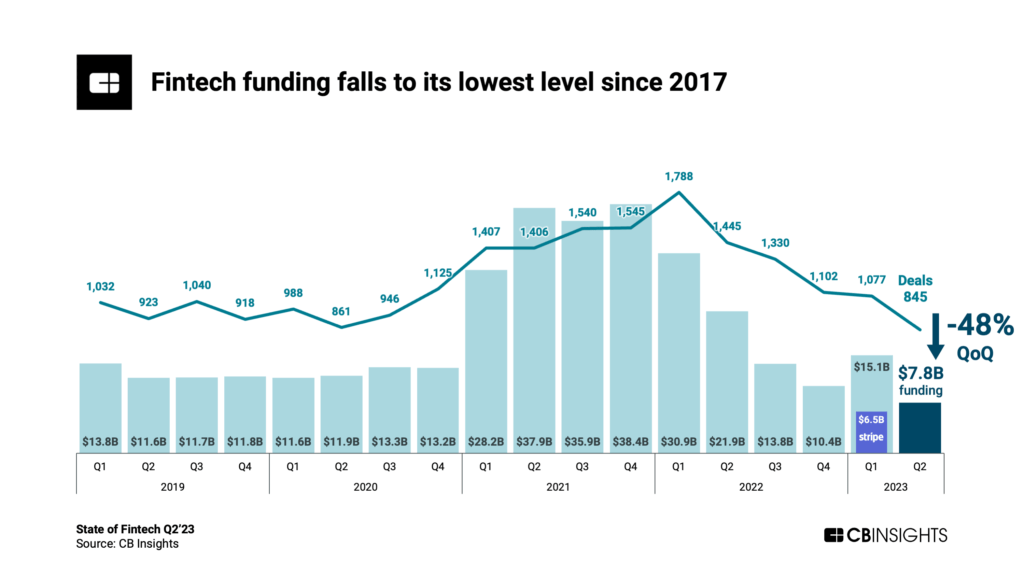

The global fintech ecosystem slows down in Q2’23, with funding and deals falling to levels not seen since 2017.

Following a spike in funding in Q1’23 (driven by Stripe‘s $6.5B round), global fintech funding decreased 48% quarter-over-quarter (QoQ) in Q2’23 to $7.8B. Deal count also fell for the fifth straight quarter to hit 845.

Using CB Insights data, we dig into key takeaways from our State of Fintech Q2’23 Report, including:

- Global fintech funding falls by nearly half to $7.8B, its lowest level since 2017.

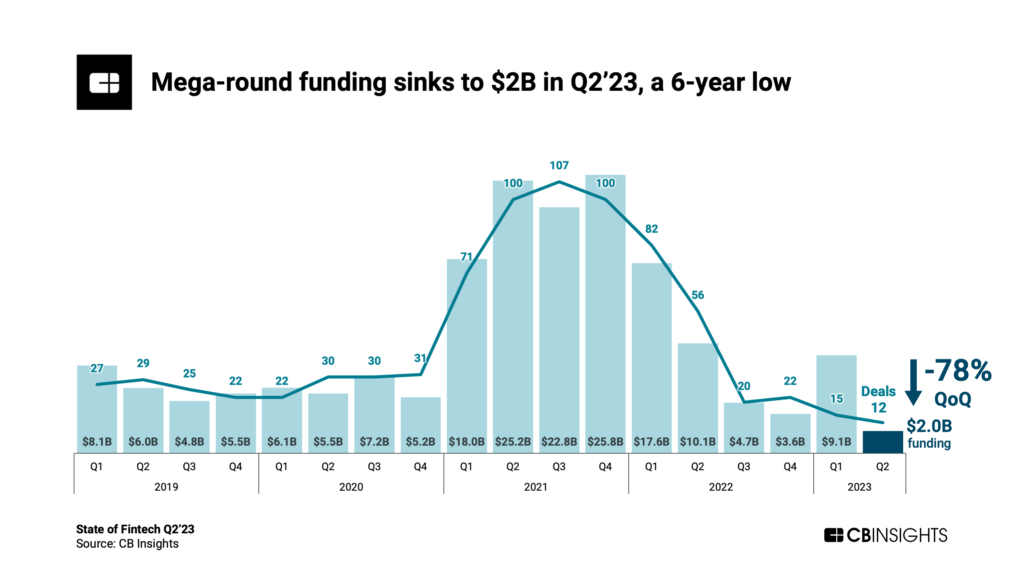

- Funding from $100M+ mega-rounds totals $2B — a 6-year low.

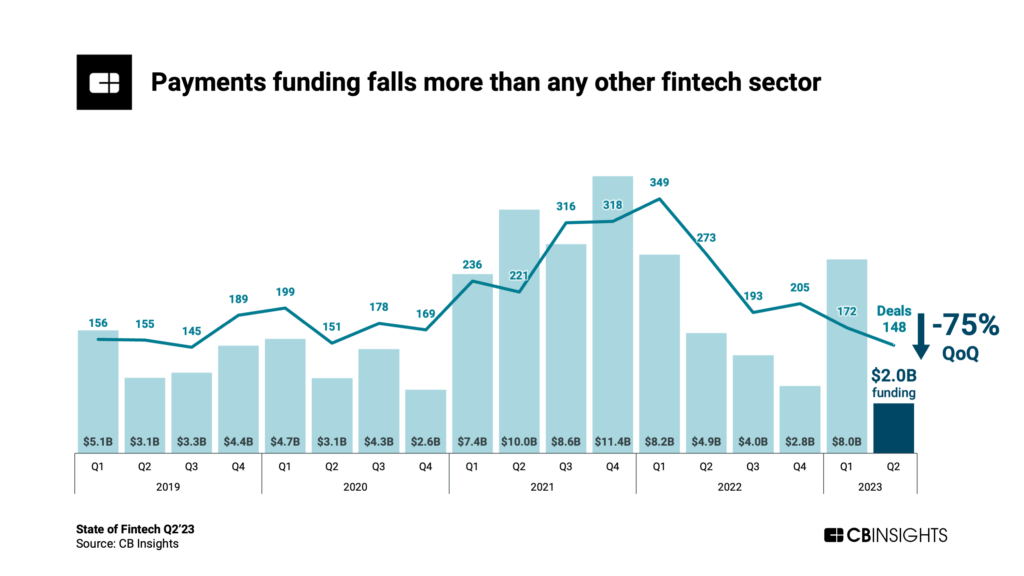

- Payments funding falls 75% QoQ, the biggest decrease across all fintech sectors.

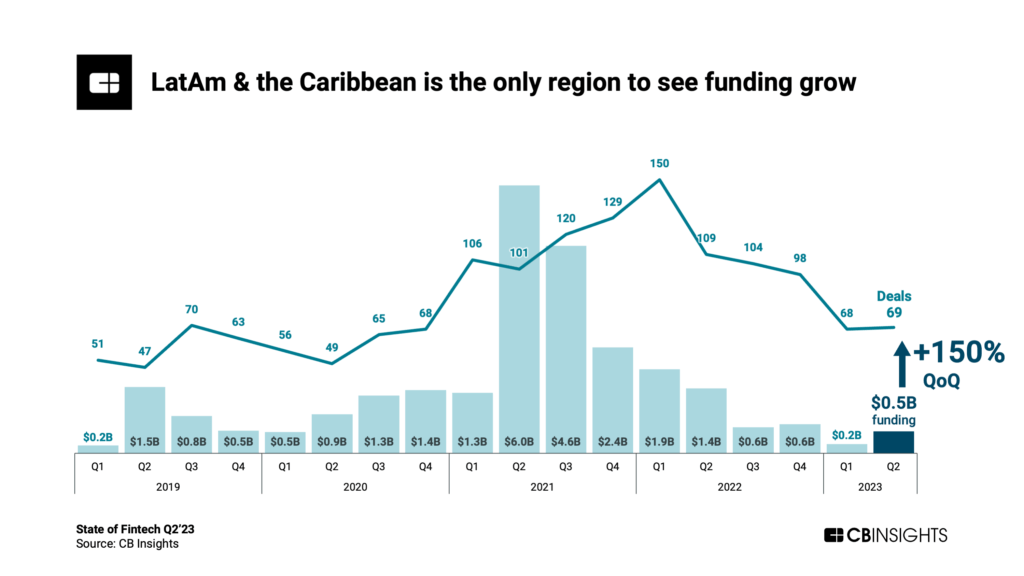

- LatAm & the Caribbean funding more than doubles, making it the only region to see funding grow QoQ.

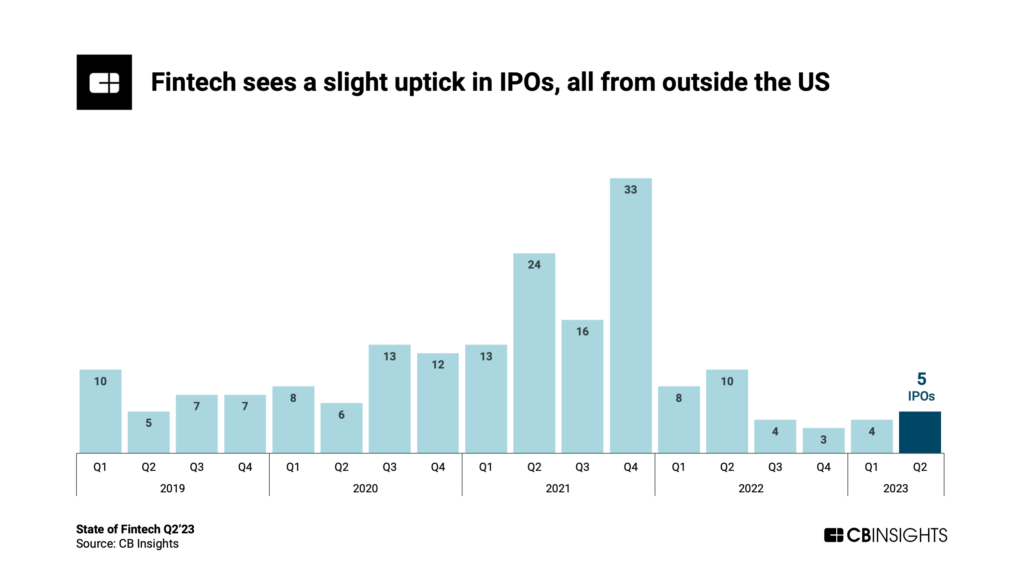

- All 5 of the quarter’s IPO exits come from fintechs based outside of the US.

CB Insights clients can sign in and download the full report to see all the latest funding trends in fintech.

Let’s dive in.

Global fintech funding fell 48% QoQ to hit $7.8B in Q2’23 — the lowest level since 2017. The steep drop was due in part to Stripe’s $6.5B deal in March, which inflated funding for Q1’23.

Without the Stripe deal in Q1’23, this quarter’s funding would have been down 9% QoQ.

Fintech deal count also fell 22% QoQ to 845 in Q2’23. That decline was worse than the venture ecosystem as a whole, where deal count fell by 16% QoQ.

Funding from $100M+ mega-rounds fell 78% QoQ to hit $2B in Q2’23 — a 6-year low. Mega-rounds represented just 26% of total funding in the quarter, a far cry from the recent high of 67% share in 2021.

The number of mega-rounds also fell to its lowest level in 5 years, dropping 20% QoQ to 12 rounds in Q2’23. The quarter’s top deal went to brokerage platform Clear Street, which raised a $270M Series B round.

Funding to payments companies fell 75% QoQ in Q2’23 to $2B, marking a 6-year funding low for the sector and the biggest QoQ decrease across all fintech sectors. Deal count also declined, dropping by 14% QoQ to 148.

Every other fintech sector — including banking, insurtech, wealth tech, and capital markets — saw funding declines. Digital lending experienced the biggest drop after payments, down 44% to $1B.

Meanwhile, early-stage players dominated fintech deal volume. In 2023 so far, early-stage companies have received 72% of all deals — a 5-year high if the trend holds through the end of the year.

LatAm & the Caribbean drew $0.5B in fintech funding, up 150% from $0.2B in Q1’23. This was the only major region that saw funding grow QoQ. Deal count remained roughly the same at 69.

Early-stage fintechs have seen 4 out of 5 deals in 2023 so far (81% deal share). The region’s top deal went to Cayman Islands-based DeFi platform Kross Wallet, which raised a $100M seed round. In fact, 3 of the top 5 deals went to fintechs based in the Cayman Islands. This is an intriguing shift, as most of the top deals in this region typically emerge from Brazil or Mexico.

Despite the drop in fintech deals and dollars, the IPO market showed a slight resurgence in Q2’23 to reach 5 in total — a minor rise from 4 the previous quarter.

All 5 of the IPOs came from non-US-based fintechs, and 4 out of the 5 went to fintechs based in Asia. However, thanks to its M&A activity, the US still led in global exit share in Q2’23 with 40% of the total.

Globally, there was a contraction in the fintech M&A market, with exits falling 20% QoQ to 142. Despite the dip, two deals breached the $1B mark: Nasdaq led with its $10.5B acquisition of Adenza, a provider of capital markets, risk management, and compliance solutions; while Visa acquired Pismo, a financial infrastructure platform, for $1B.

CB Insights clients can see all the latest investment data by signing in and downloading the full State of Fintech Q2’23 Report using the sidebar.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.