Cover Genius

Founded Year

2014Stage

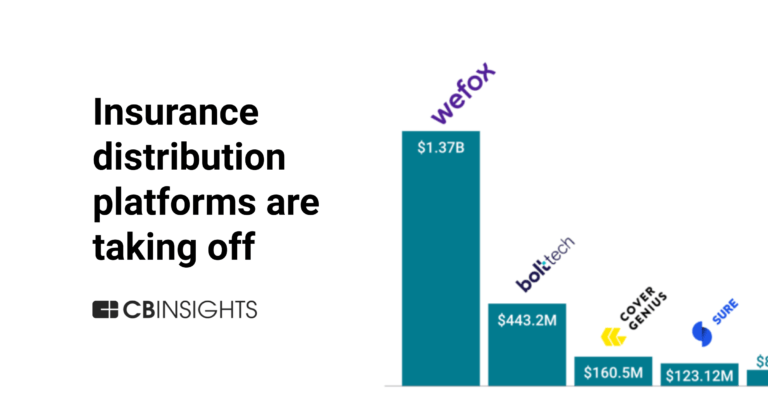

Series E | AliveTotal Raised

$240.5MLast Raised

$80M | 4 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-9 points in the past 30 days

About Cover Genius

Cover Genius is the insurtech company specializing in embedded protection for various industries. It main offerings include a global distribution platform, XCover, which provides seamless insurance and protection services, and an API that enables instant claims payments in over 90 currencies. It primarily serve sectors such as retail, fintech, logistics, mobility and auto, gig economy, travel, property, and live event ticketing. It was founded in 2014 and is based in New York, New York.

Loading...

ESPs containing Cover Genius

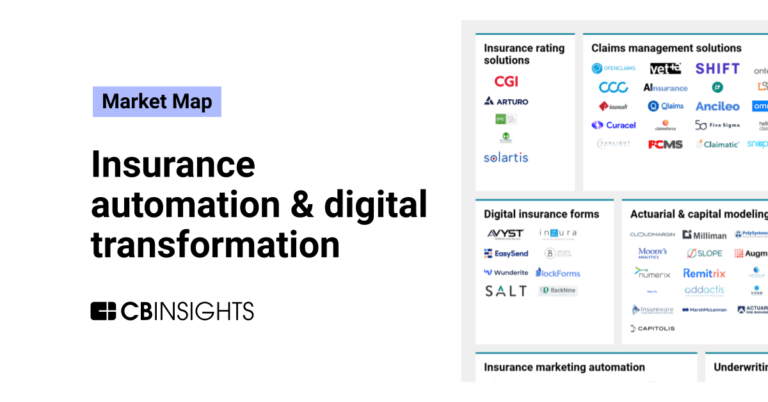

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The embedded insurance infrastructure market consists of tech vendors that offer products to enable insurance sales on third-party platforms via APIs (application programming interfaces). These companies sell their products to insurance providers or third-party platforms. Some embedded insurance infrastructure providers may also provide insurance (as a licensed carrier, managing general agent, or …

Cover Genius named as Leader among 15 other companies, including Igloo, Qover, and Matic.

Cover Genius's Products & Differentiators

XCover

XCover is Cover Genius’ award-winning global distribution platform. It protects the customers of the world’s largest digital companies with seamless, end-to-end experiences. Licensed or authorized in over 60 countries and all 50 US States, XCover enables merchants to embed and sell multiple lines of insurance and other types of protection, backed by an industry-leading post-claims Net Promoter Score (NPS).

Loading...

Research containing Cover Genius

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Cover Genius in 7 CB Insights research briefs, most recently on Aug 28, 2024.

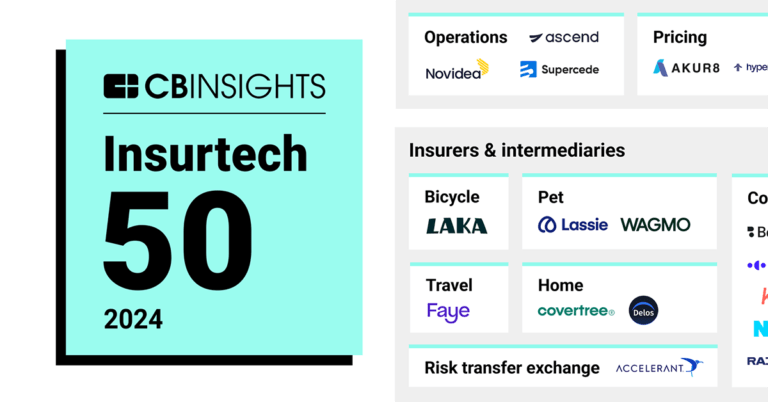

Aug 28, 2024 report

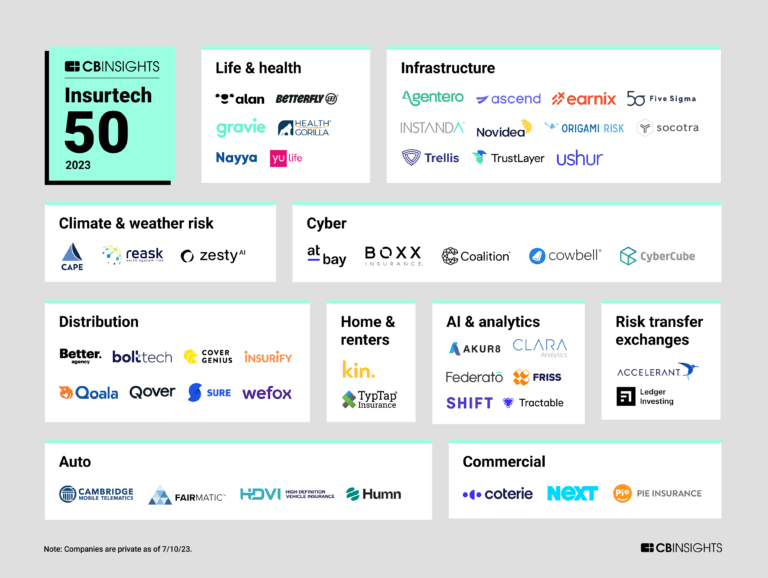

Insurtech 50: The most promising insurtech startups of 2024

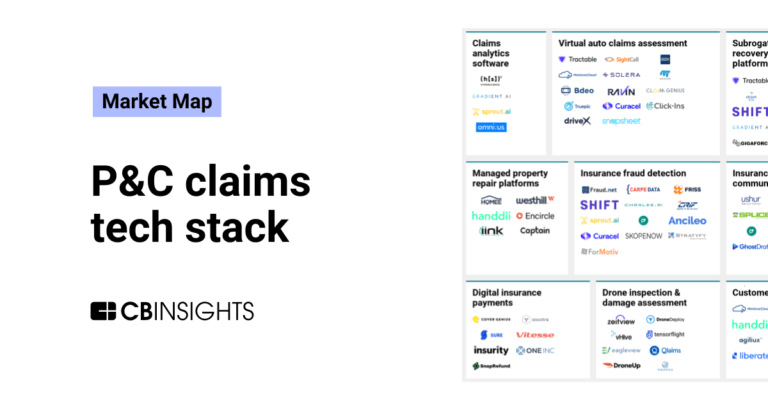

Dec 18, 2023

The P&C claims tech stack market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Cover Genius

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cover Genius is included in 5 Expert Collections, including Insurtech.

Insurtech

4,359 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,295 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

150 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Fintech 100

100 items

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Cover Genius Patents

Cover Genius has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/15/2016 | Social networking services, User interfaces, Usability, Virtual communities, Pricing | Application |

Application Date | 7/15/2016 |

|---|---|

Grant Date | |

Title | |

Related Topics | Social networking services, User interfaces, Usability, Virtual communities, Pricing |

Status | Application |

Latest Cover Genius News

Aug 12, 2024

The company will be celebrating its 10-year anniversary later this year. Share Protection insurtech Cover Genius has extended its leadership team with a series of appointments. The company will be celebrating its 10-year anniversary later this year, has amassed more than 35 million customers around the world, works with hundreds of merchant and payment partners, and raised more than $250m in funding. Go deeper with GlobalData She joins from leading global teams at firms such as MasterClass and Verana Health. Russell Corbould-Warren has been chosen to be VP Insurance for EMEA and Asservo. He has led teams and developed insurance solutions for more than 20 years, including the last eight years at Uber and Onsi.com in the on-demand, gig economy. He joins the global team from Cover Genius’ European headquarters in Amsterdam. Angus McDonald, Cover Genius’ CEO and Co-founder said: “With Ann’s experience, we are in a great position to continue building our position as a leading global insurtech company . Ann will be a great adviser to me and a supportive strategic partner to the business, and I’m confident that her dedication to facilitating talent, culture, and strategy for growth companies will contribute to Cover Genius’ ongoing success.” How well do you really know your competitors? Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge. Not ready to buy yet? Download a free sample We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form By GlobalData Submit Tick here to opt out of curated industry news, reports, and event updates from Life Insurance International. Submit and download Visit our Privacy Policy for more information about our services, how we may use, process and share your personal data, including information of your rights in respect of your personal data and how you can unsubscribe from future marketing communications. Our services are intended for corporate subscribers and you warrant that the email address submitted is your corporate email address. Barney Pierce, CBO, APAC and EMEA at Cover Genius, noted: “Russell’s expertise in insurance and protection for a changing economy will be crucial in taking Cover Genius forward. Our partnerships with global underwriters and traditional insurers are instrumental to our success, and allows for under-insured groups to access a range of products and services previously unavailable to them.” When asked why he wanted to join Cover Genius, Corbould-Warren replied: “Cover Genius is at a perfect inflection point as a global insurtech at a time when customers are switching to – and expect more from – digital solutions for their experiences, purchases and investments. This presents a rare opportunity for us to focus our energy on strengthening strategic partnerships for longer term value and leveraging the insurance structures and deep capabilities of our teams. As a global insurtech we have unique capabilities to provide companies, customers and insurance partners with solutions that deliver value from end-to-end, as we aim to serve our next 35 million customers.” Sign up for our daily news round-up! Give your business an edge with our leading industry insights.

Cover Genius Frequently Asked Questions (FAQ)

When was Cover Genius founded?

Cover Genius was founded in 2014.

Where is Cover Genius's headquarters?

Cover Genius's headquarters is located at 11 West 42nd Street, New York.

What is Cover Genius's latest funding round?

Cover Genius's latest funding round is Series E.

How much did Cover Genius raise?

Cover Genius raised a total of $240.5M.

Who are the investors of Cover Genius?

Investors of Cover Genius include King River Capital, G Squared, Dawn Capital, Spark Capital, Atlas Merchant Capital and 8 more.

Who are Cover Genius's competitors?

Competitors of Cover Genius include Boost, AIG Kenya Insurance, Curacel, bsurance, Riskcovry and 7 more.

What products does Cover Genius offer?

Cover Genius's products include XCover and 4 more.

Who are Cover Genius's customers?

Customers of Cover Genius include https://www.priceline.com.

Loading...

Compare Cover Genius to Competitors

Qover specializes in insurance orchestration within the insurance sector. The company offers a platform-as-a-service to enable businesses to integrate insurance services into their digital experiences, including claims management and customer support. Qover primarily serves sectors that require integrated insurance solutions, such as fintech, automotive, retail, and the gig economy. It was founded in 2016 and is based in Brussels, Belgium.

Bolttech is an international insurtech company focused on creating a technology-enabled ecosystem for protection and insurance within the financial sector. The company's main offerings include a global insurance exchange platform that connects insurers, distributors, and customers, facilitating the purchase and sale of insurance and protection products. Bolttech primarily serves businesses across various sectors looking to integrate insurance solutions into their customer journeys, such as telecommunications, retail, e-commerce, real estate, and financial services. Bolttech was formerly known as EdirectInsure Group. It was founded in 2015 and is based in Singapore.

Simplesurance is a company focused on providing embedded insurance solutions within various fast-changing ecosystems such as mobility, e-commerce, travel, fintech, and banking. The company offers a platform that facilitates easy and smart access to insurance services, aiming to enhance customer experiences and add value for businesses. Simplesurance primarily sells to sectors including e-commerce, mobility, travel, fintech, and banking industries. It was founded in 2012 and is based in Berlin, Germany.

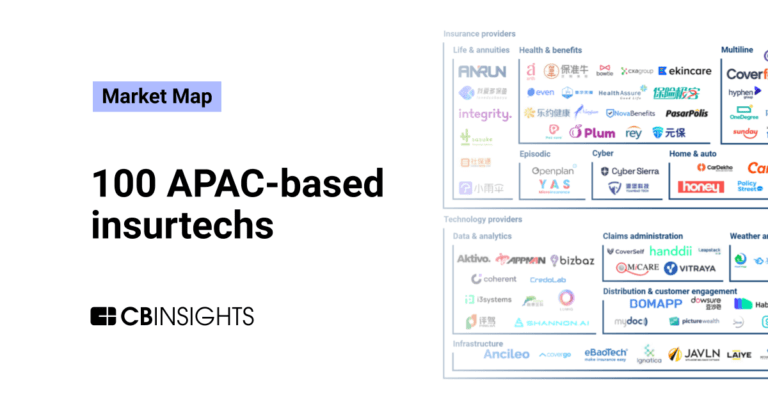

Ancileo is a provider of insurance technology solutions, specializing in the digital distribution of insurance products and services. The company offers a suite of enterprise solutions including API integration, white label services, agent portal management, AI-driven claims automation, policy management, and localized premium billing, all designed to enhance the operations of insurers, re-insurers, brokers, and affinity partners. Ancileo's technology is tailored to support the insurance industry, with a focus on travel insurance portfolios. It was founded in 2016 and is based in Singapore, Singapore.

Root is a digital insurance platform that allows users to launch, sell, and iterate digital insurance products quickly. Its services include funeral cover, device cover, credit life cover, term life cover, personal accident cover and many more. It provides its services to insurers and other insurance companies. It was founded in 2016 and is based in Cape Town, South Africa.

Socotra operates as a company providing technology solutions in the insurance industry. The company offers a range of products that help insurers accelerate product development, reduce maintenance costs, and improve customer experiences. It primarily serves the insurance industry. It was founded in 2014 and is based in San Francisco, California.

Loading...