Rapyd

Founded Year

2016Stage

Series E | AliveTotal Raised

$775MValuation

$0000Last Raised

$300M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-96 points in the past 30 days

About Rapyd

Rapyd is a fintech company specializing in global payment processing and financial technology solutions. The company offers a platform for businesses to accept payments online, send payouts, and manage multi-currency accounts, with a focus on simplifying financial transactions across borders. Rapyd's services cater to various sectors including eCommerce, marketplaces, and the gig economy. Rapyd was formerly known as CashDash. It was founded in 2016 and is based in London, England.

Loading...

Rapyd's Product Videos

ESPs containing Rapyd

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The embedded payments infrastructure solutions market allows companies to integrate payment processing into non-banking digital platforms, such as online stores, without having to build the payment infrastructure from scratch. Vendors use APIs and software development kits to embed payment functionalities into software applications, websites, IoT devices, and other digital ecosystems. This integra…

Rapyd named as Challenger among 15 other companies, including Stripe, Fiserv, and Adyen.

Rapyd's Products & Differentiators

Rapyd Collect

A single integration that connects your business to hundreds of payment methods worldwide.

Loading...

Research containing Rapyd

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Rapyd in 15 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

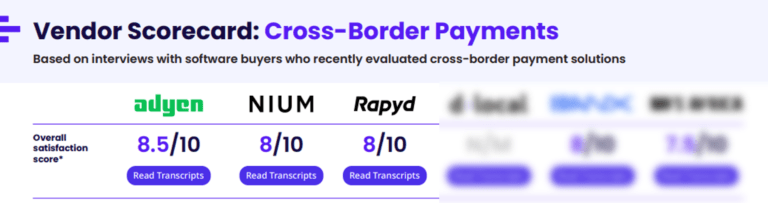

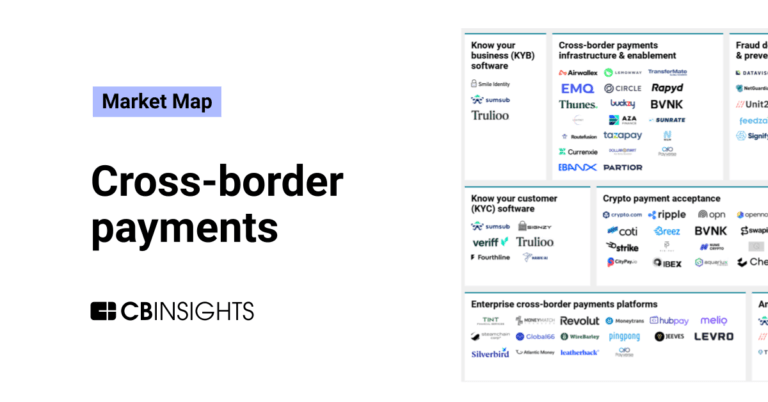

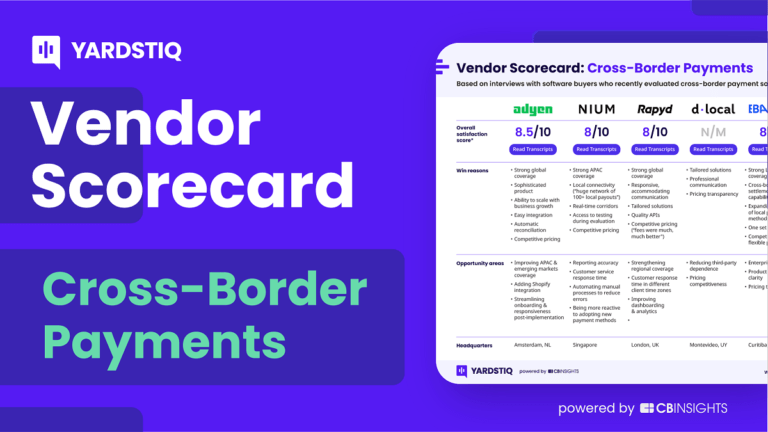

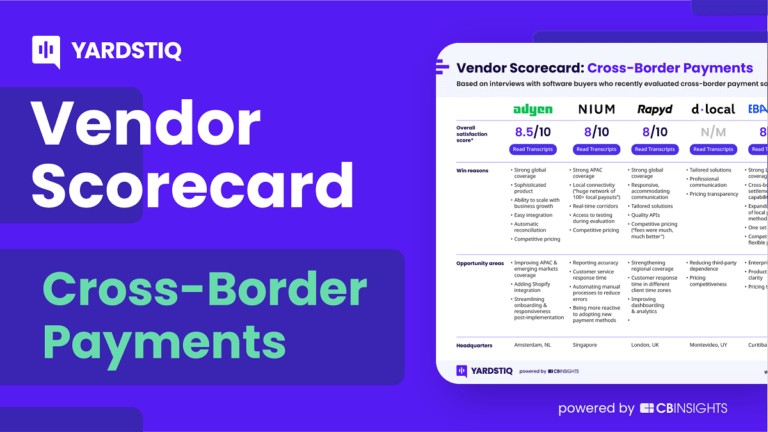

Cross-border payments market map

Jan 23, 2023 report

Top cross-border payments companies — and why customers chose themExpert Collections containing Rapyd

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Rapyd is included in 9 Expert Collections, including E-Commerce.

E-Commerce

11,250 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,244 items

SMB Fintech

1,648 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Rapyd News

Sep 19, 2024

News Provided By Share This Article The Avid Ventures Team With $165M in Total AUM and a larger team of five, Avid Ventures pursues a unique, concentrated Toehold/Double Down investment strategy and offers a differentiated Strategic Finance value-add offering NEW YORK, NY, UNITED STATES, September 19, 2024 / EINPresswire.com / -- Avid Ventures (“Avid”) today announced the launch of its second fund, an $87M early-stage vehicle that brings total capital raised since inception to over $165M. Avid Fund II remains committed to backing exceptional founders building transformative software and fintech companies at the Seed through Series B stages. Already, Avid Fund II has completed five initial investments in various sectors, including payments, insurance, gaming, and data analytics. Avid is thrilled to welcome new institutional investors to Fund II including The Mellon Foundation, Hall Capital Partners, Vintage Investment Partners, UJA-Federation of New York, Soka University, and CM Wealth Advisors, among others. Returning Fund I investors include Foundry, General Catalyst, multi-billion dollar philanthropic family offices, and leading investors and executives such as Brian Singerman (Partner, Founders Fund), Rob Hayes (Partner, First Round), and Susan Sobbott (former multi-decade American Express leader). Based in New York City, Avid was founded in 2020 by Managing Partner Addie Lerner, who spent the prior decade investing at General Catalyst, General Atlantic, and Goldman Sachs, deploying over $450M across early- and growth-stage investments. Since then, Lerner has been partnered with Founding Investor Tali (Vogelstein) Miller, formerly an early-stage investor at Bessemer Venture Partners. Over the past several months, Avid has significantly expanded the team. In July, Irene Gendelman, a former private equity investor at Silver Lake with prior investment banking experience at Evercore, joined the investment team. Dan Deutsch also joined Avid in early 2024 as Vice President of Finance to lead Avid’s Finance and Operations functions alongside Allie Yurkevich, Avid’s Operations Manager. Avid maintains close advisory relationships with Go-To-Market Advisor Kieran Flanagan, who currently serves as SVP of Marketing at HubSpot; Strategic Growth Advisor Jack Larson, who is currently the Head of Finance and Strategy at dbt Labs; and COO Advisor Jenna Pfeffer, who previously spent five years at General Atlantic focused on fundraising, investor relations, and strategy. “We are excited to continue to back a new wave of visionary founders with this fresh pool of capital and scaled team. Given our combined experience from General Catalyst, General Atlantic, Bessemer, and Silver Lake, we are confident we have the right team in place to identify and partner with top founders, while further delivering our bespoke Strategic Finance value-add,” said Lerner. “We are grateful for the support from our returning Fund I investors and are delighted to build long-term relationships with this new group of Fund II partners who are proven backers of emerging managers.” Avid pursues a differentiated Toehold/Double Down investment strategy, writing ~$500k-$2M collaborative “Toehold” checks at the Seed through Series A, and up to $10M high-conviction “Double Down” checks around the Series B. Avid serves as a hands-on “Strategic Finance Advisor” to its companies, developing an insider perspective as well as earning the ability to Double Down into portfolio winners. Avid develops close relationships with portfolio founders by serving as an extension of their teams across strategic finance and business development. This dedicated work includes continuous support across strategic growth modeling and KPI dashboard building, warm customer and partner introductions, hand-picked advisor introductions, vetted talent recruiting, as well as fundraising advice and introductions to top-tier investors. “The Avid team has been incredible, supporting Coast with conviction from just after our Seed through our recent Series B,” said Daniel Simon, founder and CEO of Coast, one of Avid’s largest Fund I positions. “They are veteran analysts and investors, and have been critical with the strategic aspects of building our financial models to the tactical hustling of doing deals with some of our largest fleet customers. They consistently feed us leads – including our very first design partner, which was a plumbing business. I’ve invited Addie to all the board meetings because I deeply value her perspective as an investor and a friend, and consider the Avid team to truly be part of the Coast team.” Avid has backed 20 companies in its $72M Fund I, including Nova Credit, Alloy, Coast, Clara, Oyster, Basis, and Thatch. To date, Avid has made meaningful Double Down investments in Alloy and Coast, which each represent concentrated, double-digit percentages of Fund I. Avid has also invested in and maintained a close relationship with Lerner’s General Catalyst portfolio company Rapyd through a series of SPVs. Select Avid co-investors include General Catalyst, Bessemer Venture Partners, Accel, Index Ventures, a16z, Thrive Capital, Union Square Ventures, and Ribbit Capital. “I’ve had the pleasure of working with Addie and Tali since the very inception of Avid and at our prior company Nova Credit,” said Nicky Goulimis, co-founder and CEO of Avid Fund II company Tunic, and co-founder and former COO of Avid Fund I company Nova Credit. “They were the first investors we called about our new idea — and they provided invaluable intel but also hustle to help us make this business a reality. They consistently give us real feedback and real help, on everything from cap table dynamics to hiring. We believe Avid is defining the modern operating model for VC and we are thrilled to get to partner with them!" For more information, please visit www.avidventures.com or email info@avidventures.com About Avid Ventures Avid Ventures is a $165M early-stage venture capital firm based in New York City backing exceptional founders building transformative software and fintech companies across North America, Europe, and Israel. Founded in 2020 by Addie Lerner, Avid makes initial investments at the Seed and Series A stages alongside top-tier lead investors, and writes up to $10M high-conviction follow-on checks into existing portfolio companies. To date Avid has invested in 25+ companies including Rapyd, Nova Credit, Alloy, Coast, Clara, Oyster, Basis, and Thatch. Leveraging 20+ years of collective venture and growth experience at premier investment firms including General Catalyst, General Atlantic, Bessemer Venture Partners, Silver Lake, and Goldman Sachs, Avid actively partners with founders and their teams as a “Strategic Finance Advisor” to grow startups into proven growth businesses with best-in-class metrics. Avid’s differentiated support includes strategic financial modeling & analysis, impactful customer, partner, & advisor introductions, as well as fundraising guidance given the firm’s unique position as a flexible co-investor with a deep network of top angel and lead investors. Dan Deutsch

Rapyd Frequently Asked Questions (FAQ)

When was Rapyd founded?

Rapyd was founded in 2016.

Where is Rapyd's headquarters?

Rapyd's headquarters is located at 119 Marylebone Road, London.

What is Rapyd's latest funding round?

Rapyd's latest funding round is Series E.

How much did Rapyd raise?

Rapyd raised a total of $775M.

Who are the investors of Rapyd?

Investors of Rapyd include Target Global, General Catalyst, Tal Capital, Durable Capital Partners, Avid Ventures and 20 more.

Who are Rapyd's competitors?

Competitors of Rapyd include Conduit, Colleen AI, NIUM, Alviere, Tazapay and 7 more.

What products does Rapyd offer?

Rapyd's products include Rapyd Collect and 3 more.

Who are Rapyd's customers?

Customers of Rapyd include Uber, Google, Hotmart, Rappi and GoTrade (TR8 Securities).

Loading...

Compare Rapyd to Competitors

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

BlueSnap, formerly Plimus, is a flexible payment solutions provider delivering a customizable platform to global online businesses such as software publishers, web hosting companies, and online retailers. BlueSnap builds and manages online businesses for software publishers, web hosting companies and online retailers. A business can choose BlueSnap hosted application that spans the entire e-Commerce lifecycle, or it can deploy the BlueSnap API which allows retailers to integrate the technology with existing solutions. Using BlueSnap software, retailers can deliver newsletters to customers, coupons and promotions, realtime reporting, and live chat amongst other features.

Checkout.com offers companies to accept payments around the world through one application program interface. It facilitates an integrated payment processing platform allowing the processing of payments in real-time, sending payouts, issuing, processing, and managing card payments. It also offers fraud prevention and secure authentication. The company was formerly known as Opus Payments. It was founded in 2012 and is based in London, United Kingdom.

NIUM specializes in modern money movement within the financial technology sector. Its main offerings include a platform for cross-border payments, card issuance services, and banking-as-a-service solutions, designed to facilitate global financial transactions for businesses. NIUM primarily serves financial institutions, travel companies, payroll providers, spend management platforms, and global marketplaces. NIUM was formerly known as InstaReM. It was founded in 2014 and is based in Singapore.

Payall operates as a cross-border payment processor for banks operating in the financial technology sector. The company offers automated compliance and risk management solutions to facilitate international transactions. Payall's technology provides a global platform with accounts and special-purpose payment processing for global payments, along with payout options for recipients. It was founded in 2018 and is based in Miami Beach, Florida.

Planet Payment specializes in tax-free shopping services and (Value Added Tax) VAT refund solutions within the retail and hospitality sectors. The company offers a VAT refund service for international shoppers and provides businesses with end-to-end payment solutions and tax-free refund processes. Planet Payment was formerly known as Fintrax. It was founded in 1985 and is based in Galway, Ireland.

Loading...