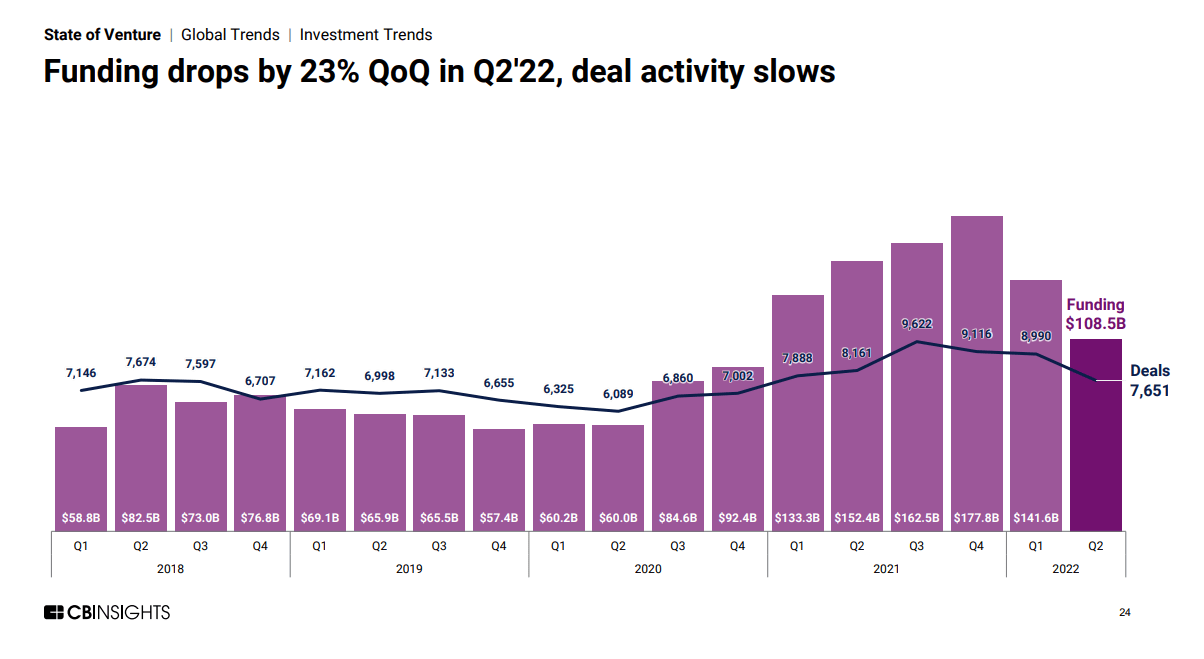

The global venture ecosystem continues its slowdown in Q2’22 as funding decreases by 23% QoQ.

Global venture funding saw $108.5B raised across 7,651 deals last quarter — marking the biggest quarterly percentage drop in deals (and the second-largest drop in funding) in a decade. Despite this eye-opening decline, funding and deal totals remain above levels last seen in 2020.

US-based companies accounted for nearly half of all funding, with some of the largest rounds of the quarter going to Epic Games, SpaceX, and Intersect Power.

Below, check out a few highlights from our 329-page, data-driven State of Venture Q2’22 Report. For deeper insights, all the record figures, and a ton of private market data, download the full report.

Q2’22 highlights across the venture ecosystem include:

- Mega-rounds ($100M+) accounted for $50.5B in funding, a 31% fall from the previous quarter.

- M&A deals trended down for the first time in 8 quarters, dropping to 2,502 — a 6-quarter low. IPOs and SPACs dropped by 15% and 26% QoQ, respectively.

- For the first time since Q4’20, fintech startups accounted for less than a fifth of all funding.

- Europe saw a 13% decrease in funding compared to Q1’22, the smallest dip among major regions.

- Tiger Global Management was the top investor for the third straight quarter in Q2’22, investing in 86 companies. However, that number marked a decline from 120 in Q1’22.

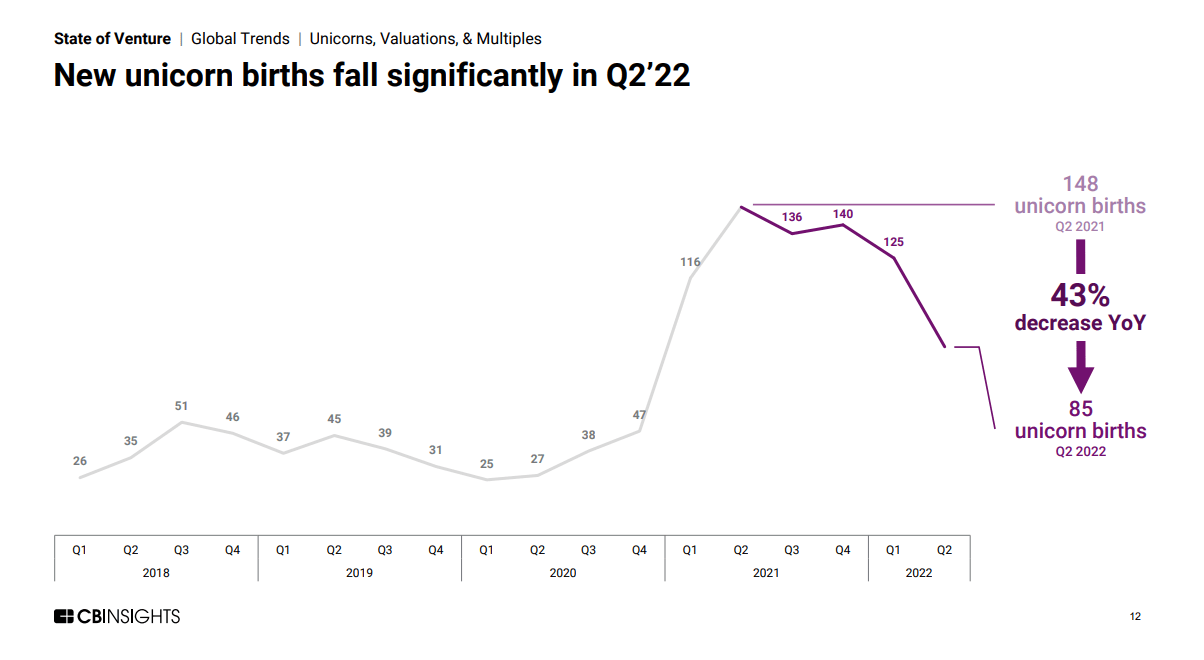

- Global unicorn births slowed to 85, bringing the total unicorn count to 1,170 — a modest 6.8% QoQ increase. The US and Europe accounted for most of the new unicorns, with 49 and 16 unicorn births, respectively. Entrants include KuCoin ($10B valuation), The Boring Company ($5.7B), and SonarSource ($4.7B).

Download our Q2’22 State of Venture Report to learn more about all these trends and more.

If you aren’t already a client, sign up for a free trial to learn more about our platform.