SumUp

Founded Year

2012Stage

Loan - III | AliveTotal Raised

$4.045BLast Raised

$1.608B | 5 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+22 points in the past 30 days

About SumUp

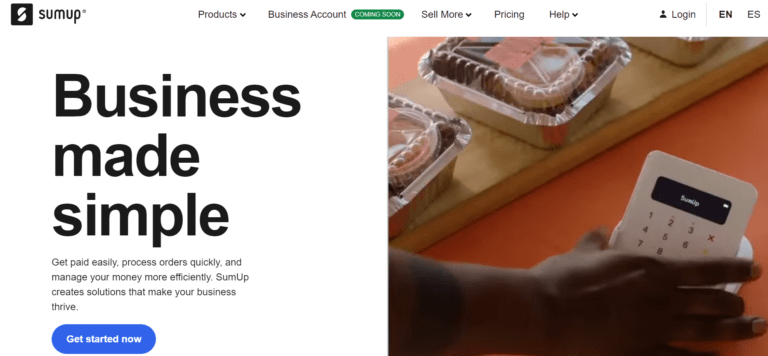

SumUp is a financial technology company specializing in payment processing solutions and point-of-sale systems for small businesses. The company offers a range of products including mobile payment applications, card readers, and business bank accounts, designed to facilitate transactions and manage sales. SumUp's services cater to various sectors such as restaurants, salons, spas, and retail, providing tools for appointment management, loyalty rewards, and inventory management. SumUp was formerly known as Ka-Ching Payments. It was founded in 2012 and is based in London, United Kingdom.

Loading...

ESPs containing SumUp

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The virtual payment terminals market refers to a type of payment solution that allows merchants to accept payments through a web-based platform, without the need for a physical payment terminal. Virtual payment terminals are typically used by e-commerce businesses and other remote merchants who do not have a physical store or who need to accept payments from customers who are not present. The mark…

SumUp named as Outperformer among 15 other companies, including Stripe, Fiserv, and PayPal.

SumUp's Products & Differentiators

SumUp Solo Lite

Our card readers, like SOLO Lite, are also a major milestone. They’re portable, affordable, and designed for merchants who are always on the go. We’ve also developed business accounts that allow merchants to manage their finances, pay suppliers, and track income, all in one place.

Loading...

Research containing SumUp

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SumUp in 7 CB Insights research briefs, most recently on Jan 18, 2024.

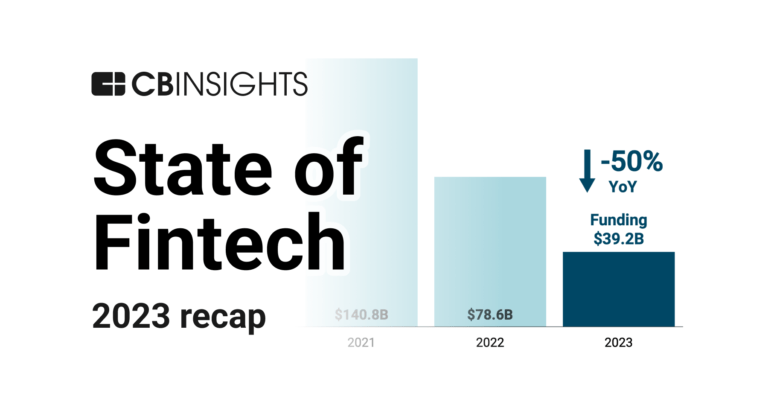

Jan 18, 2024 report

State of Fintech 2023 Report

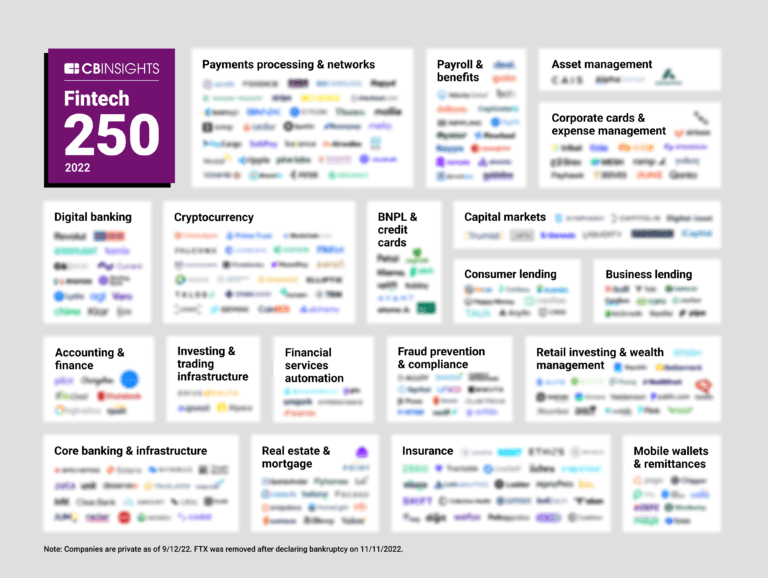

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

Sep 13, 2022

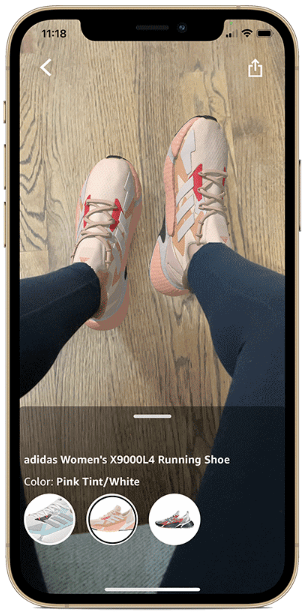

3 retail tech trends to watch in Q3’22Expert Collections containing SumUp

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

SumUp is included in 7 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,677 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,244 items

SMB Fintech

1,648 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SumUp Patents

SumUp has filed 7 patents.

The 3 most popular patent topics include:

- payment systems

- banking technology

- banks

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/24/2021 | 9/17/2024 | Payment systems, Banking technology, Banks, Interbank networks, Circulating currencies | Grant |

Application Date | 9/24/2021 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Payment systems, Banking technology, Banks, Interbank networks, Circulating currencies |

Status | Grant |

Latest SumUp News

Sep 19, 2024

| Membership (fee-based) getty In recent years, there’s been a widespread drive to encourage companies to think of their technology teams and tools not as cost centers, but as revenue drivers. And with technology playing such a large role in today’s businesses, it’s time for leadership teams to think of CTOs as more than just experts in “keeping the lights on.” Companies are accustomed to trusting their CTOs to oversee the creation and acquisition of new technologies when business is humming. But on the flip side, CTOs can also be key players in finding ways to cut costs and/or boost revenues during economic downturns. Below, 20 members of Forbes Technology Council discuss practical, meaningful ways CTOs can positively impact organizational health during difficult times (and why they’re perfectly positioned to do so). 1. Striking A Balance Between Innovation And Improvement CTOs can guide an organization in effectively using its resources, striking a balance between innovation and improvement. In the tech industry, there is always a tug-of-war between investing in new product features to attract new customer segments and improving existing offerings to increase upselling. CTOs can effectively align development goals to optimize returns. - Amrit Jassal , Egnyte 2. Balancing ‘Defense’ With ‘Offense’ Economic cycles continually fluctuate. Some useful questions for a CTO to answer are: How do we rigorously prioritize the existing demand funnel to optimize outcomes? Where can we double down on reusable services and architecture to maximize investments and velocity? What accelerators can we add so that when the cycle rebounds, we can outpace our competitors? This exercise helps a CTO balance “defense” with “offense.” - Micheline Casey , Siemens Energy MORE FOR YOU 3. Addressing Technical Debt During an economic downturn, a CTO can positively impact the organization by addressing technical debt and strengthening infrastructure. This prepares the company for future growth and sudden demand increases when the market rebounds, ensuring resilience and agility in changing conditions. - Dzmitry Lubneuski , a1qa 4. Leveraging AI To Do More With Less During an economic downturn, it’s typical to try to reduce costs by improving operational efficiency. For a CTO in the current market, it’s critical to see how your company can leverage artificial intelligence to do more with less. A couple of practical examples: Improve engineering productivity through introducing a coding assistant like Copilot, and enhance knowledge discovery by leveraging a finely tuned large language model to analyze organizational data. - Bhavdeep Sethi , Frec Markets, Inc. 5. Seeking Opportunities For Innovation One practical and meaningful way for a CTO to help is to view an economic downturn as an opportunity for innovation. “Do more with less” is the mindset a CTO should drive. A CTO must work with the business to identify and solve challenges through innovation and collaboration. A design-thinking workshop or hackathons can help teams imagine new ways of operating in a new normal. Thus, the CTO becomes an agile change agent. - Alvaro Rozo , Arcus Power Corp. 6. Performing A Thorough IT Audit Perform an IT audit that looks for shadow IT, outdated or underutilized software, and gaps in cybersecurity risk mitigation—both for your organization and any key suppliers or vendors that have access to company or customer data. Audits can also trigger new policy and procedure development, potentially saving an organization from financial and regulatory headaches down the road. - Ogie Sheehy , ViClarity 7. Driving The Efficiency And Effectiveness Of Core Business Processes During an economic downturn, budgets are constrained and there’s a limited infusion of talent from external sources. A CTO’s blueprint for organizational success must focus on driving the efficiency and effectiveness of the core business processes, operating models and digital workflow capabilities that create competitive differentiation in the marketplace. Look toward leveraging digital transformation, artificial intelligence, machine learning and the cloud. - Hemant Ahire , Amazon Web Services 8. Prioritizing Tech Projects With The Best Near-Term ROI A meaningful way a CTO can positively impact the health of their organization during an economic downturn is to help the business prioritize technology projects that have the best near-term return on investment. What can be done relatively quickly and for the least amount of money while still moving the needle on both cost and revenue? - Laura Merling 9. Taking Care Of People CTOs must be honest with the team about the situation, looking for outside-the-box solutions, offering assurance and trying to avoid layoffs. People are the most important aspect of any organization and should always be treated as such. Find ways to cut costs beyond the obvious—automation, enabling new technologies and doing more with what is available are some aspects to consider. - Sameer Zaveri , Datamotive.io 10. Focusing On Tools For Cutting Costs One practical and meaningful way a CTO can positively impact the health of their organization during an economic downturn is by prioritizing technology investments that drive operational efficiency and cost savings. This can include automating routine tasks, optimizing existing infrastructure and implementing data-driven decision-making tools. - Praveen Andapalli , Vitel Global Communications, LLC 11. Homing In On The Company’s Competitive Advantage As a CTO, you know what works and what doesn’t. Focusing on your company’s competitive advantage allows you to leverage your knowledge and experience to achieve short-term monetary effects. Examine current technologies, market gaps and opportunities. Quickly align with sales, and redirect your efforts toward improving customer-centric technology to increase revenue. - Arturo Garcia , DNAMIC 12. Optimizing Infrastructure And R&D Regardless of economic conditions, one key responsibility of a CTO is optimization, as it directly contributes to the business’ bottom line. Health extends beyond finances to overall company morale. A practical approach is to optimize infrastructure and R&D while maintaining a strong learning culture to keep motivation high, ensuring the team remains engaged and innovative even during a downturn. - Vikrant Labde , Cuelogic Technologies 13. Accelerating Digital Initiatives During an economic downturn, a CTO can drive cost efficiency, agility and new revenue by accelerating digital initiatives like cloud computing and automation. This reduces costs, boosts agility and enhances productivity. Investing in digital tools now strengthens competitiveness and positions the organization for growth when the economy recovers. - Volodymyr Dudas , CodeLions 14. Ensuring All Tech Projects Align With The Enterprise Strategy A CTO should have a laser focus on the enterprise strategy and ensure all technology projects and initiatives are aligned to it. If a project is not increasing revenue (through cross-sells and upsells), maintaining revenue (through retention), or reducing costs (by making processes, systems and spend more efficient), it should not be prioritized. - Gladwin Mendez , The Global Centre for Risk and Innovation 15. Building A Learning Culture And Growth Mindset Every downturn is an opportunity to invest in keeping your house in order to prepare for future growth. Today’s challenges are dynamic and unique. So it’s important for a CTO to invest in building a learning culture and growth mindset to prepare the organization to deal with any challenges. Focus on knowledge-sharing, paying off product debt and team-building. - Simana Paul , SumUp 16. Overhauling And Upgrading Legacy Tech A meaningful way a CTO can positively impact the health of their organization during an economic downturn is by prioritizing and accelerating digital transformation initiatives, overhauling legacy tech, reducing technical debt and upgrading to maintain an innovation cycle that enhances operational efficiency. - Rignesh Soni , Metropolis 17. Helping Enhance Customer Retention During an economic downturn, a CTO can positively impact the organization by focusing on technologies that enhance customer retention. Addressing technical debt, prioritizing features that drive adoption and increase stickiness, and exploring cost-effective development frameworks can optimize resources. This approach ensures a steady revenue stream and builds long-term customer relationships. - Ketan Anand , Suuchi 18. Shoring Up Nonfunctional Requirements And Minimizing Bugs Assuming lower sales activity and, hence, fewer new “promised by sales,” “out of the box” features, an economic downturn could offer a CTO and the engineering team some leeway to focus on reducing technical debt and shoring up implementations in terms of nonfunctional requirements. It’s also a good time to work on minimizing bugs and improving the experience for existing customers, since retention and renewals become key. - Sreenivasan Iyer , Antares Vision Group (RfXcel) 19. Adopting Cloud-Based Technologies A CTO can adopt cloud-based technologies to navigate economic downturns. Cloud migration reduces costs if you leverage a pay-as-you-go model, provides scalable resources and ensures business continuity with redundancy. It supports remote work, boosts agility and innovation and lets businesses focus on core activities by outsourcing IT management, enhancing resilience and efficiency in tough times. - Meenakshi Panda , Capital One 20. Taking A Close Look At R&D Spend As a CTO, it’s crucial for me to manage R&D spend by assessing what drives the best ROI. I’ve analyzed each Scrum team’s contributions, prioritizing projects based on clear ROI. This detailed review impacts both margins and future investments, especially considering R&D’s significant impact on the cost of goods sold. It’s challenging, but it’s essential for business success. - Abishek Viswanathan , Apollo.io Check out my website .

SumUp Frequently Asked Questions (FAQ)

When was SumUp founded?

SumUp was founded in 2012.

Where is SumUp's headquarters?

SumUp's headquarters is located at 16-20 Shorts Gardens, London.

What is SumUp's latest funding round?

SumUp's latest funding round is Loan - III.

How much did SumUp raise?

SumUp raised a total of $4.045B.

Who are the investors of SumUp?

Investors of SumUp include Oaktree Capital Management, BlackRock, Goldman Sachs Asset Management, Vista Credit Partners, Apollo Global Management and 33 more.

Who are SumUp's competitors?

Competitors of SumUp include Tide, Zoop, Clip, CloudWalk, Sticky and 7 more.

What products does SumUp offer?

SumUp's products include SumUp Solo Lite and 4 more.

Who are SumUp's customers?

Customers of SumUp include Deb Dobney-Cobb, Aidan Conway and Arlene Wedgbury.

Loading...

Compare SumUp to Competitors

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Worldpay provides electronic payment processing services to merchants and financial institutions. It offers merchant acquiring and payment processing services, such as authorization and settlement, customer service, chargeback and retrieval processing, and interchange management for national merchants, and regional and small-to-medium-sized businesses. The company was founded in 1993 and is based in London, United Kingdom.

Hash operates a financial technology platform. It enables companies to create and test payment and other financial solutions. It provides non-financial business-to-business (B2B) enterprises wishing to offer banking services with payment infrastructure. The company was founded in 2017 and is based in Sao Paulo, Brazil.

EBANX is a company focused on providing cross-border payment solutions and services for global companies looking to succeed in emerging markets. The company offers a comprehensive payment platform that supports over 100 payment methods, enabling businesses to reach customers in 29 countries across Latin America, Africa, and India. EBANX's platform is designed to simplify operations for its clients, offering features such as instant market access, advanced fraud and risk management, and a commitment to innovation with a suite of payment services tailored for various digital-driven industries. It was founded in 2012 and is based in Curitiba, Brazil.

Mswipe offers mobile POS solutions that enable merchants to accept various card payments using compact, wireless devices without the need for a bank account or paper charge slips. Mswipe primarily caters to the needs of small enterprises, with mainstream financial services and digital commerce. It was founded in 2011 and is based in Mumbai, India.

Jusp provides a mobile payment platform. The Jusp card reader can connect via a mini jack to any smart device and is compatible with any device to manage applications. The company accepts all major credit card networks, its prepaid cards, circuits of international debt V-Pay, Visa Electron, Maestro/Cirrus and the circuit of national debt Pagobancomat.

Loading...