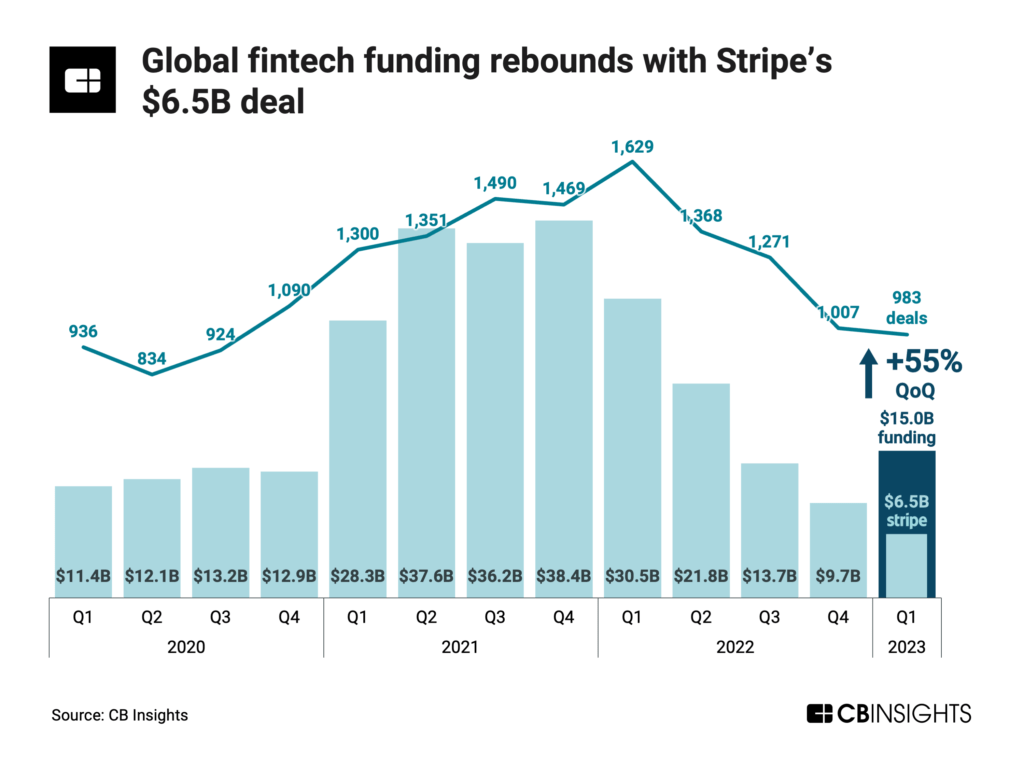

The global fintech ecosystem isn’t out of the woods yet, despite funding in Q1’23 rising 55% quarter-over-quarter.

Following the steady decline of investment activity in 2022, global fintech funding increased 55% quarter-over-quarter (QoQ) in Q1’23. Excluding Stripe’s massive $6.5B round, however, funding fell 12%. Deal count also dropped, falling for the fourth straight quarter to hit 983.

Using CB Insights data, we highlight some of the key takeaways from our Q1’23 State of Fintech report, including:

- Global fintech funding grows 55% QoQ in Q1’23; $6.5B is raised by Stripe alone.

- Early-stage deal share reaches 72%, a new high.

- Unicorn births fall to 1 for the first time since 2016.

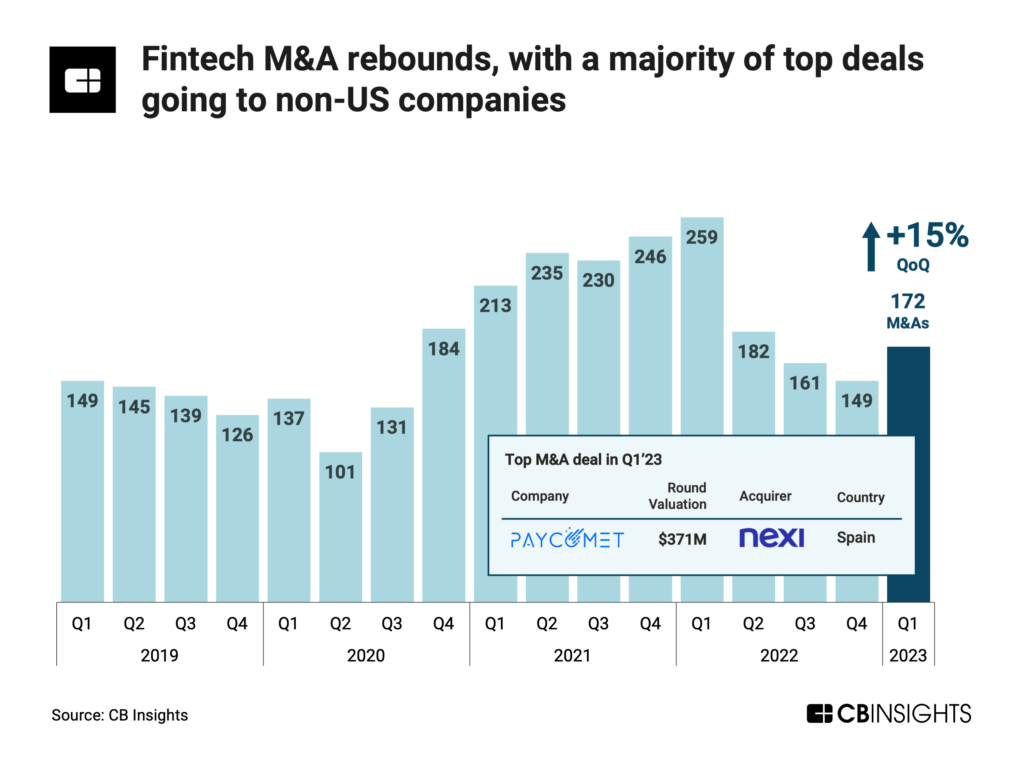

- Fintech M&A exits rebound, increasing 15% QoQ.

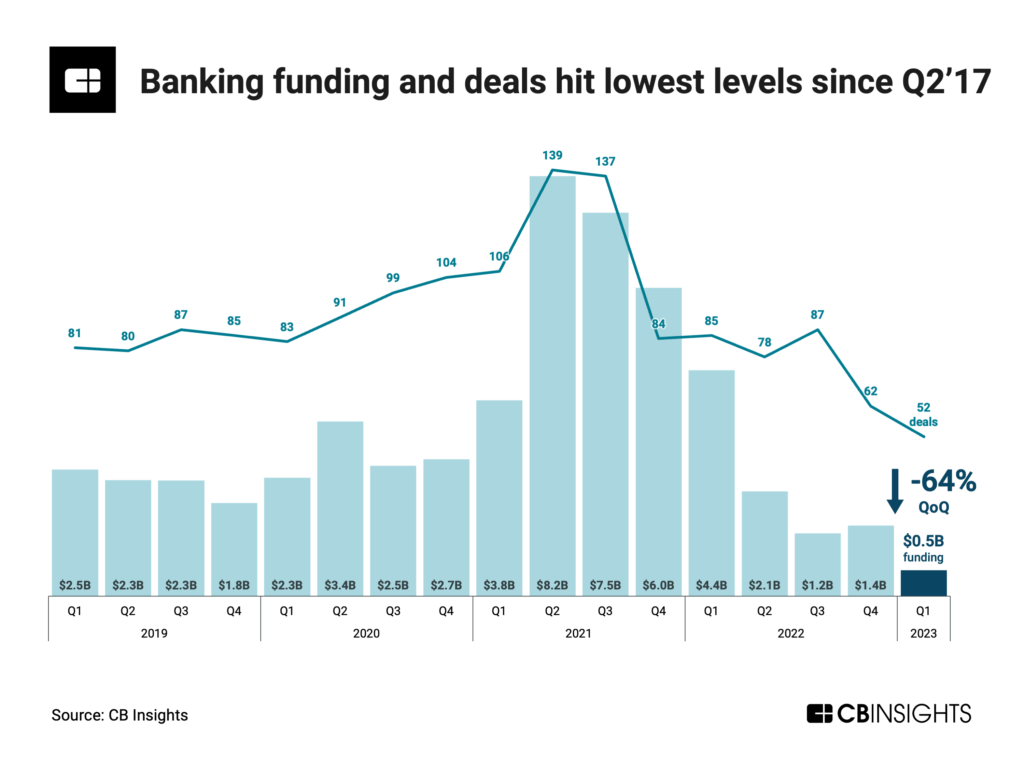

- Banking funding and deals hit lowest levels since Q2’17.

Let’s dive in.

Global fintech funding rebounded in Q1’23. It hit $15B — a 55% increase QoQ. While deal count fell by 2% QoQ to 983 deals, it did relatively well compared to the broader venture ecosystem, where deal count fell 12% QoQ.

However, Stripe’s enormous $6.5B Series I round accounted for more than 40% of the quarter’s total funding amount. Without Stripe’s round, fintech funding would have come in at $8.5B, a 12% drop from Q4’22’s total.

Stripe’s mega-round alone prevented quarterly fintech funding from falling back to 2017 levels. This suggests that fintech investment activity, like overall venture investment activity, is continuing to slow down.

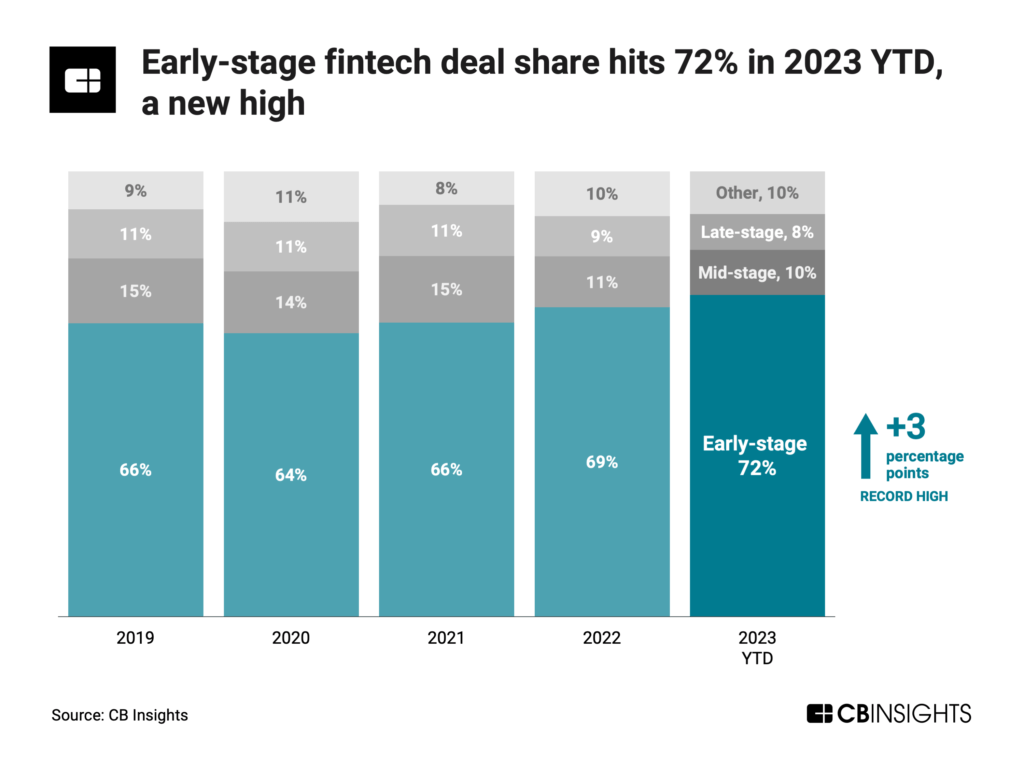

Early-stage deal share regularly dominates overall fintech investment activity. In Q1’23, it reached a new high. Seventy-two percent of deals were early-stage, up from 69% in full-year 2022.

This is likely due in part to investor concerns over inflated 2021 valuations and uncertain public markets, which are compelling them to invest in smaller, less risky early-stage rounds.

Among the top 10 seed and angel rounds, 60% went to fintechs outside of the US. The largest seed round ($45M) in Q1’23 went to UK-based carbon credit settlement platform Carbonplace.

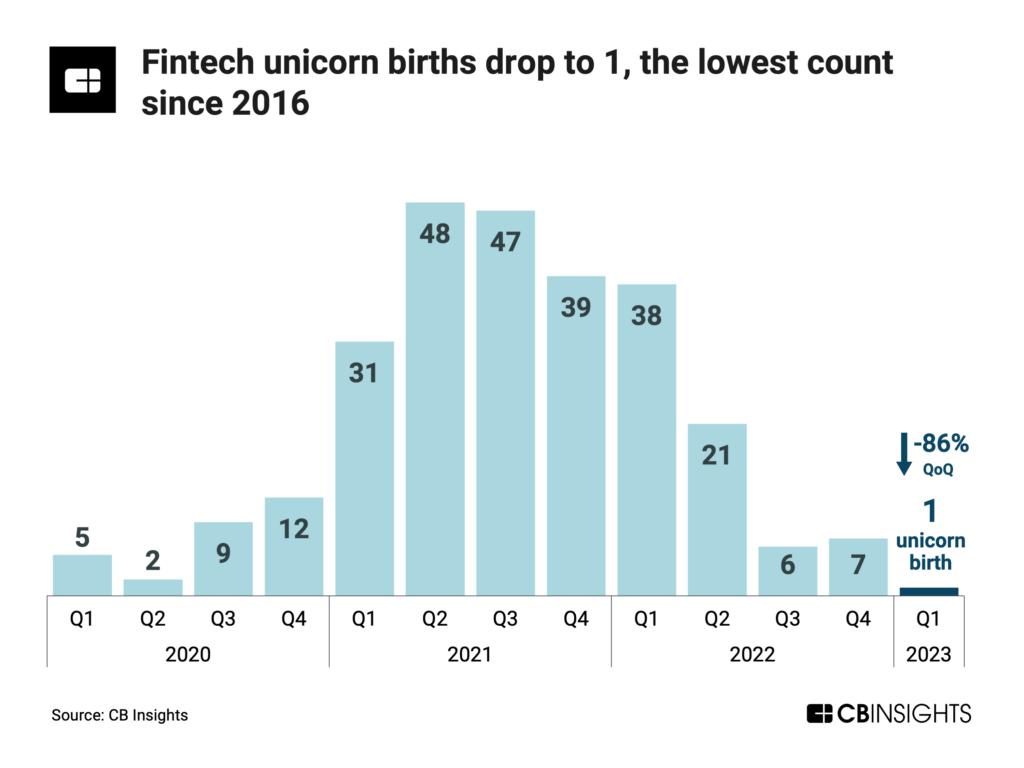

Q1’23 saw the birth of just 1 unicorn (company valued at $1B+), an 86% drop QoQ and the lowest quarterly level since 2016. The only unicorn born in Q1’23 was Egypt-based MNT-Halan, a lender for the underserved, which entered the unicorn club at a $1B valuation.

Over the past year, fintech unicorn births have become increasingly rare as fintech and the broader VC space have started to undergo corrections in valuations. From Q1’22 to Q1’23, unicorn births dropped by 97%.

However, the total fintech unicorn herd still stood at 314 in Q1’23, up 11% YoY. The top 10 unicorns by valuation in Q1’23 are located in either the US or the UK, and 60% of them primarily provide B2B solutions.

Given the current macroeconomic environment and lower valuations, fintech startups have been starting to delay their exits. While fintech M&A exits rebounded 15% QoQ to reach 172 deals in Q1’23, this still marked a 34% decrease from their record high of 259 in Q1’22.

Most of Q1’23’s top 10 M&A deals involved fintechs based outside of the US. However, the US still led in global exit share in Q1’23, accounting for 37% of the total. Notably, the top M&A valuation fell below $500M for the first time in the past year. The top M&A deal in Q1’23 went to Spain’s PAYCOMET, which was acquired by Nexi for $371M.

How did other exit types fare? IPOs ticked up slightly to hit 4 in Q1’23, but SPACs remained at 0. The only IPO with a disclosed valuation ($25M) was for TAP Global, a Gibraltar-based crypto platform.

Funding to banking-focused fintechs has dropped significantly over the past 2 years. It fell 64% QoQ to reach $0.5B in Q1’23 — its lowest level since Q2’17. Deal count also declined, dropping by 16% QoQ. In comparison to Q2’21’s record highs, fintech funding and deal count were down 94% and 63%, respectively.

This was the largest quarterly funding drop across all fintech categories in Q1’23. Wealth tech funding only dropped by 24% QoQ. Meanwhile, payments, digital lending, insurtech, and capital markets all saw funding increase QoQ.

Most of the funding in Q1’23 went to early-stage banking players. In fact, early-stage deals in banking accounted for 60% of the total for Q1’23 — a 5-year high. The top early-stage banking deal ($28M Series A) went to Spiral, a neobank for charitable donations. Meanwhile, mid- and late-stage deal share dropped 6 and 4 percentage points respectively in Q1’23.

CB Insights clients can see all the latest investment data by signing in and downloading the full State of Fintech Q1’23 Report using the sidebar.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.