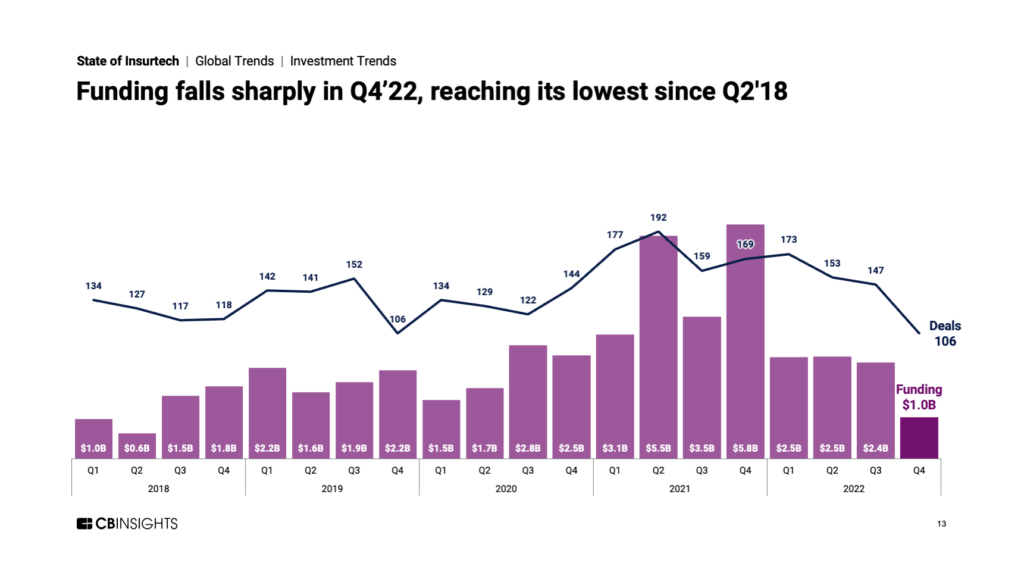

Insurtech investment activity saw a sharp decline in Q4'22 while annual funding fell to less than half of 2021's record total.

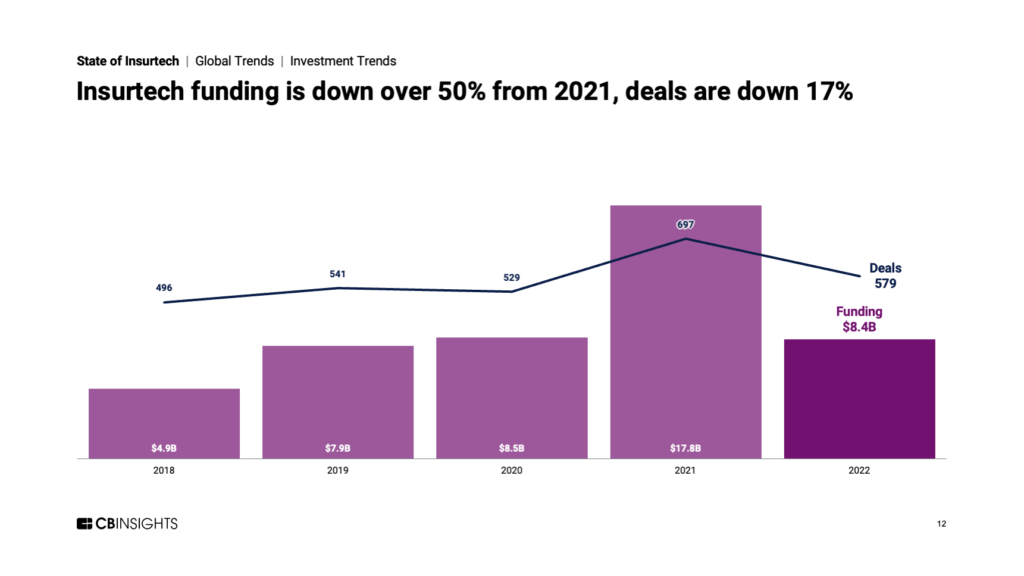

Insurtech investment activity in 2022 pulled back sharply after a record-breaking year in 2021. Annual funding fell 53% from $17.8B to $8.4B, while deals fell 17% from 697 to 579. While a steep fall compared to the previous year, the annual totals for 2022 were not far off those for 2020.

However, investment activity has continued to slow. Q4’22 funding only reached $1B — the lowest quarterly total since Q2’18 — and deals were down 28% QoQ at just 106.

Below, check out a handful of highlights from our 96-page, data-driven State of Insurtech 2022 Report. For deeper insights, all the trends to watch, and a ton of private market data, download the full report.

Other 2022 highlights across insurtech include:

- M&A activity surged to reach a new high amid falling insurtech valuations. European insurtechs led the way, representing 50% of all M&A exits.

- $100M+ mega-rounds — which were a significant driver of 2021 insurtech funding — fell sharply in 2022.

- Average and median deal sizes were down 42% and 31%, respectively, compared to 2021’s totals.

- Early-stage deals made up 65% of all insurtech deals, the highest share since 2018.

- In Q4’22, Europe (28%) reclaimed its second-place spot for regional insurtech deal share from Asia (18%). The US led with 46% of all deals.

Download the full State of Insurtech 2022 Report to dig into all these trends and more.