Mollie

Founded Year

2004Stage

Series C | AliveTotal Raised

$934.32MValuation

$0000Last Raised

$800M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-10 points in the past 30 days

About Mollie

Mollie is a financial technology company specializing in payment processing and money management for businesses. The company offers a suite of products that enable online and in-person payments, subscription management, fraud prevention, and financial reporting. Mollie provides solutions that cater to the needs of businesses ranging from startups to enterprises, aiming to simplify the complexities of financial transactions and support business growth. It was founded in 2004 and is based in Amsterdam, Netherlands.

Loading...

Loading...

Research containing Mollie

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mollie in 6 CB Insights research briefs, most recently on Mar 3, 2023.

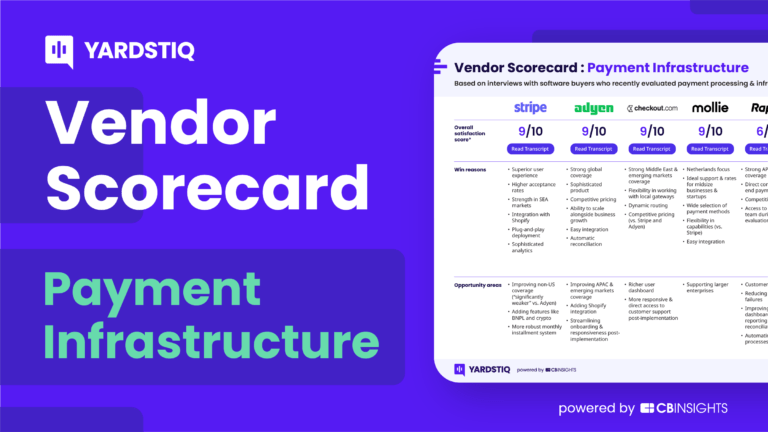

Sep 21, 2022 report

Top payment infrastructure companies — and why customers chose them

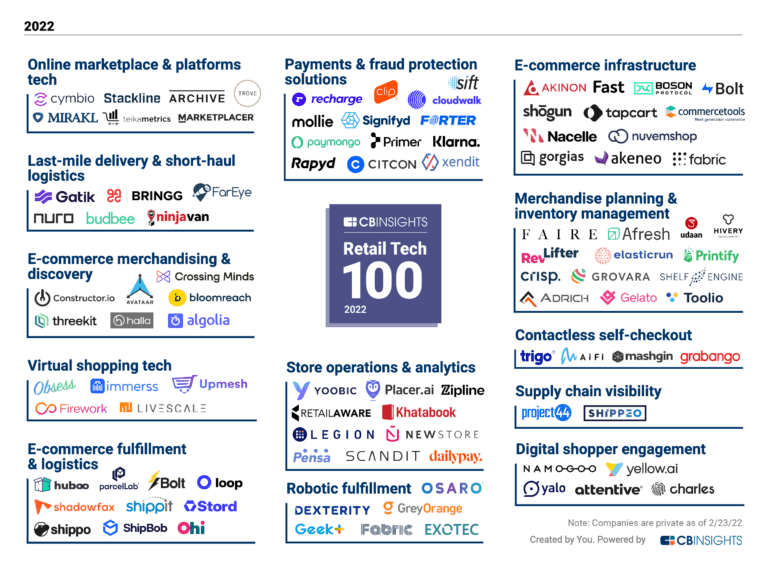

Mar 15, 2022 report

The Retail Tech 100: The top retail tech companies of 2022Expert Collections containing Mollie

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mollie is included in 7 Expert Collections, including E-Commerce.

E-Commerce

11,250 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,244 items

SMB Fintech

1,648 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Mollie News

Sep 19, 2024

Dave Smallwood directeur Mollie UK Betaalverwerker Mollie stelt Dave Smallwood (45) aan als Managing Director in het Verenigd Koninkrijk. Smallwood heeft meer dan twintig jaar ervaring bij grote organisaties in de financiële sector. Zo werkte hij onder andere bij American Express, PayPal en Super Payments. Zijn aanstelling is een belangrijke stap in Mollies strategie om haar positie in het Verenigd Koninkrijk verder te versterken en haar bredere expansieplannen in Europa te realiseren. De financieel dienstverlener kreeg eind 2023 een vergunning als betaalinstelling van de Financial Conduct Authority, de Britse tegenhanger van de AFM. Begin dit jaar lanceerde het bedrijf een geïntegreerde dienst voor zakelijke financiering, Mollie Capital, in het Verenigd Koninkrijk. Ook werd er geïnvesteerd in het personeel en is het team sinds 2023 met meer dan zestig procent gegroeid. Momenteel zijn er 26 medewerkers in het Verenigd Koninkrijk. Deel dit bericht

Mollie Frequently Asked Questions (FAQ)

When was Mollie founded?

Mollie was founded in 2004.

Where is Mollie's headquarters?

Mollie's headquarters is located at Keizersgracht 126, Amsterdam.

What is Mollie's latest funding round?

Mollie's latest funding round is Series C.

How much did Mollie raise?

Mollie raised a total of $934.32M.

Who are the investors of Mollie?

Investors of Mollie include Technology Crossover Ventures, General Atlantic, Alkeon Capital Management, Blackstone, HMI Capital and 10 more.

Who are Mollie's competitors?

Competitors of Mollie include Stripe, Hokodo, Vyne, EasyTransac, Prommt and 7 more.

Loading...

Compare Mollie to Competitors

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

PayU provides global payments and financial technology, solutions. The company offers a global payment platform that enables merchants to process online payments, optimize transaction approval rates, and utilize advanced security and anti-fraud measures. PayU primarily serves the ecommerce industry, providing financial services and payment solutions to businesses looking to expand their reach in emerging markets. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The company offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Razorpay is a comprehensive financial solutions company that specializes in online payment processing and business banking solutions. The company offers a suite of products that enable businesses to accept, process, and disburse payments, manage payroll, and access credit services. Razorpay caters to a diverse range of sectors including e-commerce, education, financial services, SaaS, and freelancers. It was founded in 2014 and is based in Bengaluru, India.

Optty is the world's first true Universal Payments Platform, specializing in the integration and orchestration of global payment methods and complimentary services across multiple sectors. The company offers a single API integration that allows access to a wide range of payment options, including Buy Now Pay Later (BNPL), digital wallets, card payments, gift cards, cryptocurrency, loyalty points, bank transfers, and peer-to-peer payments, simplifying transactions and promoting financial inclusivity. Optty primarily serves the ecommerce industry, providing solutions that cater to merchants, payment service providers, and financial institutions. It was founded in 2021 and is based in Singapore.

Till Payments is a global fintech company that operates in the payments industry. The company provides a range of payment solutions, including online and in-person payment processing, as well as a consolidated platform for managing transactions and payment methods. Its services are primarily used by businesses across various sectors to streamline their payment systems. Till Payments was formerly known as SimplePay. It was founded in 2012 and is based in Macquarie Park, New South Wales.

Loading...