Mondu

Founded Year

2021Stage

Debt | AliveTotal Raised

$122.05MLast Raised

$32.62M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-24 points in the past 30 days

About Mondu

Mondu's solution enables merchants and marketplaces to offer their business customers the most popular B2B payment methods and flexible payment terms in a multi-channel setting, both online and offline. It empowers business customers to purchase and pay when they want, which translates to a higher conversion rate and average order value, and drives growth for merchants and marketplaces. Mondu was founded in 2021 and is based in Berlin, Germany.

Loading...

Mondu's Product Videos

ESPs containing Mondu

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2B payments market offers flexible financing options for businesses to enhance their purchasing power and manage their working capital and cash flow by acquiring goods or services immediately and paying for them in installments over time. BNPL solutions in the B2B market provide streamlined application processes, quick approvals, and transparent terms for businesses…

Mondu named as Outperformer among 15 other companies, including PayPal, Slope, and Amount.

Mondu's Products & Differentiators

MonduOnline

Allows online merchants and marketplaces to offer flexible payment terms and methods in their checkout.

Loading...

Research containing Mondu

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mondu in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

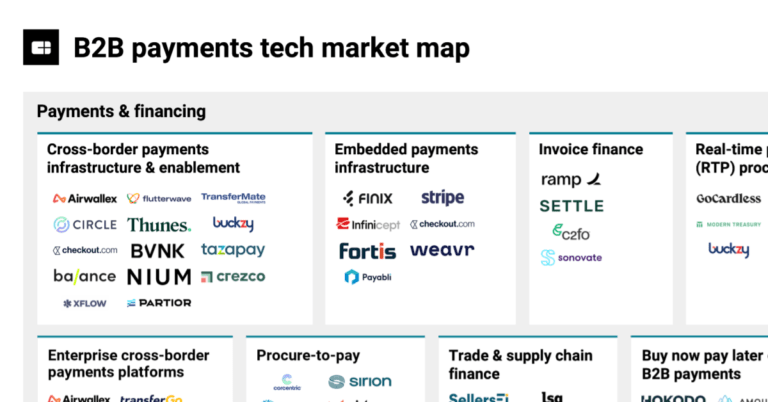

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Mondu

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mondu is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,250 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Digital Lending

197 items

Track and capture company information and workflow.

Fintech 100

100 items

Latest Mondu News

Sep 19, 2024

By PYMNTS | September 19, 2024 | The B2B landscape is full of what buyers and suppliers don’t know. In today’s rapidly evolving landscape, B2B businesses across the transaction frequently find themselves navigating uncertainty. Whether it’s the hidden costs of transactions, the intricacies of payment terms, or the evolving regulatory and technological environments, these knowledge gaps have real-world consequences. As ongoing innovation helps reshape the marketplace, the complex, opaque and often fragmented nature of B2B is changing. A large part of the change is due to a growing commitment to adopting evolving technologies as well as educating stakeholders that remain stuck on paper-based and traditional processes. The future is being built on more flexible and dynamic B2B solutions that automate with agility and ensure the optionality and security of B2B payments. This technical and behavioral shift is reflected in the top themes shaping the B2B landscape this week, which were around embracing the next-generation advances making B2B payments better, the opportunities that embedded payments can unlock, and the importance of smarter supply chain management. Embracing Digital B2B Payments Means Embracing the Future “You can digitize the payment, but if the receiver is turning it into cash and manually entering the data, then the value of that exchange has ended,” Schultz explained, noting that true success comes from digitizing every step of the payment process, ensuring a seamless flow of information from end to end. After years of being bogged down by manual work and fragmented workflows, technologies like robotic process automation are helping modernize accounts payable and receivable departments. Their implementation requires minimal labor and results in a productivity lift. With the advent of new B2B technologies, payment methods, and the complexity of global supply chains, PYMNTS analyzed Wednesday how chief product officers across the payments industry face unprecedented challenges and opportunities in ensuring their product strategies keep up with the pace of change and propel growth and innovation. How Embedded Payments Are Transforming B2B As B2B payments go more digital, they are also becoming increasingly embedded. Brex launched an embedded B2B payments solution Wednesday that complements the company’s corporate card and spend management platform for startups and enterprises. The day before, Capchase and Stripe partnered to offer a B2B buy now, pay later (BNPL) payment method in the United States. In other Stripe B2B BNLP news, Mondu said Sept. 11 that its new Stripe integration allows B2B merchants and marketplaces to offer Mondu’s BNPL options through their existing Stripe setup. This “ Mondu via Stripe ” offering is now available to businesses in the Netherlands, Germany and France, and it will expand to more markets soon. Wells Fargo introduced specialized APIs Tuesday (Sept. 17) tailored for its commercial banking clients. They provide clients real-time, on-demand information so they can efficiently and seamlessly manage inventory, supply chain and payments. Also on Tuesday, TurboTax maker Intuit debuted a new product suite for mid-market businesses. Intuit Enterprise Suite is designed to serve an $89 billion total addressable market of larger, mid-market businesses whose needs become more complex as they scale. As B2B payments evolve, so too are the roles of the executives tasked with making and managing them. In an era of rapid technological and data advancement, corporate treasurers find themselves at the forefront of change in their own roles and responsibilities. As two J.P. Morgan executives, Maria Chavez , head of payments for core middle market and specialized industries, and Janette Hutton , head of international payments for U.S. corporations, told PYMNTS in an interview published Thursday (Sept. 19), the cornerstone of this transformation is the increasing availability and use of data, which includes generative artificial intelligence. The fundamental step of identifying available data and its potential applications is crucial for treasurers looking to use analytics for strategic decision-making. As Global B2B Accelerates, Supply Chains Need to Adapt July PYMNTS Intelligence revealed that concerns over supply chain integrity and macroeconomic conditions highlight how larger external factors also remain on chief financial officers’ radars. And in the months since, supply chain realities have only surged in prominence. PYMNTS unpacked Wednesday how NASA ’s reliance on highly specialized suppliers is emblematic of a broader risk in B2B supply chains — the lack of redundancy. As industries globally contend with increasingly complex and interconnected supply chains, NASA’s experience with a vendor undergoing challenging times offers a cautionary tale about the hidden risks and opportunities for B2B enterprises in managing such networks. Meanwhile, as international trade becomes more complex, the need for real-time intelligence and innovative financial solutions grows. Businesses can no longer rely on traditional methods of monitoring their supply chains, as the dynamic and unpredictable nature of modern trade demands faster, more accurate data to mitigate risks. The marketplace is responding in turn. Amazon added a fully managed option to the lineup of supply chain services it offers to sellers Wednesday. The new fully managed Supply Chain by Amazon solution will be available to all U.S. sellers for domestic pickups in October and will be expanded to global pickups by the end of the year. For all PYMNTS B2B coverage, subscribe to the daily B2B Newsletter . Recommended

Mondu Frequently Asked Questions (FAQ)

When was Mondu founded?

Mondu was founded in 2021.

Where is Mondu's headquarters?

Mondu's headquarters is located at Alexanderstrasse 36, Berlin.

What is Mondu's latest funding round?

Mondu's latest funding round is Debt.

How much did Mondu raise?

Mondu raised a total of $122.05M.

Who are the investors of Mondu?

Investors of Mondu include Vereinigte Volksbank Raiffeisenbank eG, FinTech Collective, Valar Ventures, Cherry Ventures and Peter Thiel.

Who are Mondu's competitors?

Competitors of Mondu include Tranch, Hokodo, Tabby, Defacto, Treyd and 7 more.

What products does Mondu offer?

Mondu's products include MonduOnline and 4 more.

Who are Mondu's customers?

Customers of Mondu include Ionto Comed, Orderchamp and Trotec.

Loading...

Compare Mondu to Competitors

Billie is a leading provider of Buy Now, Pay Later (BNPL) payment methods for the B2B sector, offering innovative digital payment services. The company's main offerings include modern checkout solutions that enable businesses to pay and get paid on their terms, with features such as upfront payment for sellers and flexible payment terms for buyers. Billie's services cater to a variety of sectors, including e-commerce, telesales, and in-person sales channels. It was founded in 2016 and is based in Berlin, Germany.

Klarna specializes in providing payment solutions and services within the e-commerce sector. The company offers a platform for online shopping that includes price comparisons, deals, and various payment options to facilitate purchases for consumers. Klarna primarily serves the e-commerce industry by enabling a seamless shopping experience through its payment and financing services. It was founded in 2005 and is based in Stockholm, Sweden.

Hokodo specializes in B2B (business-to-business) payment solutions, offering a digital platform for trade credit and financing services within various industries. The company provides credit terms to businesses, enabling a frictionless checkout experience and real-time credit decision-making. Hokodo's solutions cater to sectors such as B2B marketplaces, food and beverages, agriculture, industrial supplies, construction and building materials, freight and logistics, freelance and workplace management, and corporate travel. It was founded in 2018 and is based in London, United Kingdom.

Two specializes in B2B Buy Now Pay Later (BNPL) payment solutions within the e-commerce sector. The company offers services that enable merchants to provide high net term credit limits, manage credit and fraud risks, and streamline the checkout process for business customers. Two's solutions cater to various sectors including construction, wholesale, B2B marketplaces, and SaaS. Two was formerly known as Tillit. It was founded in 2020 and is based in Oslo, Norway.

Cashew specializes in flexible payment solutions within the financial services sector. The company offers a range of products including buy now pay later options, interest-free installment plans, and comprehensive financial management services. Cashew primarily caters to individual consumers seeking manageable payment options for their purchases. It was founded in 2020 and is based in Dubai, United Arab Emirates.

PayJoy focuses on providing credit solutions in the financial services industry. The company's main offerings include providing customers with the ability to afford their first smartphone on credit, using the phone itself as collateral, and offering cash loans with minimal requirements. It primarily serves the financial services sector in emerging markets. It was founded in 2015 and is based in San Francisco, California.

Loading...