Razorpay

Founded Year

2014Stage

Secondary Market | AliveTotal Raised

$741.62MLast Raised

$75M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-28 points in the past 30 days

About Razorpay

Razorpay is a comprehensive financial solutions company that specializes in online payment processing and business banking solutions. The company offers a suite of products that enable businesses to accept, process, and disburse payments, manage payroll, and access credit services. Razorpay caters to a diverse range of sectors including e-commerce, education, financial services, SaaS, and freelancers. It was founded in 2014 and is based in Bengaluru, India.

Loading...

ESPs containing Razorpay

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The omnichannel point-of-sale (POS) market, also called unified POS, provides integrated payment acceptance across digital and physical retail sales channels. These solutions provide the hardware and software to sync sales data, allowing for centralized transaction and inventory visibility. Some providers also offer customer service, shopper marketing, or sales analytics features. As more shopping…

Razorpay named as Outperformer among 15 other companies, including Stripe, Fiserv, and Shopify.

Loading...

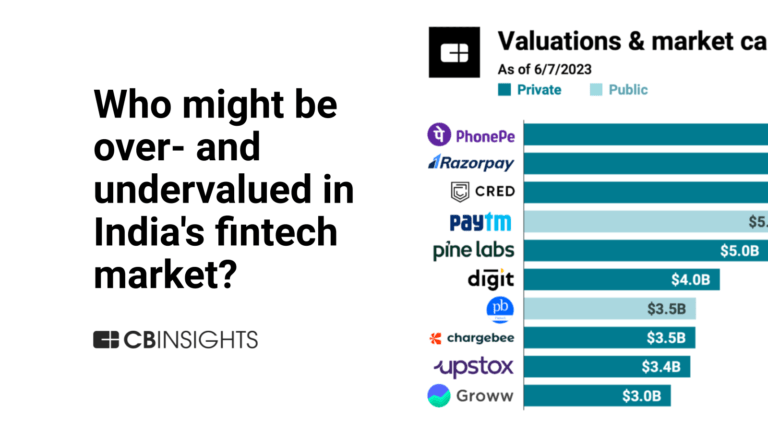

Research containing Razorpay

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Razorpay in 7 CB Insights research briefs, most recently on Jun 14, 2023.

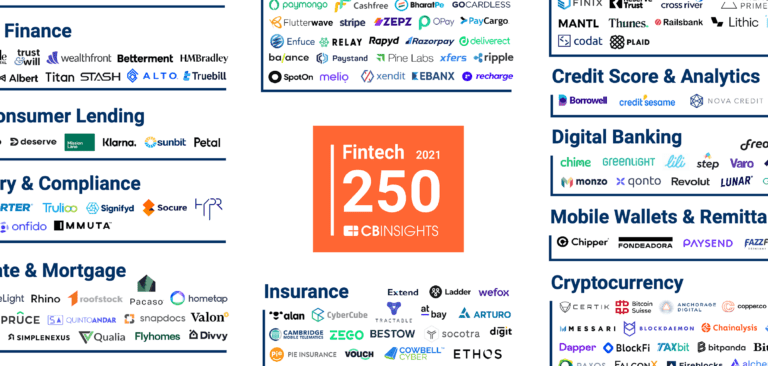

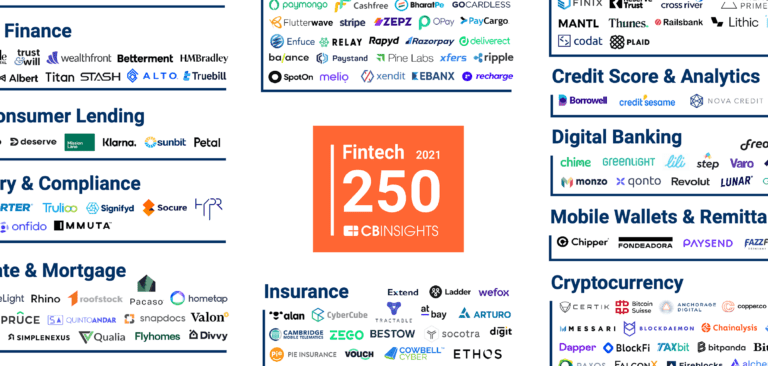

Oct 5, 2021 report

The Fintech 250: The Top Fintech Companies Of 2021

Oct 5, 2021 report

The Fintech 250: The top fintech companies of 2021Expert Collections containing Razorpay

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Razorpay is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

SMB Fintech

1,648 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Future Unicorns 2019

50 items

Fintech

13,396 items

Excludes US-based companies

Razorpay Patents

Razorpay has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/7/2017 | Payment service providers, Payment systems, Electronic funds transfer, Online payments, Digital currencies | Application |

Application Date | 6/7/2017 |

|---|---|

Grant Date | |

Title | |

Related Topics | Payment service providers, Payment systems, Electronic funds transfer, Online payments, Digital currencies |

Status | Application |

Latest Razorpay News

Sep 18, 2024

SHARE SUMMARY The B2B fintech startup is in talks with Helios Investment Partners to scoop up around $80 Mn in new funding round, a deal which is expected to include around $50 Mn (INR 419 Cr) and $30 Mn (INR 251 Cr) in primary and secondary infusions, respectively As per Arc report, the round is also expected to catapult M2P’s valuation to about $800 Mn (INR 6,704 Cr), close to a unicorn tag Founded in 2014 by Muthukumar A, Prabhu R and Madhusudanan R, M2P offers fintech API solutions to companies like slice, CRED, Ola and Razorpay. It offers a wide range of solutions across payments, lending and banking FOLLOW US has kicked off discussions with a major private equity player for a fresh fundraise. As per Arc, the B2B fintech startup is in talks with Helios Investment Partners to scoop up around $80 Mn in new funding round, a deal which is expected to include around $50 Mn (INR 419 Cr) and $30 Mn (INR 251 Cr) in primary and secondary infusions, respectively. The report further said that the round is also expected to catapult M2P’s valuation to about $800 Mn (INR 6,704 Cr), close to a unicorn tag. The startup is also looking to onboard more investors to its cap table, including its existing backers, in this round. M2P counts Insight Partners and Tiger Global among its marquee investors, who led its funding rounds in 2021. Additionally, Beennext, Flourish Ventures and Omidyar also hold significant stakes in the company, with the founders retaining over 40% control. RECOMMENDED FOR yOU 18th September, 2024 Founded in 2014 by Muthukumar A, Prabhu R and Madhusudanan R, M2P offers fintech API solutions to companies like slice, CRED, Ola and Razorpay. It offers a wide range of solutions across payments, lending and banking. It is pertinent to note that from the end of FY22 to mid-FY23, M2P raised new funds in several tranches as part of its Series C-1 round. The startup indicated it would use this capital to enhance its technology, grow its teams, and accelerate global expansion. The startup’s consolidated net loss more than tripled to INR 134.3 Cr in the financial year 2022-23 (FY23) from INR 40.1 Cr in the previous fiscal year, hurt by a sharp rise in a few expense buckets. The startup’s bottom line was hurt despite an over 126% jump in operating revenue to INR 440.7 Cr during the year under review from INR 194.7 Cr in FY22.

Razorpay Frequently Asked Questions (FAQ)

When was Razorpay founded?

Razorpay was founded in 2014.

Where is Razorpay's headquarters?

Razorpay's headquarters is located at 1st Floor, SJR Cyber, Bengaluru.

What is Razorpay's latest funding round?

Razorpay's latest funding round is Secondary Market.

How much did Razorpay raise?

Razorpay raised a total of $741.62M.

Who are the investors of Razorpay?

Investors of Razorpay include Salesforce Ventures, Lightspeed Venture Partners, Moore Strategic Ventures, Y Combinator, Tiger Global Management and 24 more.

Who are Razorpay's competitors?

Competitors of Razorpay include Innoviti, Stripe, Vyne, xPay, GoKwik and 7 more.

Loading...

Compare Razorpay to Competitors

Pine Labs offers cloud-based point-of-sale (PoS) payment solutions. The company allows merchants to accept credit or debit card payments, as well as methods such as e-wallets, quick response (QR) code payment solutions, and unified payments interface (UPI)-based solutions. The company was founded in 1998 and is based in Noida, India.

Yoco develops a financial platform for small businesses. It offers tools to accept digital payments at both point-of-sale and online through intelligent software and grow through cash advances. The company was founded in 2013 and is based in Cape Town, South Africa.

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Previse specializes in accelerating B2B payments through data-driven solutions in the financial technology sector. The company offers services that enable instant invoice payments and supply chain payment optimization using artificial intelligence to assess invoices and facilitate early payments. Previse's solutions cater to large enterprises looking to improve their working capital efficiency and supplier payment processes. It was founded in 2016 and is based in London, England.

PingPong specializes in cross-border payment solutions for businesses. The company offers services such as facilitating international payments through virtual accounts, managing invoices for global clients, processing payments to suppliers and freelancers, and handling tax payments like VAT and GST. PingPong also provides foreign exchange management and integrates with QuickBooks for streamlined bookkeeping. It was founded in 2015 and is based in San Mateo, California.

Loading...