Upstox

Founded Year

2009Stage

Series C | AliveTotal Raised

$54MValuation

$0000Last Raised

$25M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-80 points in the past 30 days

About Upstox

Upstox is a financial services company specializing in online trading and investment platforms. The company offers a range of services including stock trading, mutual funds, IPOs, and derivatives trading, as well as tools and calculators for financial planning and market analysis. Upstox primarily caters to individual investors and traders looking for digital solutions to manage their investment portfolios. It was founded in 2009 and is based in Mumbai, India.

Loading...

Loading...

Research containing Upstox

Get data-driven expert analysis from the CB Insights Intelligence Unit.

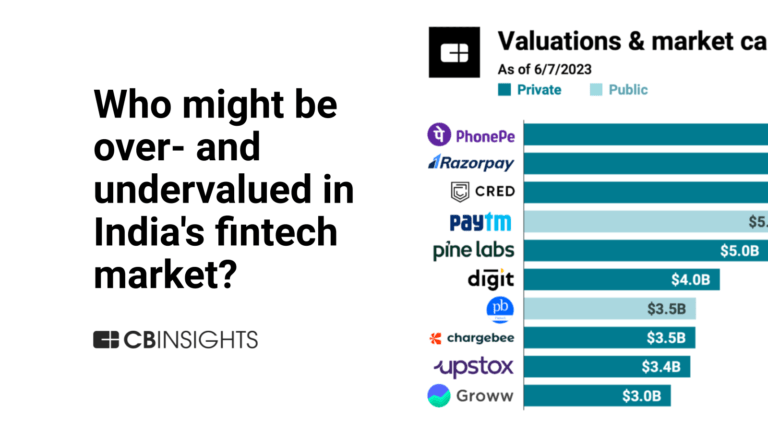

CB Insights Intelligence Analysts have mentioned Upstox in 4 CB Insights research briefs, most recently on Jun 14, 2023.

Expert Collections containing Upstox

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Upstox is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Wealth Tech

2,296 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

13,398 items

Excludes US-based companies

Latest Upstox News

Sep 20, 2024

The Avax Apparels and Ornaments IPO minimum market lot is 2000 shares with ₹140,000 application amount. The Avax Apparels and Ornaments IPO is a SME IPO, and it is to be listed on BSE. Avax Apparels and Ornaments Limited is engaged in two distinct lines of business: one is Wholesale trading and the second is Online retail of silver ornaments. They are operating in the wholesale trading of knitted cloth which they are buying from the manufacturers and supplying to the wholesale companies and readymade garment manufacturers in Punjab. The company has recently purchased new and latest machinery for manufacturing of knitted cloth. The Company operates in the business of online retail of silver ornaments which have a wide range of designs and articles with a choice of the weight of products, such as silver rings, silver ladies’ pajeb, silver gents kada, silver plate sets, silver glass, silver bangles, silver bowls, silver chains, and other silver jewellery. The company has a plan to start manufacturing in a short period of time, a step towards backward integration. They aim to manufacture what they have been outsourcing till now. IPOWatch View We recommend investors may apply for an IPO with Long-term Views. Investors should also look at the QIB, NII, and Retail numbers before investing. Avax Apparels and Ornaments IPO Subscription Status – Day 1 Category Avax Apparels and Ornaments IPO Form How to apply for the Avax Apparels and Ornaments IPO? You can apply for Avax Apparels and Ornaments IPO via ASBA available in your bank account. Just go to the online bank login and apply via your bank account by selecting the Avax Apparels and Ornaments IPO in the Invest section. The other option is you can apply for Avax Apparels and Ornaments IPO via IPO forms downloaded online. Check out the Avax Apparels and Ornaments forms – Click IPO Forms blank IPO forms download, fill, and submit in your bank or with your broker. Avax Apparels and Ornaments IPO Subscription Status FAQs: When Avax Apparels and Ornaments IPO Subscription will start? The IPO subscription starts on September 20, 2024 for QIB, NII, and Retail Investors. How to subscribe Avax Apparels and Ornaments IPO? You can go with ASBA and Non-ASBA options for a subscription. Go to your bank account and apply for IPO online via ASBA or download the form online or get the physical form and submit the filled form to your broker or bank. How do I check live Avax Apparels and Ornaments IPO Subscription Numbers Today? One can visit our portal for live IPO subscription numbers that we are updating hourly basis from the official websites. One can check the live subscription on official websites on the particular IPO page. How to Apply the Avax Apparels and Ornaments IPO through Zerodha? Log in to Console in Zerodha Website or in Application. Go to Portfolio and Click on IPO. You will see the IPO Name “Avax Apparels and Ornaments “. Click on Bid Button. Enter your UPI ID, Quantity and Price. Submit IPO Application Form. Now go to your UPI App on Net Banking or BHIM App to Approve the mandate. Open Demat Account with Zerodha . How to Apply the Avax Apparels and Ornaments IPO through Upstox? Log in to Upstox Application with your credentials. Select the IPO. You will see the IPO Name “Avax Apparels and Ornaments “. Click on Bid Button. Confirm your Application. Now go to your UPI App on Net Banking or BHIM App to Approve the mandate. Open Demat Account with Upstox . How to Apply the Avax Apparels and Ornaments IPO through Paytm Money? Log in to Paytm Money Application with your credentials. Select the IPO. You will see the IPO Name “Avax Apparels and Ornaments ” Click on Bid Button. Confirm your Application. Now go to your UPI App on Net Banking or BHIM App to Approve the mandate. Open Demat Account with Paytm Money .

Upstox Frequently Asked Questions (FAQ)

When was Upstox founded?

Upstox was founded in 2009.

Where is Upstox's headquarters?

Upstox's headquarters is located at Senapati Bapat Marg, Dadar (West), Mumbai.

What is Upstox's latest funding round?

Upstox's latest funding round is Series C.

How much did Upstox raise?

Upstox raised a total of $54M.

Who are the investors of Upstox?

Investors of Upstox include Tiger Global Management, Kalaari Capital, Aragen Life Sciences, Ratan Tata and Reddy Ventures.

Who are Upstox's competitors?

Competitors of Upstox include Sharekhan, Nuvama Wealth Management, Anand Rathi Wealth Services, Paytm, 5paisa and 7 more.

Loading...

Compare Upstox to Competitors

HDFC Securities is a financial services company with a focus on providing a comprehensive suite of investment products and services. The company offers a platform for trading in equities, derivatives, and currency, as well as investment opportunities in mutual funds, fixed deposits, bonds, and more. HDFC Securities caters to a diverse customer base, including retail and institutional investors, with offerings such as portfolio management services, investment advisory, and value-added services like online will writing and tax filing. It was founded in 2000 and is based in Mumbai, India.

Zerodha is a financial services company specializing in discount broking and online stock trading. The company offers a platform for investing in stocks, derivatives, mutual funds, ETFs, and bonds with a transparent flat fee pricing model. Zerodha provides educational resources and a community for traders and investors. It was founded in 2010 and is based in Bengaluru, India.

Kotak Securities is a company that focuses on providing opportunities in the capital markets, operating within the financial services industry. The company offers a range of services including online trading in the stock market, investment in futures and options, exchange traded funds, commodities, and mutual funds, among others. It primarily serves individuals and businesses interested in the financial markets. It was founded in 1994 and is based in Mumbai, India.

PredictRAM focuses on risk management in the financial domain. The company offers artificial intelligence-driven solutions for registered advisors and research analysts, providing insights and data-driven solutions for portfolio risk analysis. Its solutions include individual risk analysis, portfolio risk analysis, market event risk analysis, and risk mitigation strategies through customized exchange-traded fund (ETF). Primarily it serves the financial service sector. The company was founded in 2020 and is based in New Delhi, India.

Groww is a financial services company specializing in investment and trading platforms. The company offers a range of services including equity trading, direct mutual funds, and investment in US stocks, all through a user-friendly online platform. Groww provides tools for both systematic investment plans (SIPs) and lumpsum investments, as well as educational resources to empower investors. It was founded in 2016 and is based in Bengaluru, India.

Ventura operates as a brokerage firm. The company provides a complete array of financial products and services, as well as facilitates clients to trade in equity online. Ventura serves clients in India. It is based in Thane, India.

Loading...