Plaid

Founded Year

2013Stage

Series D - II | AliveTotal Raised

$734.8MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-16 points in the past 30 days

About Plaid

Plaid operates as a technology company that focuses on providing a data network for fintech solutions. The company offers a suite of products that enable secure and easy connection of financial accounts to various applications and services. Plaid primarily serves the financial technology industry, including personal finance, lending, and wealth management sectors. Plaid was formerly known as Plaid Technologies. It was founded in 2013 and is based in San Francisco, California.

Loading...

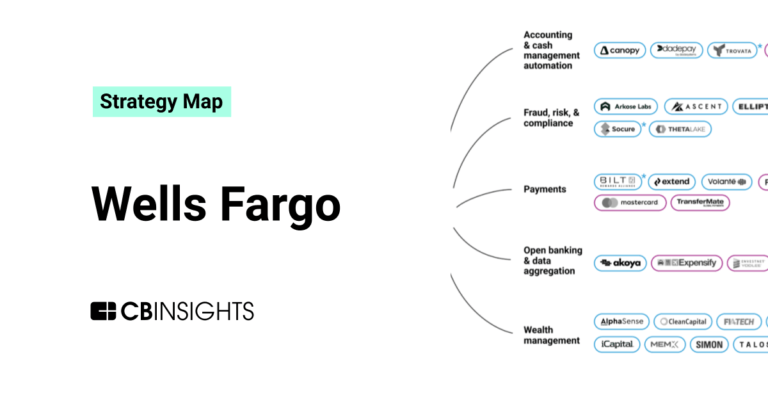

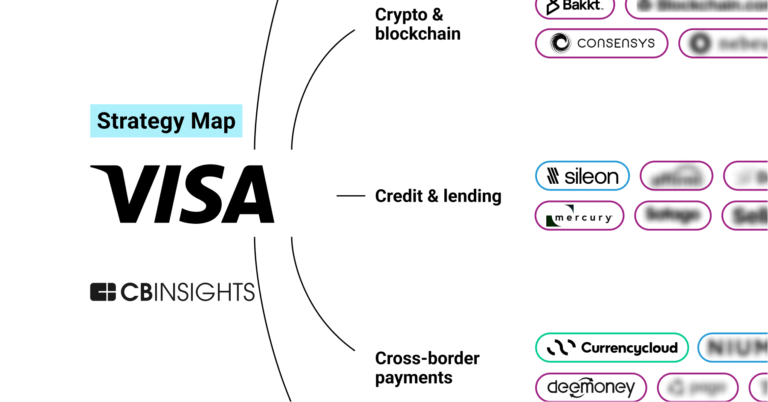

ESPs containing Plaid

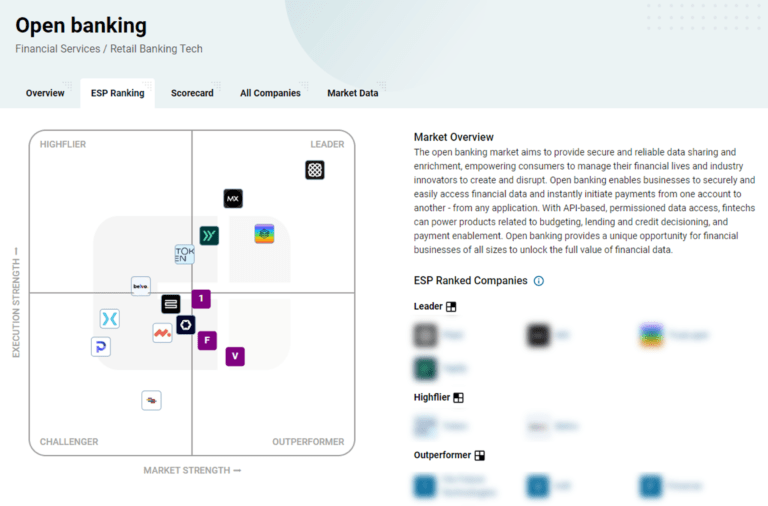

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

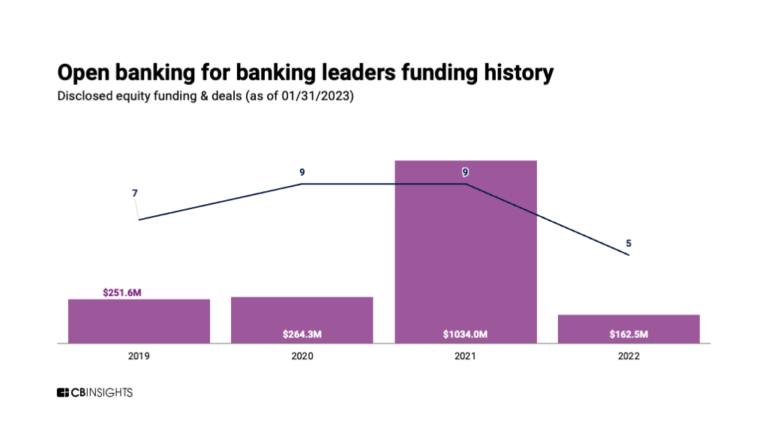

These platforms provide advanced account aggregation capabilities that, using open finance capabilities, securely consolidate financial data from various sources, offering users a comprehensive and real-time view of their entire financial ecosystem. Designed for both banking and wealth management, they enable institutions to deliver personalized financial insights, automate actions based on user b…

Plaid named as Leader among 7 other companies, including MX, Personetics, and Masttro.

Plaid's Products & Differentiators

Transacttions

Retrieve typically 24 months of transaction data, including enhanced geolocation, merchant, and category information. Stay up-to-date by receiving notifications via a webhook whenever there are new transactions associated with linked accounts.

Loading...

Research containing Plaid

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Plaid in 20 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

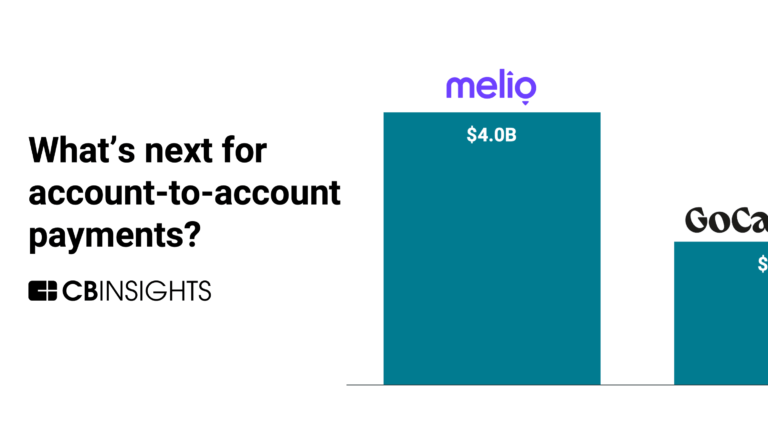

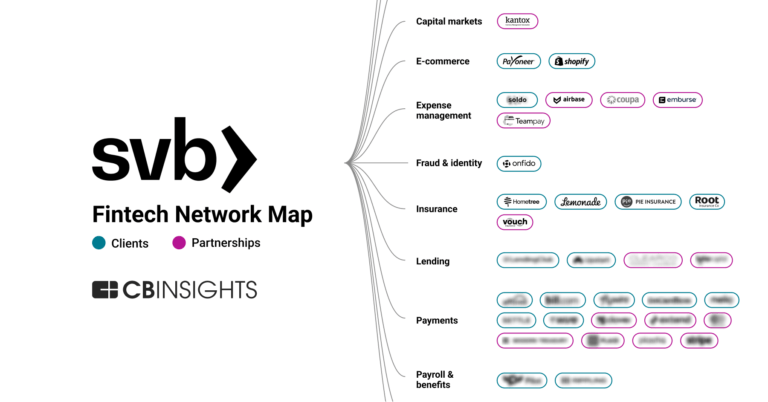

The embedded banking & payments market map

Jan 4, 2024

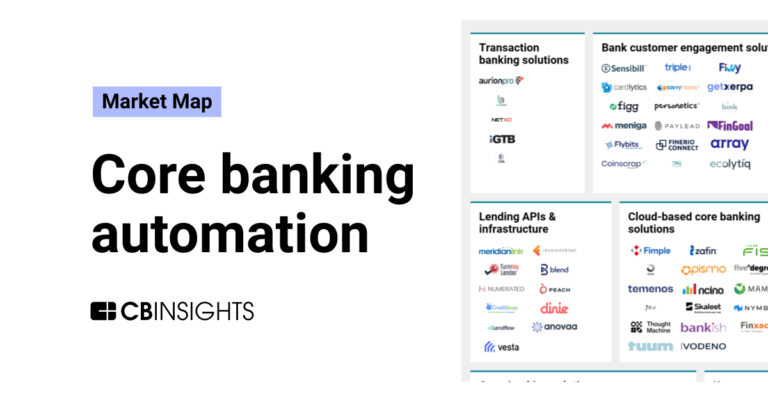

The core banking automation market map

Expert Collections containing Plaid

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Plaid is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Wealth Tech

2,294 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,374 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Tech IPO Pipeline

825 items

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Plaid Patents

Plaid has filed 58 patents.

The 3 most popular patent topics include:

- data management

- payment systems

- banking technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/25/2022 | 8/27/2024 | Application programming interfaces, Social networking services, Computer security, Operating system security, Linux kernel features | Grant |

Application Date | 3/25/2022 |

|---|---|

Grant Date | 8/27/2024 |

Title | |

Related Topics | Application programming interfaces, Social networking services, Computer security, Operating system security, Linux kernel features |

Status | Grant |

Latest Plaid News

Sep 20, 2024

News provided by Share this article Share toX Arrangement allows PNC customers to more safely, securely permission financial data to Plaid powered apps and services PITTSBURGH, Sept. 20, 2024 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC ) and Plaid have entered into a bilateral data access agreement that will enable PNC customers nationwide to more safely and securely connect and share financial data to their chosen financial applications through Plaid. PNC uses Akoya as its API service provider to provide PNC customers' financial information to all data recipients. Plaid Logo "Through this new partnership with Plaid, PNC customers will be able to achieve greater data security, privacy, and control while using the third-party financial apps and services they enjoy," said Natalie Talpas, executive vice president, Digital and Payments at PNC. "PNC's use of its Akoya-provided API allows for all data recipients, including Plaid, to get connected fast, while also enabling customers to reliably control what financial data they are permissioning without having to share their login credentials with third parties." "We are pleased to have reached a data access agreement with PNC that further supports their customers securely connecting to applications and services powered by Plaid," said Christy Sunquist, head of Open Finance Partnerships at Plaid. "Moving the industry away from credential-based access is a top priority for Plaid, and our alignment on key principles around security, access and control played a definitive role in establishing this partnership. We look forward to future collaboration for many years to come." Together, PNC and Plaid are proud to continue supporting PNC customers in their ability to have more control over the solutions they use to lead a healthy financial life. About PNC: The PNC Financial Services Group, Inc. is one of the largest diversified financial services institutions in the United States, organized around its customers and communities for strong relationships and local delivery of retail and business banking including a full range of lending products; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management. For information about PNC, visit www.pnc.com . About Plaid: Plaid powers the tools millions of people rely on to live a healthier financial life. Plaid's ambition is to facilitate a more inclusive, competitive, and mutually beneficial financial system by simplifying payments, revolutionizing lending, and leading the fight against fraud. Today, thousands of companies including the largest fintechs, several of the Fortune 500, and many of the largest banks use Plaid to empower people with more choice and control over how they manage their money. Headquartered in San Francisco, Plaid's network spans over 12,000 institutions across the US, Canada, UK and Europe. CONTACTS

Plaid Frequently Asked Questions (FAQ)

When was Plaid founded?

Plaid was founded in 2013.

Where is Plaid's headquarters?

Plaid's headquarters is located at San Francisco.

What is Plaid's latest funding round?

Plaid's latest funding round is Series D - II.

How much did Plaid raise?

Plaid raised a total of $734.8M.

Who are the investors of Plaid?

Investors of Plaid include American Express Ventures, J.P. Morgan Private Bank, Spark Capital, New Enterprise Associates, Index Ventures and 24 more.

Who are Plaid's competitors?

Competitors of Plaid include Finix, Nymbus, Bud, Aeropay, Solaris and 7 more.

What products does Plaid offer?

Plaid's products include Transacttions and 4 more.

Loading...

Compare Plaid to Competitors

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Railsr operates as a banking and compliance platform. It connects together a global network of partner banks with companies offering embedded banking and wallets known as banking-as-a-service, embedded rewards known as reward-as-a-service, embedded cards known as cards-as-a-service, and embedded credit known as credit-as-a-service. Railsr was formerly known as Railsbank. The company was founded in 2016 and is based in London, United Kingdom.

Budget Insight focuses on open finance and embedded finance solutions. The company offers a range of services including instant money transfers, real-time revenue checking, automated bank identity verifications, and a platform for aggregating financial data from various institutions. Its services primarily cater to sectors such as banking, insurance, technology companies, and utilities. It was founded in 2012 and is based in Roubaix, France.

Teller is a company that focuses on providing API solutions for bank accounts in the financial technology sector. Their main service involves offering an easy-to-use API that allows users to connect their bank accounts to applications, enabling account verification, money transfers, payments, and transaction viewing. The company primarily serves the financial technology industry. It was founded in 2014 and is based in London, England.

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

TrueLayer provides an open banking platform, specializing in the financial technology sector. The company provides solutions for instant bank payments, verified payouts, and streamlined user onboarding, leveraging real-time financial and identity data. TrueLayer primarily serves businesses in the ecommerce, iGaming, financial services, and cryptocurrency sectors. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, England.

Loading...