Checkout.com

Founded Year

2012Stage

Valuation Change - II | AliveTotal Raised

$1.83BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+16 points in the past 30 days

About Checkout.com

Checkout.com offers companies to accept payments around the world through one application program interface. It facilitates an integrated payment processing platform allowing the processing of payments in real-time, sending payouts, issuing, processing, and managing card payments. It also offers fraud prevention and secure authentication. The company was formerly known as Opus Payments. It was founded in 2012 and is based in London, United Kingdom.

Loading...

ESPs containing Checkout.com

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The automated payments reconciliation market provides a streamlined and efficient solution for reconciling payments. Auto reconciliation refers to the automated process of matching incoming payments with corresponding invoices or transactions, eliminating the need for manual reconciliation efforts. By automating the reconciliation process, businesses can save time, reduce errors, and improve finan…

Checkout.com named as Highflier among 15 other companies, including Stripe, Ramp, and GoCardless.

Checkout.com's Products & Differentiators

Consolidated payment technology platform

Checkout.com's consolidated payment technology platform offers merchants an all-in-one solution featuring a fully proprietary payment processing, acquiring, and payment gateway, resulting in offering optimal authorization rates and complete access to data.

Loading...

Research containing Checkout.com

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Checkout.com in 14 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

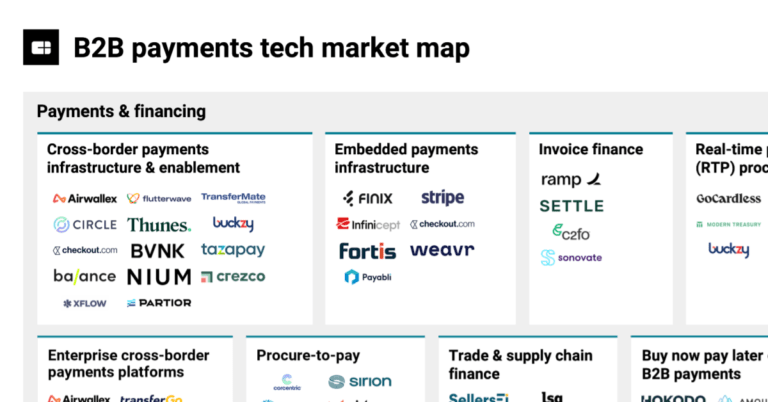

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Jan 18, 2024 report

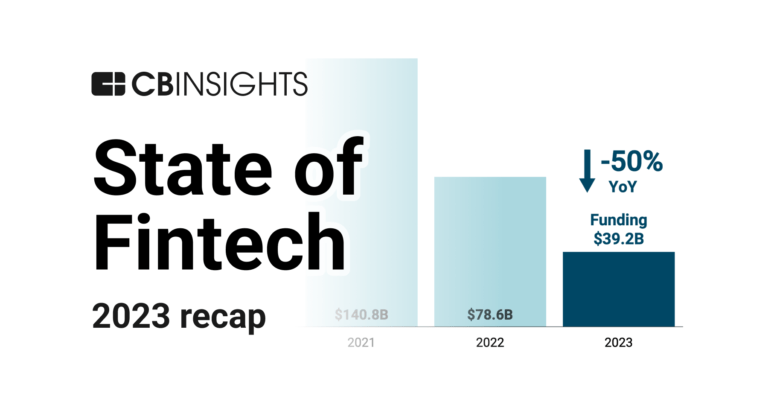

State of Fintech 2023 ReportExpert Collections containing Checkout.com

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Checkout.com is included in 9 Expert Collections, including E-Commerce.

E-Commerce

11,250 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,244 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Conference Exhibitors

5,302 items

Fintech

13,396 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Checkout.com News

Sep 19, 2024

Thursday 19 September 2024 13:21 CET | News US-based digital payments provider Checkout.com has partnered with B2B financing platform Slope to increase payment performance for US enterprise merchants. Slope’s payment platform offers two key payment solutions for B2B customers: ‘Pay Later’ (net terms or instalments) and ‘Pay Now’ (ACH and credit card acceptance). By equipping B2B businesses with the option to accept payment via terms, Slope is preserving their customers’ working capital while allowing those businesses to continue best serving their end customers. Addressing B2B cash flow challenges Born out of a need to solve the cash flow problem many businesses experienced during COVID-19, Slope provides short-term financing and simple payment options for the B2B sector. Recognising the need for robust, reliable payment infrastructure, Slope selected Checkout.com as its strategic partner. Checkout.com ’s comprehensive global acquiring and processing capabilities, alongside their commitment to cost optimisation, and enhancing payment performance, uniquely positions the business to address these challenges effectively. The partnership is driven by a shared mission of empowering merchants with superior payment solutions that streamline operations and improve cash flow management. Checkout.com’s team is happy about partnering with Slope to empower merchants with advanced, customisable payment solutions. This collaboration enhances Checkout.com's scalable payment processing capabilities, helping businesses optimise cash flow and drive growth. Both companies share a vision of supporting enterprise businesses with tailored, high-performance payment solutions for the digital economy. Already an effective collaboration The partnership has already proved successful. Areas of cooperation include optimising interchange costs through data field enhancements, evaluating payment data to improve performance, and improving reconciliation and cash management with Slope’s warehouse lending facilities. Checkout.com 's service model sets it apart by providing a dedicated team that ensures strategic support, with the right expertise and resources to drive long-term success for the merchants they serve. In a comment, officials from Slope said Checkout.com stood out because they put in the effort to build a long-term relationship and foundation to grow with them. They appreciate their investment in the payments innovation community and are excited to serve large enterprises together. There’s a human element to their support in a highly technical space. Free Headlines in your E-mail Every day we send out a free e-mail with the most important headlines of the last 24 hours.

Checkout.com Frequently Asked Questions (FAQ)

When was Checkout.com founded?

Checkout.com was founded in 2012.

Where is Checkout.com's headquarters?

Checkout.com's headquarters is located at Sheperdess Walk, London.

What is Checkout.com's latest funding round?

Checkout.com's latest funding round is Valuation Change - II.

How much did Checkout.com raise?

Checkout.com raised a total of $1.83B.

Who are the investors of Checkout.com?

Investors of Checkout.com include DST Global, Insight Partners, GIC, Blossom Capital, Coatue and 12 more.

Who are Checkout.com's competitors?

Competitors of Checkout.com include Stripe, Total Processing, Sleek, HedgeWiz, TabaPay and 7 more.

What products does Checkout.com offer?

Checkout.com's products include Consolidated payment technology platform.

Who are Checkout.com's customers?

Customers of Checkout.com include Curve, Careem, Dott and Wise.

Loading...

Compare Checkout.com to Competitors

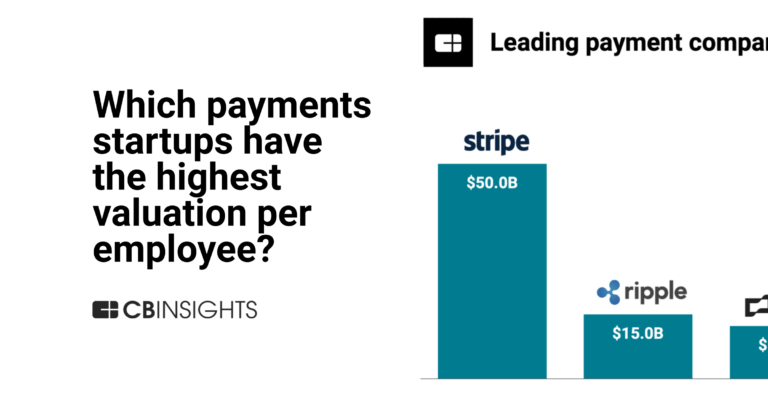

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Worldpay provides electronic payment processing services to merchants and financial institutions. It offers merchant acquiring and payment processing services, such as authorization and settlement, customer service, chargeback and retrieval processing, and interchange management for national merchants, and regional and small-to-medium-sized businesses. The company was founded in 1993 and is based in London, United Kingdom.

Rapyd is a fintech company specializing in global payment processing and financial technology solutions. The company offers a platform for businesses to accept payments online, send payouts, and manage multi-currency accounts, with a focus on simplifying financial transactions across borders. Rapyd's services cater to various sectors including eCommerce, marketplaces, and the gig economy. Rapyd was formerly known as CashDash. It was founded in 2016 and is based in London, England.

BlueSnap, formerly Plimus, is a flexible payment solutions provider delivering a customizable platform to global online businesses such as software publishers, web hosting companies, and online retailers. BlueSnap builds and manages online businesses for software publishers, web hosting companies and online retailers. A business can choose BlueSnap hosted application that spans the entire e-Commerce lifecycle, or it can deploy the BlueSnap API which allows retailers to integrate the technology with existing solutions. Using BlueSnap software, retailers can deliver newsletters to customers, coupons and promotions, realtime reporting, and live chat amongst other features.

FusionPay is a pay-tech company that operates in the financial technology sector. The company provides integrated mobile payment solutions, enabling customers to make payments without the need for currency exchange, and settles these payments in the merchant's preferred currency. FusionPay primarily serves the ecommerce industry. It was founded in 2018 and is based in London, England.

PPRO operates in the digital payments infrastructure domain. The company offers services that enable businesses and banks to expand their checkout, acquiring, and risk services through a single connection. Its infrastructure provides access to various payment methods, fraud screening tools, and other essential products from multiple providers, all of which can be managed and controlled digitally. The company primarily serves the financial technology industry. It was founded in 2006 and is based in London, United Kingdom.

Loading...