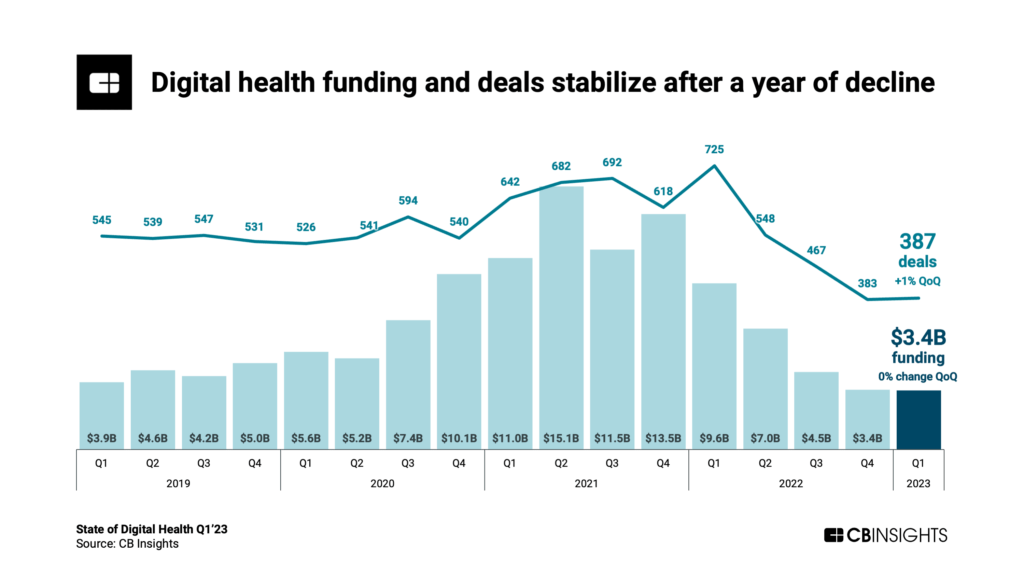

Global digital health funding holds steady at $3.4B in Q1’23 after plummeting for 4 straight quarters.

M&A exits rebound, $100M+ mega-rounds continue to fall, and digital health funding remains flat.

Using CB Insights data, we highlight key takeaways from our Q1’23 State of Digital Health Report, including:

- Global digital health funding and deals stabilize after a year of decline.

- Care delivery & navigation tech companies lead in both deals and funding.

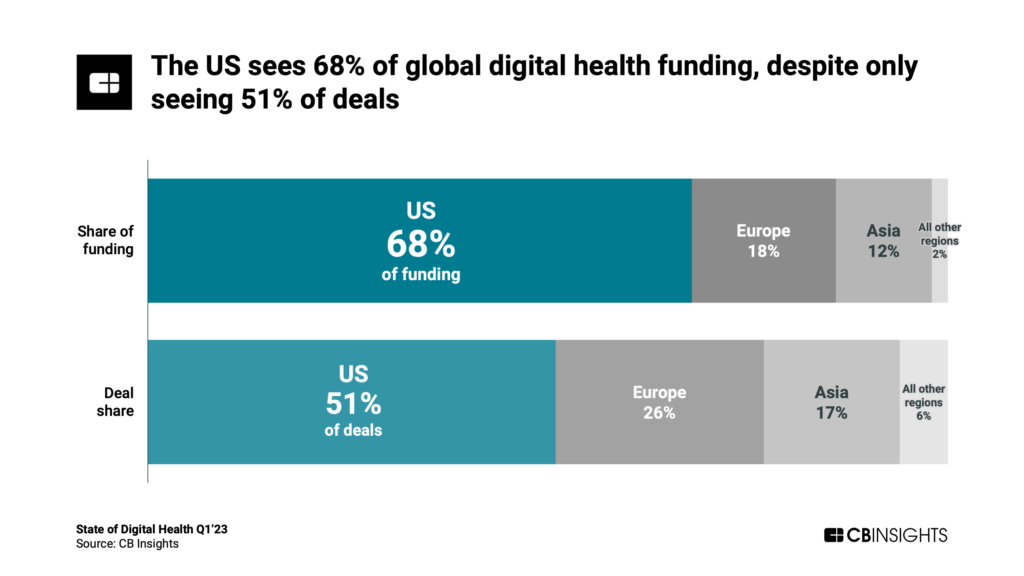

- The US sees 68% of global digital health funding, despite only seeing 51% of deals.

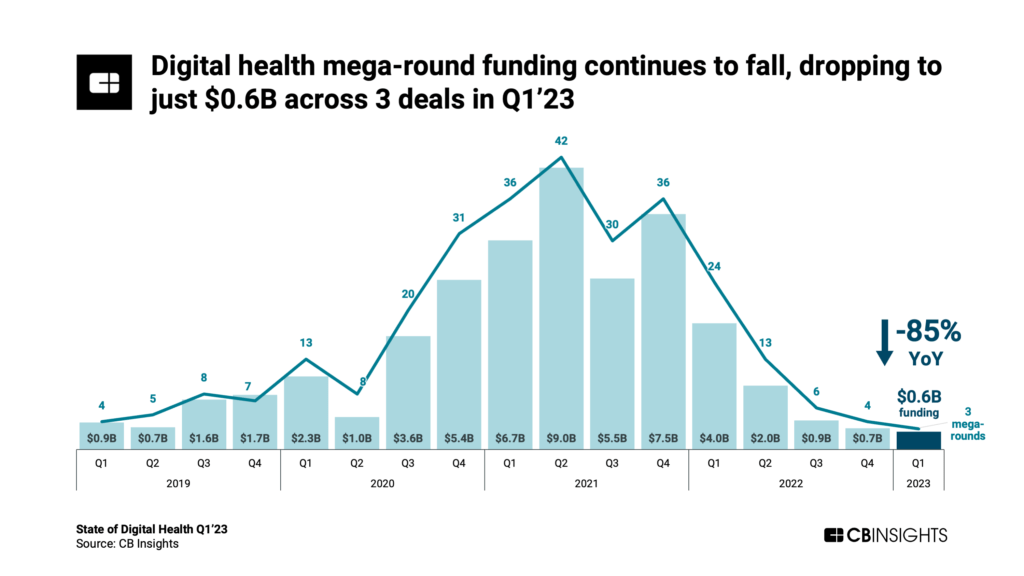

- Digital health mega-round funding continues to fall, dropping to just $0.6B across 3 deals in Q1’23.

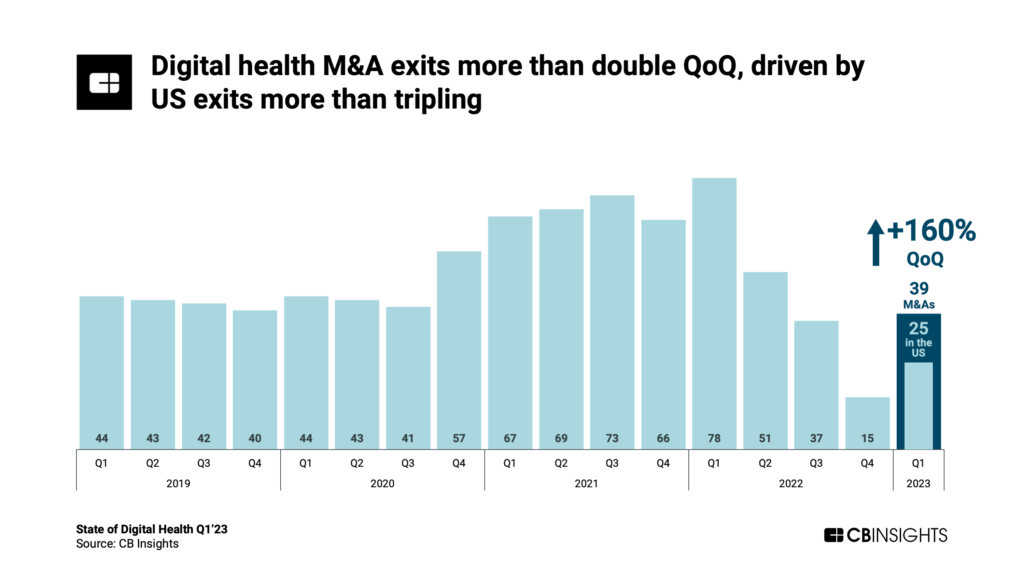

- Digital health M&A exits more than double quarter-over-quarter (QoQ), driven by US exits more than tripling.

CB Insights clients can sign in and download the full report to see all the latest funding trends in digital health.

Let’s dive in.

Global digital health funding saw no QoQ change, remaining at $3.4B for the second consecutive quarter. This was the first quarter to see no QoQ funding decline since Q4’21.

Q1’23 digital health funding trends defied the decline seen across the broader venture environment, where funding fell 13% QoQ. Even so, digital health funding remains at the lowest level in years.

Deals ticked up 1% QoQ, from 383 in Q4’22 to 387 in Q1’23. As with funding, this contrasted with venture as a whole, which saw deals decline for the fourth consecutive quarter.

Care delivery and navigation tech companies saw 44% of all funding and 37% of all deals across 7 digital health categories. Half of the category’s funding went to 5 of the quarter’s top 10 deals. As a result, the category also saw the highest average disclosed deal size ($12.6M).

Additional category highlights include:

- Digital therapeutics & wellness tech saw the lowest average disclosed deal size ($4.3M).

- Three categories saw at least three-quarters of deals go to early-stage companies: drug R&D tech (75% early-stage deal share), digital therapeutics & wellness tech (76%), and health insurance & RCM tech (81%).

US-based companies saw $2.3B in digital health funding in Q1’23, equivalent to 68% of the global total. The quarter’s top 9 deals (worth a combined $1B) went to US-based companies.

Nevertheless, US digital health deal count fell to just 198 in Q1’23, a 45% year-over-year (YoY) decline from a record-high 358 deals in Q1’22. Meanwhile, Europe’s digital health deals increased for the second consecutive quarter, leading to a record-high deal share (26%) in Q1’23.

Digital health mega-round funding ticked down to just $0.6B in Q1’23, marking an 85% YoY decline from Q1’22. More so, mega-rounds accounted for just 17% of digital health funding in Q1’23 — the lowest since Q2’19. Comparatively, this was 20 percentage points lower than the broader venture environment, which saw 37% of all funding go to mega-rounds in Q1’23.

Three digital health companies raised mega-rounds in Q1’23: Monogram Health ($375M), Carbon Health ($100M), and Kindbody ($100M). Further, Kindbody’s deal led to the company becoming the first new digital health unicorn since Q2’22 (valued at $1.8B).

Q1’23 saw the first QoQ increase in digital health M&A exits in a year, up 160% from 15 in Q4’22 to 39 in Q1’23. The increase is largely attributable to US M&A exits more than tripling QoQ, from 8 to 25. Europe also saw M&A exits more than double QoQ, from 4 to 10.

Comparatively, M&A exits across the broader venture environment saw a QoQ increase of less than 1% (from 2,132 in Q4’22 to 2,146 in Q1’23).

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.