Fintech startups hit a wall in 2023, with annual funding cut by half.

The fintech sector has not been spared from the sweeping downturn in the venture market. In fact, in 2023, funding to fintech startups dropped off more severely than broader venture funding.

Based on our deep dive below, here is the TLDR on the state of fintech:

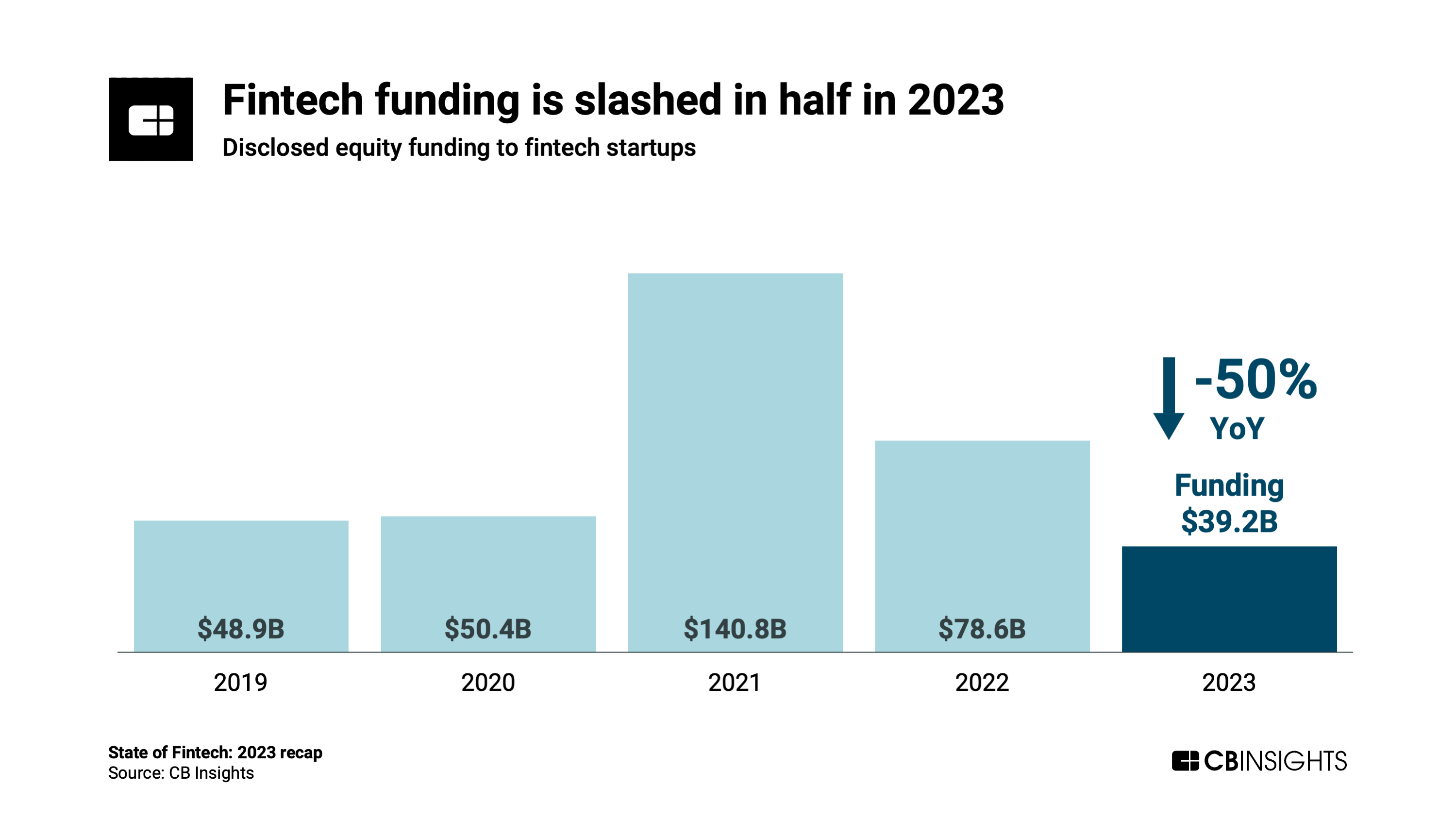

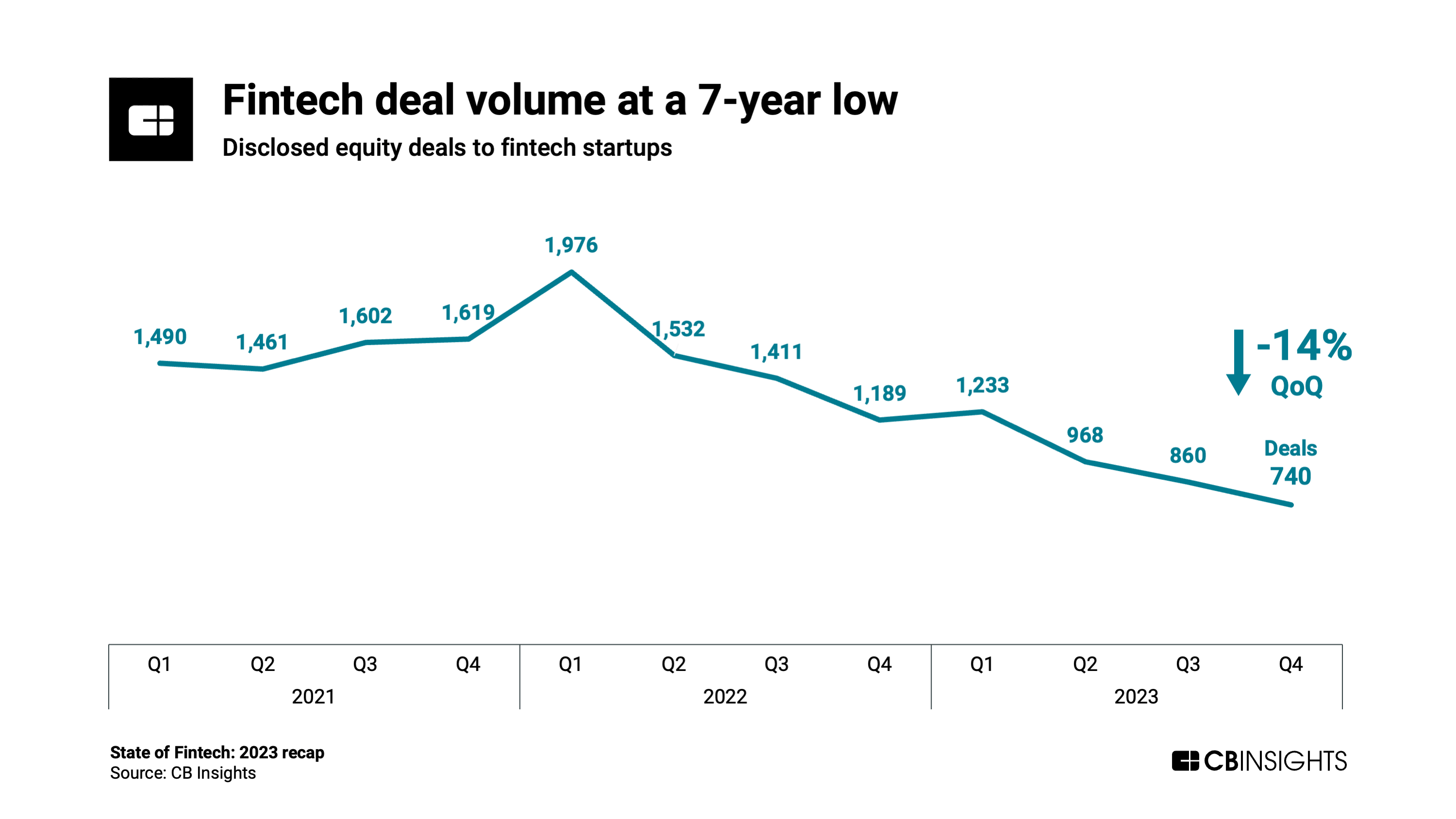

- Global fintech funding nosedived to $39.2B in 2023 (down 50% YoY), while deal volume slipped 38% to 3,801 — the lowest levels since 2017. On a quarterly basis, Q4’23 saw the fewest fintech deals in 7 years.

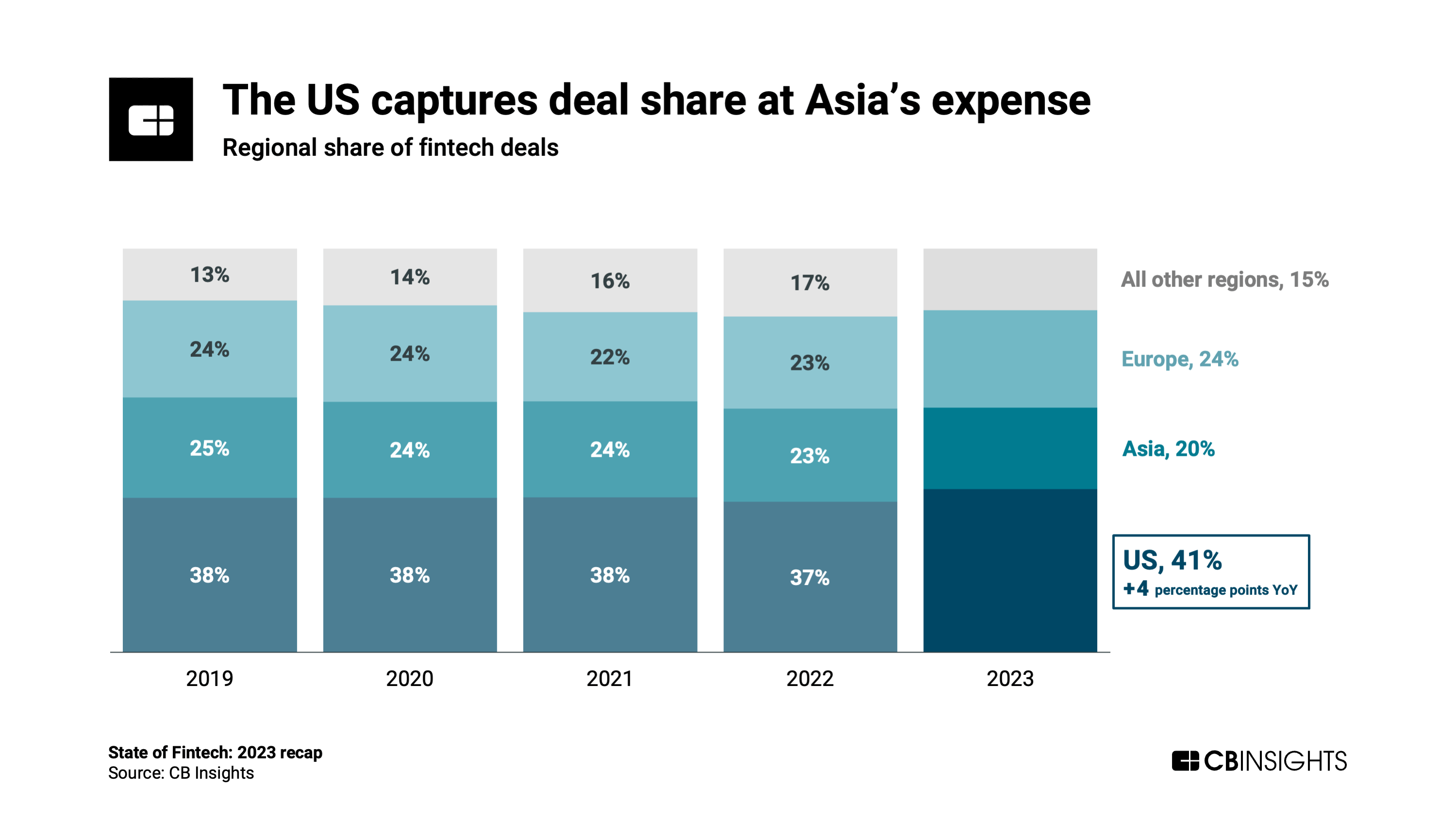

- The US increased its dominance of fintech, drawing 41% of deals in 2023 — its highest share since 2016. Meanwhile, Asia’s deal share fell to a recent low of 20%. The uptick in US deal share came as investors shifted toward early-stage companies: early-stage deal share in the US climbed to its highest level in more than a decade.

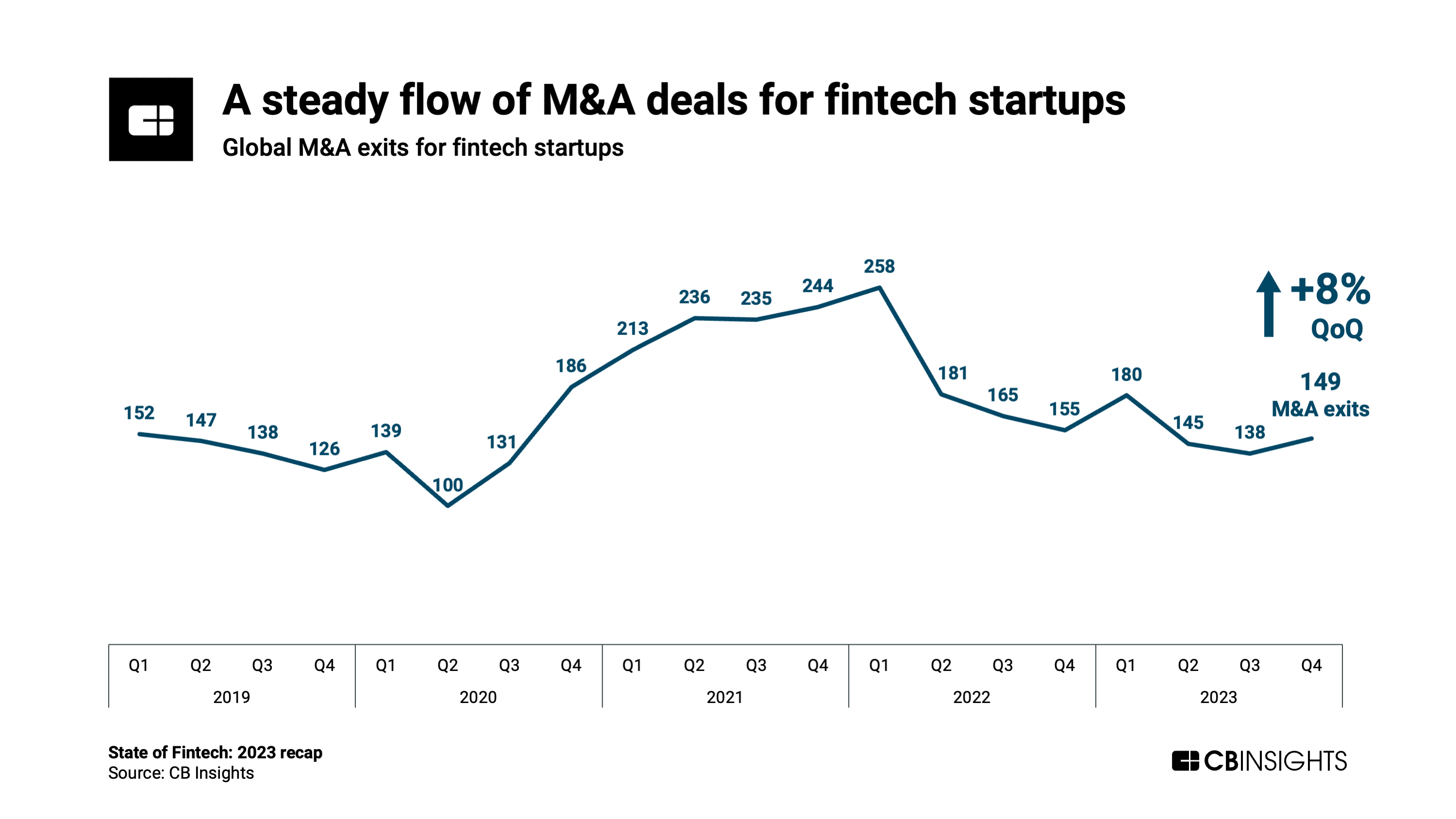

- At 612 deals, annual M&A exit volume remains higher than it was any year prior to 2021. Quarterly M&A deals saw a modest gain in Q4’23, rising to 149. Europe saw 34% of these deals — more than any other global region — but the top 3 M&A exits in Q4’23 all went to US fintechs.

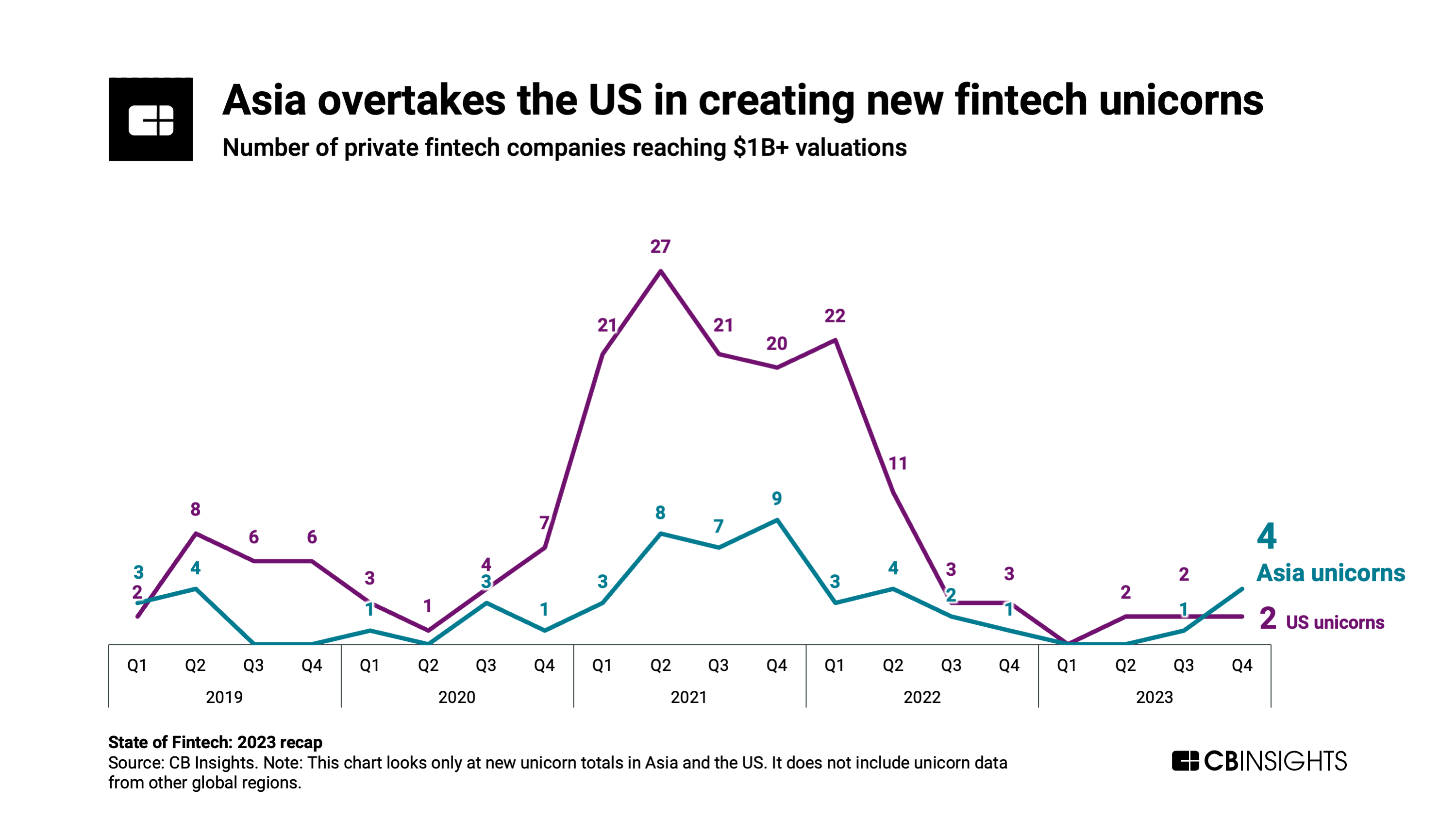

- Eight fintech unicorns were born in Q4’23 — a 6-quarter high, but far below 2021’s quarterly average. Asia contributed half of the new unicorns — 3 of which are based in Gulf States. This was the first time since 2019 that more fintech unicorns were born in Asia than in the US in a given quarter.

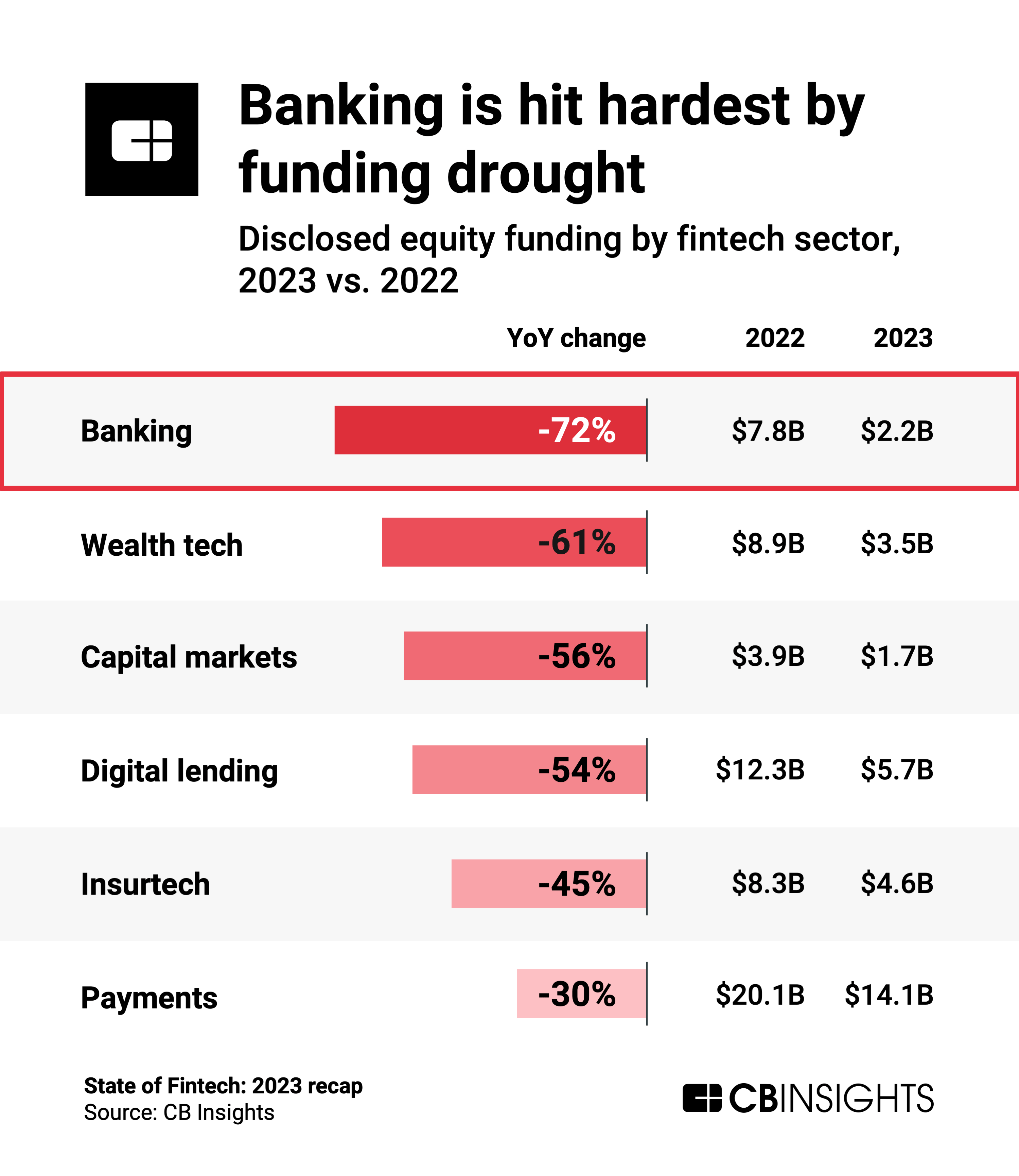

- Investment to banking startups has evaporated, with funding falling 72% in 2023 — the biggest YoY decrease across fintech sectors. Payments startups saw funding decline just 30% YoY — the least of any fintech sector — though the annual funding total was propped up by 2 massive rounds to Stripe ($6.5B) and Metropolis ($1B). Payments remains the most well-funded fintech sector by a wide margin.

Below, we’ll explore these themes across 7 charts.

Globally, funding to fintech startups fell 50% YoY, slipping below $40B for the first time since 2017. Fintech fared worse than the broader venture market, which saw funding decline 42% YoY in 2023.

The average and median deal sizes in fintech continued to decrease from 2021’s highs, falling to $13.8M and $3.2M, respectively, in 2023.

Among global regions, LatAm and Europe saw the largest drops in fintech funding in 2023:

- LatAm funding slid 68% to $1.2B

- Europe funding fell 64% to $6.5B

Q4’23 was a particularly harsh quarter for fintech in terms of deal activity.

The quarter saw fintech startups secure just 740 deals — the fewest in a quarter since Q4’16, and the third straight quarter of declines.

Among the top deals of the quarter, payments solutions for online and in-person shopping were prominent. These included SumUp ($307M Series F), as well as buy now, pay later players Tamara ($340M Series C) and Tabby ($200M Series D). Notably, payments leaders Checkout.com and PayPal invested in the deals to Tamara and Tabby, respectively.

Despite global declines in deal volume, the US picked up a greater share of deals in 2023 at 41%. The 4-percentage-point increase came at the expense of Asia, which lost 3 percentage points in share YoY. The US’ share was the highest for the country since 2016.

Fintech dealmaking in the US has shifted toward the early stages (seed/angel and Series A), which now claim 70% of all US deals — the highest annual share in more than a decade.

While down from a peak in Q1’22, M&A activity remains relatively steady for fintech startups. Financial services incumbents, larger fintech firms, and PE buyers continue to seek out undervalued assets. In Q4’23, global M&A volume ticked up to 149 deals.

While Europe led in M&A deal share in Q4’23 at 34%, the top 3 M&A deals that quarter all went to US-based firms:

- In capital markets, TMX Group acquired VettaFi for $1.1B

- In insurance, Travelers purchased Corvus Insurance for $435M

- In business payments, WEX acquired Payzer for $261M

Eight fintech companies reached unicorn status (valued at $1B+) in Q4’23. Among global regions, Asia led with 4 of these new unicorns, followed by the US with 2. LatAm and Oceania each accounted for 1.

This was the first time since 2019 that Asia outpaced the US in the number of new fintech unicorns in a single quarter.

Within Asia, the Gulf States saw especially strong representation. Two unicorns (Tabby and Tamara) came out of Saudi Arabia, while the United Arab Emirates contributed one (Andalusia Labs).

Within fintech, banking startups’ access to capital has been restricted substantially. In 2023, they raised $2.2B in equity funding, down 72% from $7.8B the year prior.

Wealth tech funding wasn’t far behind, with a decline of 61% YoY in 2023.

Funding to payments startups, on the other hand, remains relatively strong, down just 30% in 2023. The top equity deal in Q4’23 went to parking management and payment platform Metropolis, which raised over $1B.

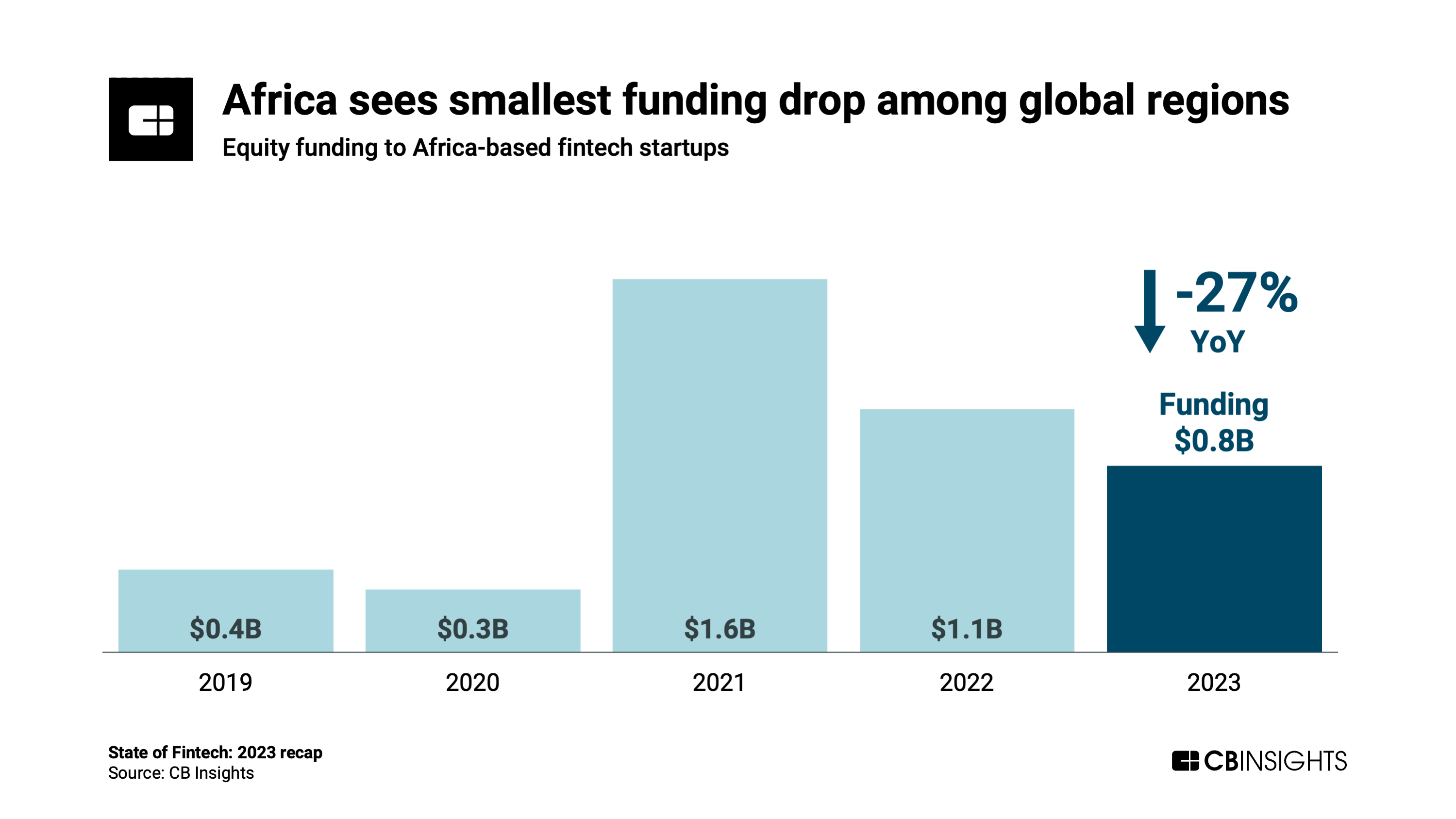

While fintech funding fell across every global region in 2023, Africa was the least affected by the downturn. Africa-based startups drew $0.8B in funding in 2023, down just 27% from 2022.

Meanwhile, the continent’s early-stage deal share declined to a recent low of 83% in 2023. While the vast majority of deals are still early-stage, this trend suggests a growing contingent of companies are maturing into later stages of funding.

Across the whole year, the top 2 deals in Africa went to North Africa-based startups: Egypt-based MNT Halan ($260M Series D) and Morocco-based Cash Plus ($60M round). The third-largest round went to Kenya’s M-Kopa ($55M round).