Midjourney — a bootstrapped generative AI startup focused on image generation — has reportedly hit $200M in ARR. We analyze its competitive landscape and potential valuation.

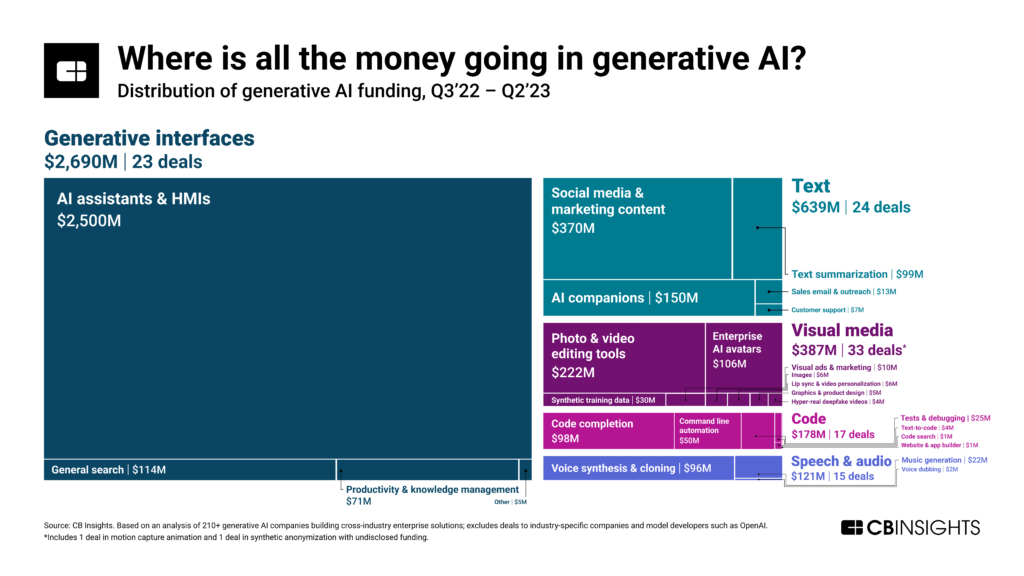

Within generative AI, image generation — a subset of visual media generation — is gaining traction.

The space has seen top-tier investors and corporations rush in, including Coatue and Lightspeed Venture Partners.

Right now, one of the biggest and most well-known players in the genAI image generation space is Midjourney — and it is choosing not to raise capital.

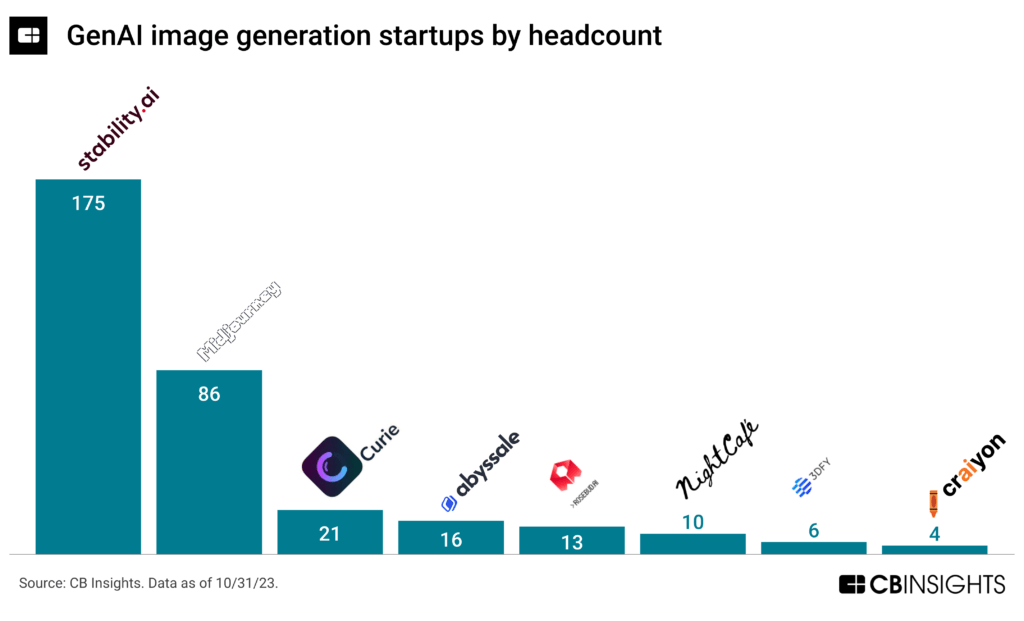

That’s because it doesn’t need to. The company has reportedly hit $200M in annual recurring revenue (ARR) with a team of fewer than 100 employees.

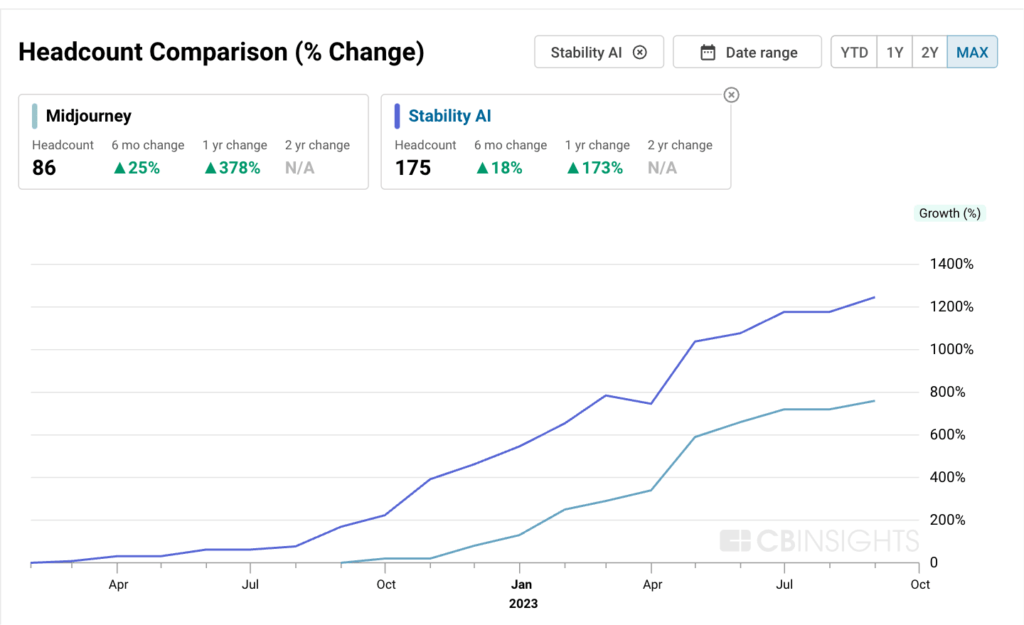

While it is growing its team aggressively, it still has fewer employees than Stable Diffusion developer Stability AI.

However, Stability AI is currently valued at $1B and is reportedly generating modest revenue. So with less than half the team and materially more revenue, it’s clear that Midjourney has a leg up on its larger competitor.

The growth that Midjourney is seeing coupled with its $200M in ARR would create a feeding frenzy in the current genAI investment boom. A 50x multiple on that ARR is very easy to see — giving it a $10B valuation — and it might even be conservative.

However, once again, Midjourney is not looking to raise capital, demonstrating significant clarity of intent on the part of founder David Holz.

Want to dive deeper into image generation and generative AI more broadly? Check out the following resources:

- The state of generative AI in 7 charts

- Which investors are leading the charge in generative AI?

- 95+ early-stage companies using AI to create and edit digital content