In 2023, digital health funding and deals continue to plummet from pandemic highs.

Digital health has been hit hard by the ongoing venture downturn. In 2023, it suffered greater drops in funding and deals than venture at large.

Based on our deep dive below, here is the TLDR on the state of digital health:

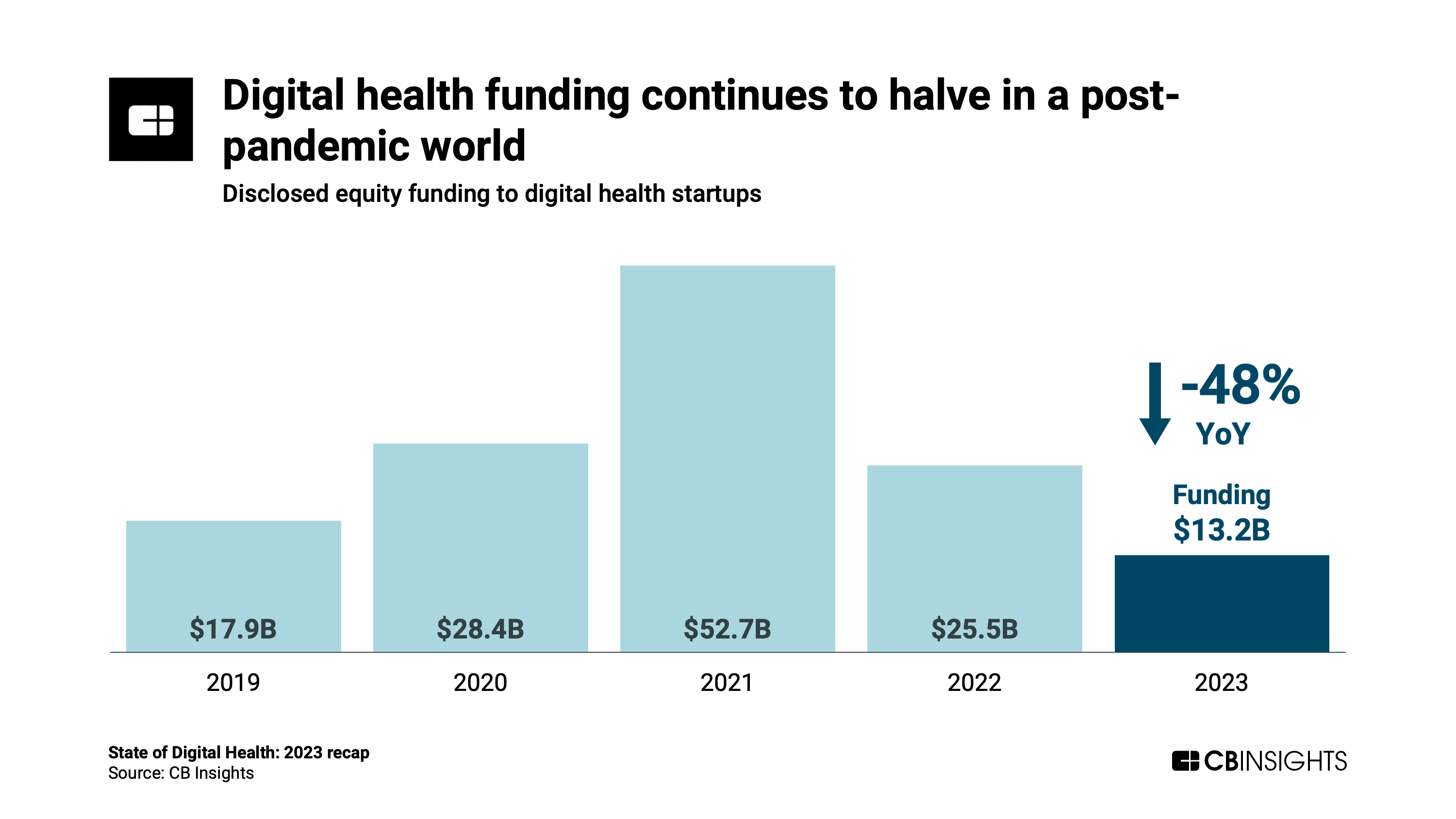

- Global digital health funding halved for the second straight year in 2023, while deals dropped by more than a third. With just $13.2B raised across 1,397 deals in 2023, funding and deals fell to their lowest levels since 2016 and 2014, respectively. Amid the downturn, the US held its leadership position, attracting more than half of all deals.

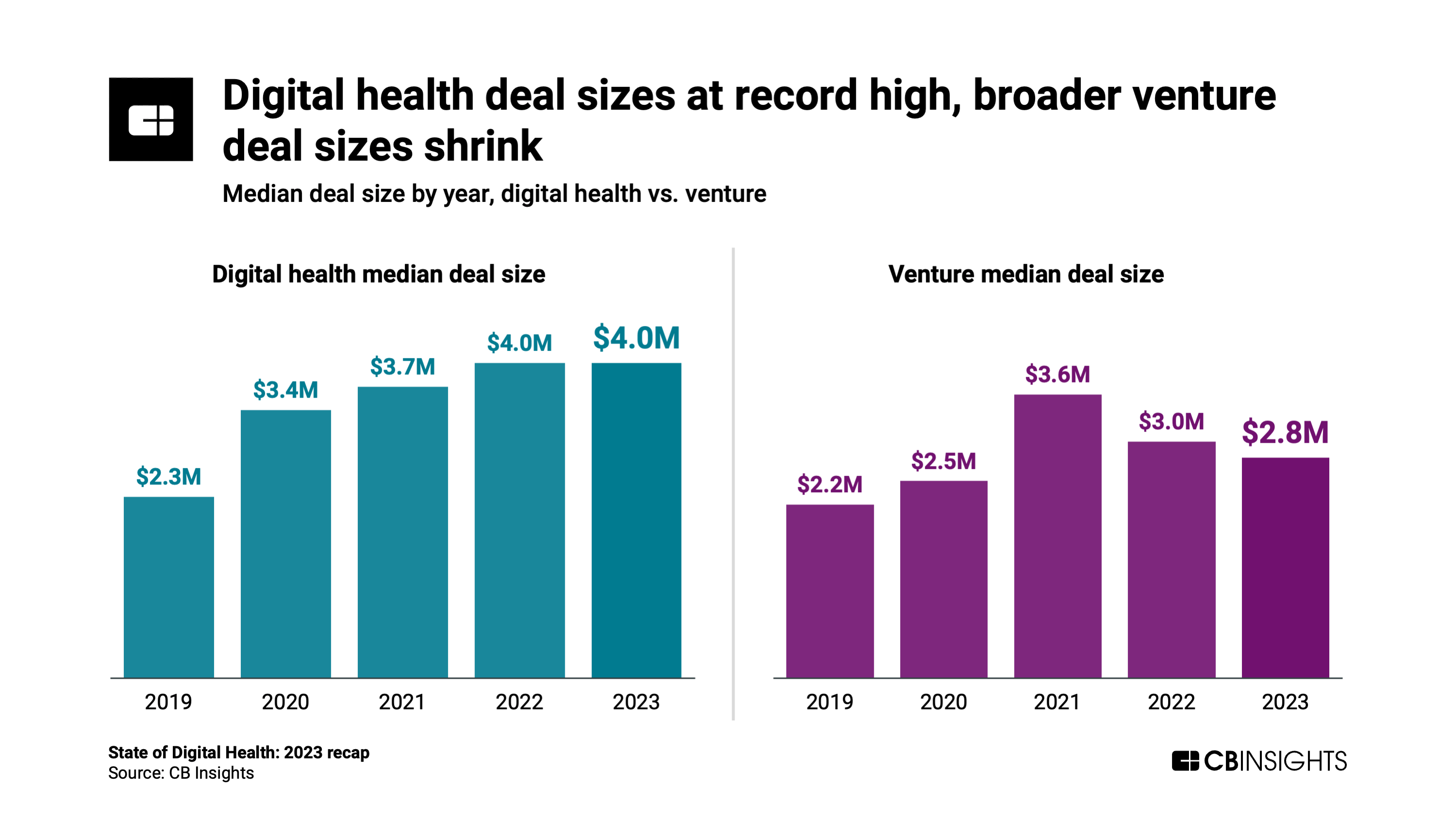

- Despite the drops, median deal size remained at $4M — the highest on record. While median digital health deal size has trended up for more than a decade, venture deal sizes more broadly have deflated since 2021.

- Mega-rounds have all but disappeared from the digital health realm. There were just 3 $100M+ rounds in Q4’23 — the lowest count since 2016. On an annual basis, mega-round count hit 20 for all of 2023, falling well below even the quarterly average for 2021 (37 deals per quarter).

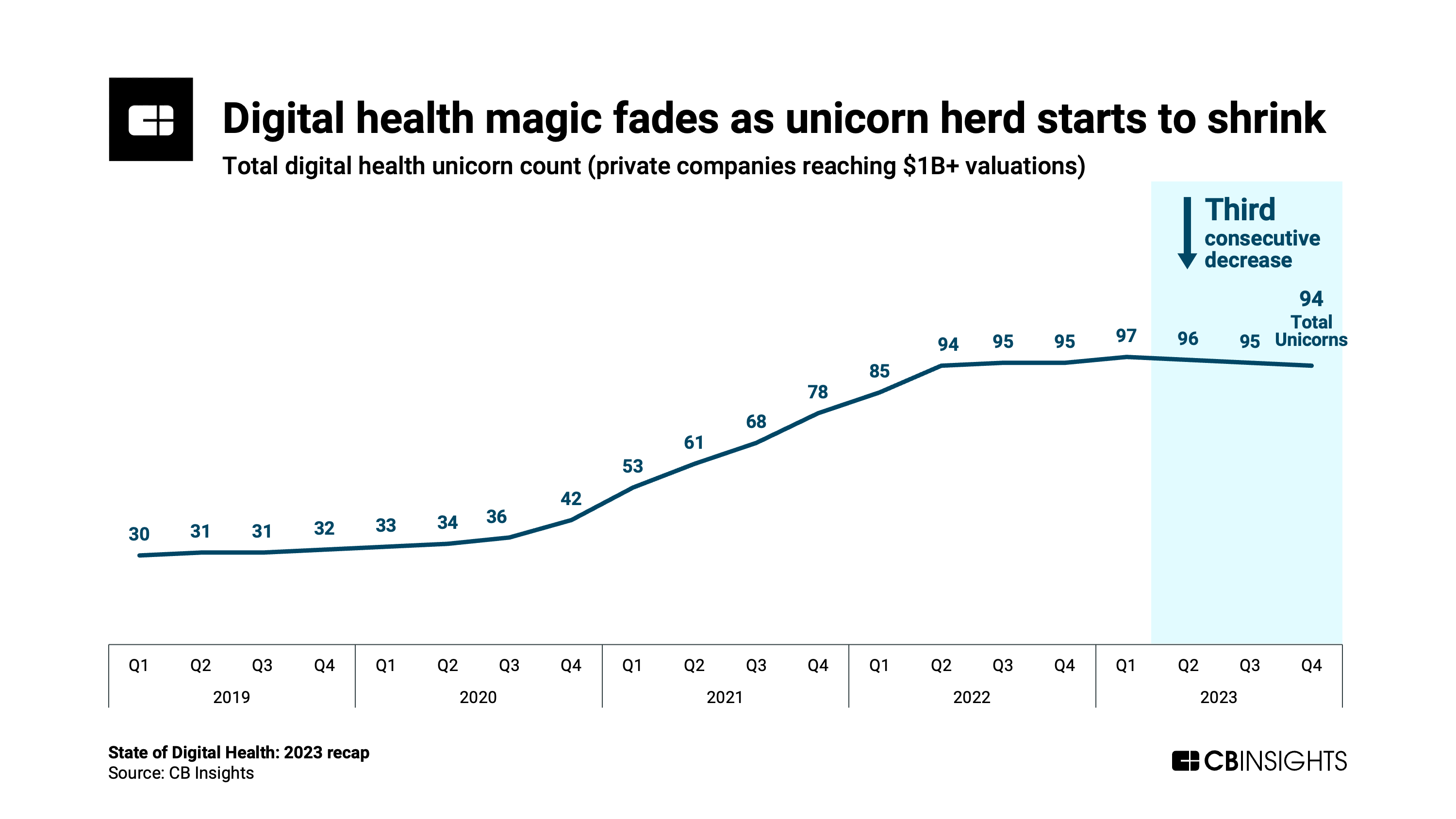

- The digital health unicorn herd started to shrink in 2023. Unicorn loss is outpacing unicorn births — a trend driven by a mix of startup exits, down rounds, and shutdowns. Despite the emergence of 4 new unicorns in 2023, digital health’s total unicorn count dropped from 97 to 94 over the course of the year.

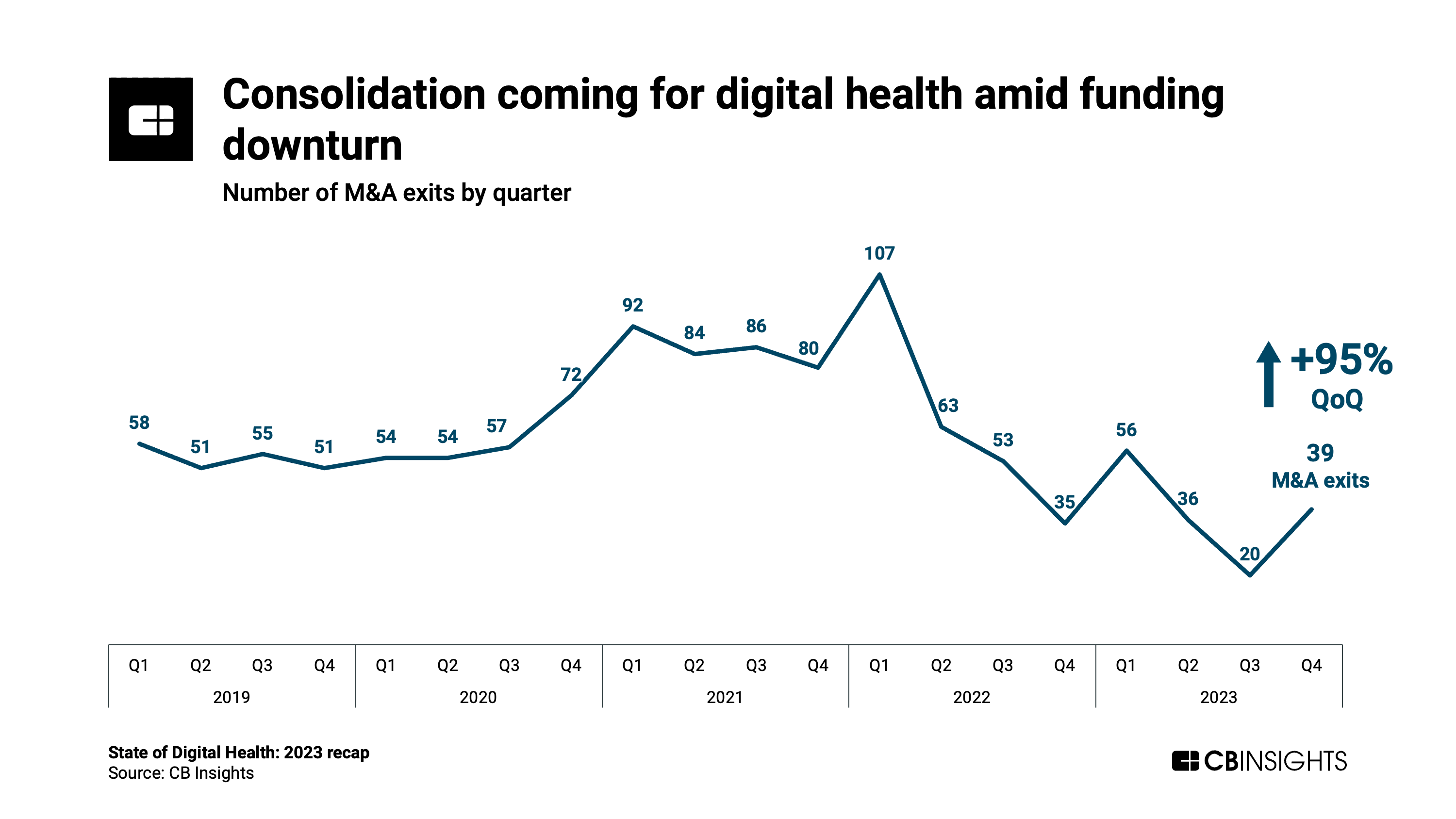

- Digital health M&A nearly doubled in Q4’23, indicating that consolidation is picking up in the market. If funding remains sparse and IPOs remain largely out of reach, M&A will become an increasingly attractive option for cash-strapped digital health startups.

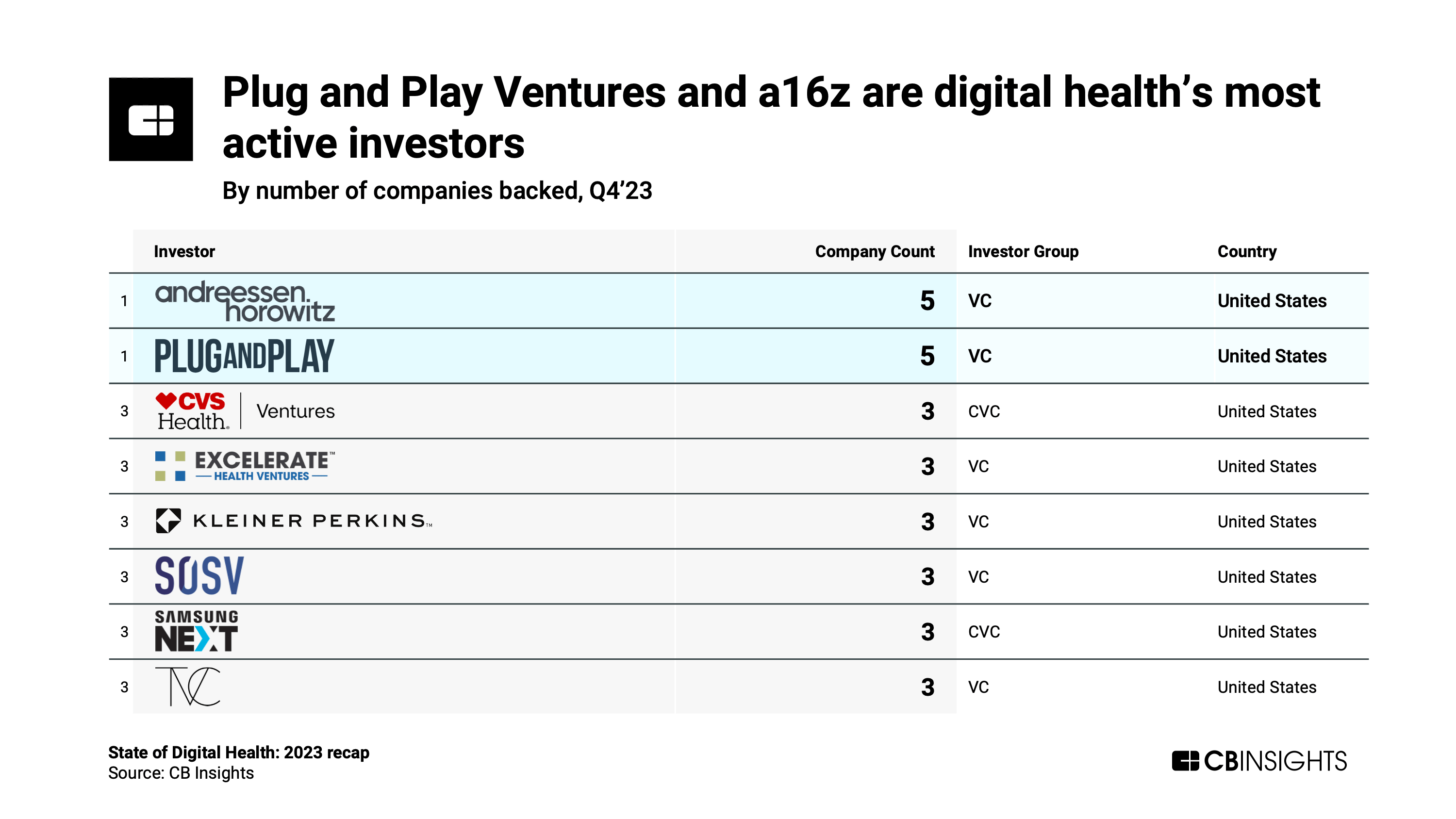

- After falling out of the top investor rankings, Andreessen Horowitz returned to tie for the top spot in Q4. The investor backed 5 unique digital health companies in Q4’23, tying Plug and Play Ventures for the title of “most active.” Thanks to its digital health bets in Q4’23, a16z added yet another unicorn to its portfolio.

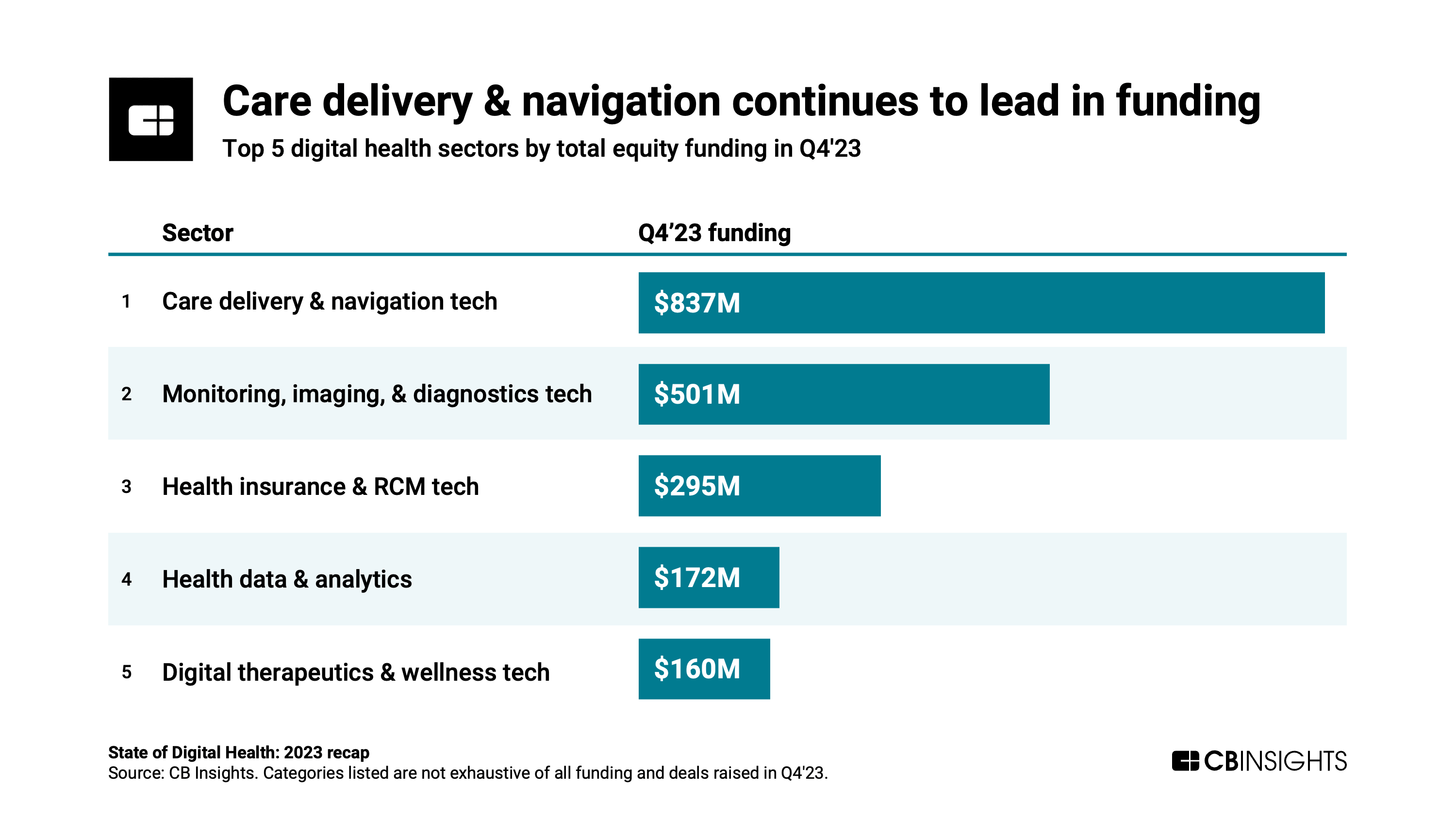

- Care delivery & navigation tech held on to its funding crown in Q4’23. With $837M raised in Q4’23, care delivery & navigation tech remained the top-funded digital health sector. It was followed by monitoring, imaging, and diagnostics tech with $501M.

Below, we’ll explore these themes across 7 charts.

Spurred by the onset of the Covid-19 pandemic — as well as the broader tech boom — digital health funding skyrocketed to unprecedented highs in 2021. However, as the pandemic has faded from public imagination, digital health startups have watched funding halve with each passing year, dropping by 52% year-over-year (YoY) in 2022 and 48% in 2023.

At $13.2B, digital health funding for 2023 stood at its lowest level since 2016. Quarterly funding levels have yet to give any indication of a recovery. Dollars to the space fell every quarter in 2023, dropping by 44% from Q1’23 to Q4’23. With just $2.3B raised in Q4’23, digital health startups saw their lowest quarterly total in 8 years.

While no major global region was spared from the downturn, Asia was hit the hardest. In 2023, the continent saw greater YoY drops in funding (-55%) and deals (-46%) than both the US and Europe. While US funding didn’t fare much better — nearly halving last year — the country continued to lead digital health funding by a significant margin, securing nearly 70% of global equity dollars to the space. Unsurprisingly, US-based startups also led on a quarterly basis, even grabbing all 10 top digital health deals in Q4’23.

While funding has been falling at an even pace since 2021, the downturn in dealmaking is only accelerating with the pandemic in the rearview mirror. Deals to digital health startups dropped by 19% YoY in 2022 and 38% in 2023. Over the course of 2023, digital health startups raised just 1,397 deals — the lowest annual count in 9 years. Quarterly deal count in Q4’23 (243 deals) also hit its lowest level since 2014.

Although digital health investors may be more hesitant to strike a deal now than in 2021, they are putting even more skin in the game where they do see value. Median equity deal size remained steady at a record high of $4M in 2023, representing an 8% increase from the heady days of 2021. This stands in stark contrast to venture at large, which saw a 22% decrease in median deal size over the same period. In digital health, the rise in deal size is particularly pronounced among Asia- and Europe-based startups — both groups have watched median deal size climb over the past 2 years.

Digital health investors may be willing to bet more cash on promising startups, but the upper dollar limit for many has dropped. Mega-rounds (deals worth $100M+) have all but disappeared from the digital health landscape. In Q4’23, just 3 of these deals were inked — the lowest count since 2016. Alongside deal count, quarterly mega-round funding also dropped to an 8-year low of $400M.

Digital health mega-round funding has fallen even further than funding to the space at large. It was down by 96% from its Q2’21 peak in Q4’23, while broader digital health funding decreased by 85% over the same period. So while mega-rounds regularly contributed more than half of the market’s funding in 2021, that share dropped to just 17% in Q4’23 — the lowest since 2019.

After 2 barren quarters, digital health saw 2 new unicorns (private companies with a $1B+ valuation) in Q4’23. However, despite these births, the total digital health unicorn count dropped by 1 — from 95 to 94.

In fact, driven by a mix of startup exits, down rounds, and shutdowns, digital health unicorn count has been on the decline since Q1’23. For example, Ysbang went public via IPO in Q2, digital pharmacy startup Alto Pharmacy lost unicorn status when its valuation slipped to $800M in Q3, and healthcare AI company Olive folded in Q4 — all while the unicorn birth rate remained at or near zero.

There is a very real possibility that digital health unicorn loss will continue to outpace unicorn births, bringing the digital health unicorn herd even further from its peak. The tight capital market is making it difficult for startups to attain $1B+ valuations — and existing unicorns will find it challenging to sustain their sky-high valuations should they find themselves able to raise additional funding (e.g., Alto Pharmacy).

Other digital health unicorns will find it difficult to secure fresh capital — even at a reduced valuation. The paths forward for these unicorns are limited. The IPO market is frozen, largely precluding it as a fundraising option. This could put unicorns strapped for cash in a scenario where they must consider either turning to M&A or closing down entirely.

Digital health unicorns are not the only companies that could explore M&A to stave off shutdowns. If funding remains sparse and IPOs remain largely out of reach, M&A will become an increasingly attractive option for cash-strapped digital health startups more broadly. Incumbents may be able to enhance their capabilities and grab more market share by acquiring startups.

Consolidation is already ramping up in digital health — after falling for 2 straight quarters, digital health M&A deals nearly doubled QoQ in Q4’23. The majority of the quarter’s largest M&A deals went to monitoring, imaging, and diagnostics tech startups, including Sonic Healthcare’s $150M acquisition of Pathology Watch, which topped the list.

Digital health consolidation is expected to continue in 2024, particularly in sectors that have seen considerable funding drops and leading players go under — such as digital therapeutics & wellness, which saw pioneer Pear Therapeutics file for bankruptcy last year. Amid this shift, digital health innovation could take on a much different form than that seen in 2021, turning from the influx of new players with new tools and capabilities to the deeper development of existing technologies by incumbents.

The top investor list for digital health changed significantly from Q3’23 to Q4’23.

After falling out of the top rankings the previous quarter, VC powerhouse Andreessen Horowitz reappeared in Q4’23 to back 5 unique companies and add yet another unicorn to its portfolio. The investor participated in mental health startup Headway’s $125M Series C round, which saw the startup reach a $1B valuation. Plug and Play Ventures also backed 5 digital health companies in Q4’23, tying a16z as the space’s top VC investor last quarter.

On the corporate venture capital (CVC) front, Samsung NEXT remained active QoQ, backing 3 unique companies in Q4, while fellow CVC CVS Health Ventures jumped in the rankings to tie Samsung at 3. Samsung participated in Forward’s $50M Series E round — the seventh largest equity deal in Q4’23 — while CVS contributed to some of the quarter’s smaller deals.

Among digital health sectors, care delivery & navigation tech retained its funding crown in Q4’23, with $837M raised. It was followed by monitoring, imaging, & diagnostics tech ($501M) as well as health insurance & RCM tech ($295M). Headway’s $125M Series C round was the biggest care delivery & navigation deal last quarter.

Despite holding the No. 3 spot, health insurance & RCM tech saw the largest digital health deal overall in Q4’23 — a $175M Series E round for Medicare Advantage plan provider Devoted Health. This round total was greater than some sector totals in Q4’23, such as those for health data & analytics and digital therapeutics & wellness tech.

Devoted Health’s valuation ticked up to $12.9B on the heels of its Series E round, reinforcing its status as the most highly valued healthcare unicorn.