Consolidation is on the horizon for legal AI agents & copilots. We mined CB Insights buyer interviews, Mosaic scores, exit probabilities, and funding data to forecast what’s next for the market.

What you need to know:

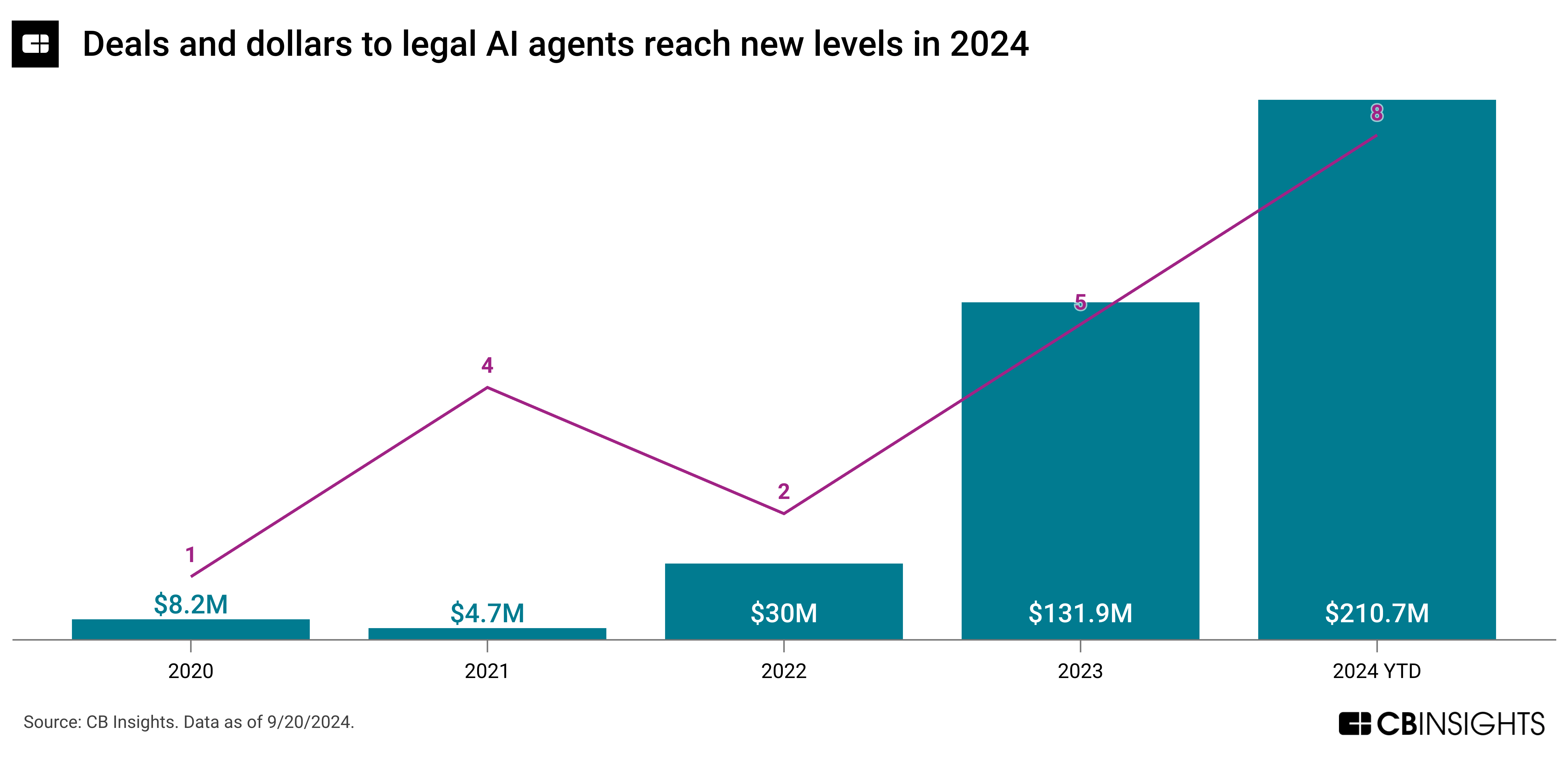

- Funding for AI agents has skyrocketed since 2022, driven by market leaders like Harvey and Luminance.

- Differentiation will be important to watch — whether through added features, integration strategy, or core product.

- Existing companies have deep AI expertise and are ripe targets for incumbents with legal domain knowledge.

Legal AI agents & copilots have seen a swell of investor attention over the last year.

These tools use generative AI to streamline lawyers’ workflows in areas like legal research, document summarization, and contract review — either via copilots that assist human workers or agents that actually execute tasks on their own.

Funding has already reached a new high in 2024, led by Harvey, which raised a $100M Series B round in July 2024 at a $1.5B valuation. It counts Google Ventures and the OpenAI Startup Fund as investors.

Source: CB Insights — legal AI agents & copilots market data

However, our conversations with these solutions’ customers paint a less optimistic picture. They express concern about the lack of differentiation between solutions as well as the low switching cost between competitors — signaling that the likelihood of consolidation in the market is high.

To win over customers, legal AI agents and copilots will need to distinguish themselves on something other than features and integrate more deeply into the existing legal tech stack.

Below, we use CB Insights data to dig into the market’s challenges and opportunities, including:

- Legal AI agents’ current weaknesses

- Where startups can win through differentiation

- A target-rich environment for M&A

We also look at which solutions are most likely to get acquired next.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.