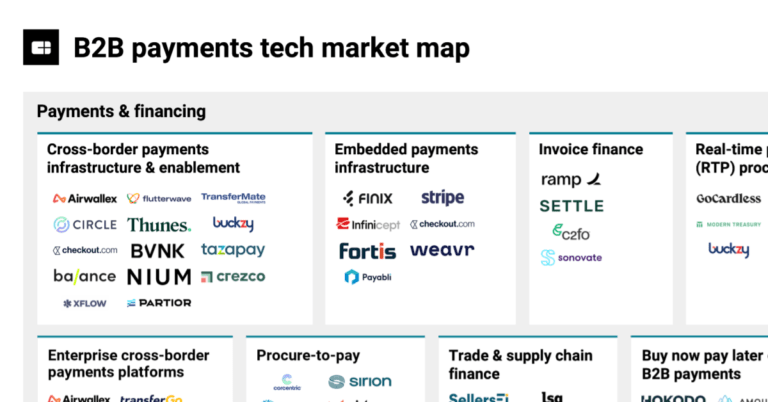

Aug 23, 2024

The B2B payments tech market map

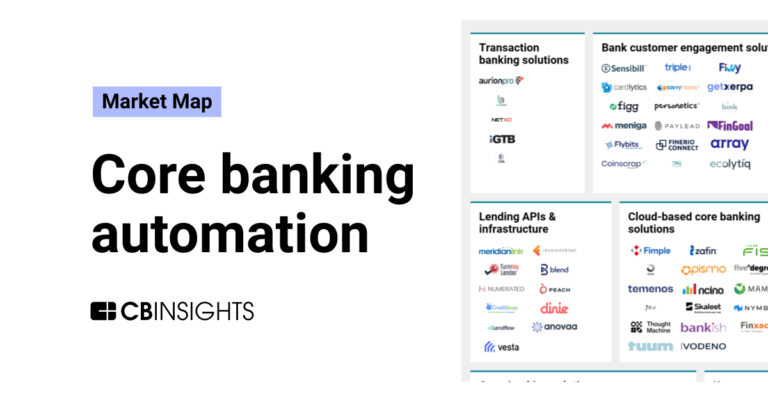

Jan 4, 2024

The core banking automation market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Banked

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Banked is included in 2 Expert Collections, including Fintech.

Fintech

13,398 items

Excludes US-based companies

Fintech 100

100 items

Latest Banked News

Aug 1, 2024

Today Customers of fintech lender Plenti now have a new way to make additional loan repayments, made possible with National Australia Bank's (NAB) Pay by Bank solution, which enables PayTo transactions. This technology, developed by global fintech Banked in partnership with NAB, allows for fast and secure payments directly from a user's bank account. Plenti is the first NAB business customer to integrate this new account-to-account payment solution into their online lending platform. This integration allows their customers to make real-time, secure payments via PayTo and expedite their debt repayments. Glenn Riddell, Co-founder and Chief Operating Officer of Plenti, remarked on the new payment option: "We wanted to offer our customers a faster, smarter, and more convenient way to make payments to their Plenti loans. PayTo ticked all these boxes. Customers making extra loan payments will be the first to access Plenti's instant PayTo option, and we look forward to working with NAB to make PayTo payments more widely available across our platform." NAB and Banked are working together to enhance the digital payments landscape in Australia, aiming to accelerate the adoption of Pay by Bank technology using Australian Payments Plus (AP+) PayTo services. This move is designed to offer merchants and consumers more choice and control over their payment methods. NAB's Executive Transaction Banking and Enterprise Payments, Shane Conway, highlighted the benefits for businesses adopting the technology. "NAB's Pay by Bank solution can help business customers improve cash flow, speed up reconciliation processes, reduce fraud risk, and save money," he said. "The improved payment experience for consumers is also a key benefit for businesses enabling PayTo, which offers a faster, more secure, and enhanced experience compared to other payment options such as Direct Debit and BPAY." Conway added, "Our Pay by Bank solution has been designed to seamlessly integrate into various payment systems, making it easy for more businesses to unlock the benefits of real-time payments. We’re excited to see PayTo live in the market on the Plenti lending platform and we hope to see a rapid uptake of Pay by Bank across a range of industries including insurance, government, utilities, and retail." Brad Goodall, CEO of Banked, also commented on Plenti's adoption of the PayTo solution. He said, "The switch to PayTo by Plenti is a testament to the technology we have built and the strong partnership we have forged with NAB to deliver a better way of paying that is beneficial to consumers and merchants alike. Plenti's decision to use PayTo showcases the success of our partnership in action, providing Australians with more choice and control in the way they pay." NAB Consumer Sentiment Survey data indicates that one in five Australians is making an effort to pay down debt to manage the higher cost of living. The integration of PayTo is seen as a progressive step towards assisting individuals in this endeavour. NAB's Pay by Bank solution utilises Australian Payments Plus PayTo services and has been developed in conjunction with fintech Banked. The collaboration between these entities underscores their commitment to revolutionising the payments sector in Australia. Follow us on:

Banked Frequently Asked Questions (FAQ)

When was Banked founded?

Banked was founded in 2018.

Where is Banked's headquarters?

Banked's headquarters is located at Floor 4, 8, London.

What is Banked's latest funding round?

Banked's latest funding round is Series A - II.

How much did Banked raise?

Banked raised a total of $39.81M.

Who are the investors of Banked?

Investors of Banked include Citi Ventures, Insight Partners, NAB Ventures, Rapyd Ventures, Paul Forster and 14 more.

Who are Banked's competitors?

Competitors of Banked include Vyne and 4 more.

What products does Banked offer?

Banked's products include Payments and 3 more.

Who are Banked's customers?

Customers of Banked include Bank Of America, Rapyd, Thunes, PC Specialist and Blue Motor Finance.

Loading...

Compare Banked to Competitors

Volt focuses on the development of real-time payment solutions, operating within the financial technology sector. The company offers a platform enabling instant notifications, real-time reporting, fraud prevention, payment tracking, unified commerce, customer bank account verification, and conversion of card payments into open banking payments. Volt primarily serves the e-commerce industry. It was founded in 2019 and is based in London, United Kingdom.

TrueLayer provides an open banking platform, specializing in the financial technology sector. The company provides solutions for instant bank payments, verified payouts, and streamlined user onboarding, leveraging real-time financial and identity data. TrueLayer primarily serves businesses in the ecommerce, iGaming, financial services, and cryptocurrency sectors. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, England.

Trustly Group is a global company that focuses on providing open banking solutions in the financial services sector. The company offers a range of services including facilitating secure and low-cost payments, instant payouts, and expedited customer onboarding. Additionally, it serves various sectors of the economy including the eCommerce industry, financial services, and gaming. It was founded in 2008 and is based in Stockholm, Sweden.

Yaspa operates as a fintech company specializing in instant payments and identity services within the financial technology sector. The company offers a suite of products that enable payments and deposits, instant payouts, and comprehensive account verification services for regulated businesses. Yaspa primarily serves industries such as iGaming, eCommerce, electronic point-of-sale systems, utilities, charities, and trading. Yaspa was formerly known as Citizen. It was founded in 2017 and is based in London, United Kingdom.

Loyalize offers an engagement platform for retailers and financial institutions to connect customers with the loyalty program. The company's platform helps retailers save money on transaction fees and improve the customer experience by adding more value to the payment journey. The company was founded in 2019 and is based in London, United Kingdom.

Neonomics is a company that focuses on open banking and operates within the financial technology sector. The company offers services such as facilitating payments and providing financial data integration, all through a unified PSD2 API. These services primarily cater to the fintech industry, payment service providers, and banks. It is based in Oslo, Norway.

Loading...