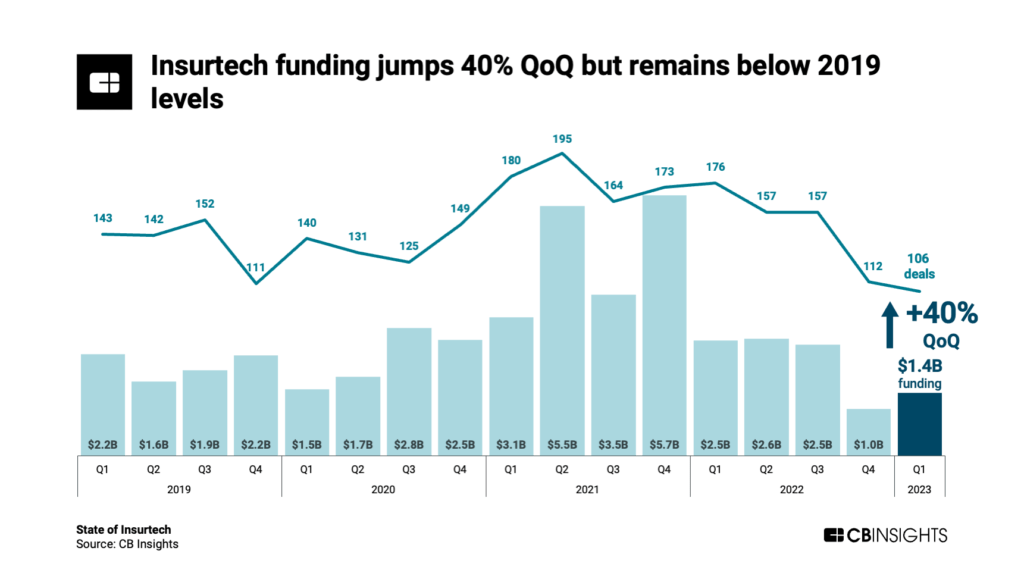

Insurtech funding jumps 40% QoQ to hit $1.4B in Q1'23. However, this still marks its second-lowest quarter in 4 years.

Following the decline of investment activity in 2022, insurtech funding increased 40% quarter-over-quarter (QoQ) to hit $1.4B in Q1’23. Deal count, however, dropped by 5%, falling for the second straight quarter to hit 106.

Using CB Insights data, we highlight some of the key takeaways from our Q1’23 State of Insurtech report, including:

- Global insurtech funding grows 40% QoQ in Q1’23, deals drop 5%.

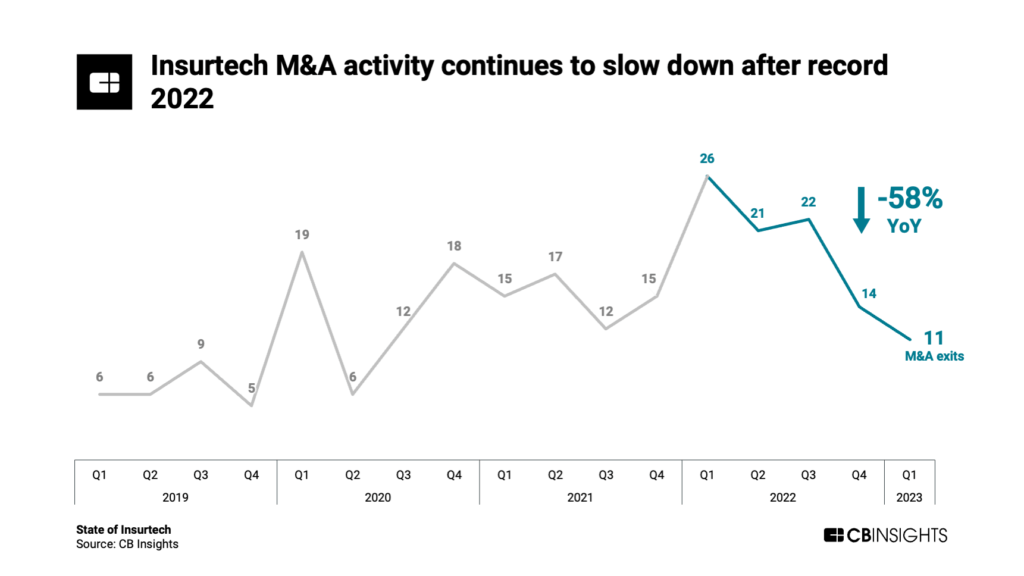

- Insurtech M&A exits drop 58% YoY, marking a continued slowdown from 2022’s record-high activity.

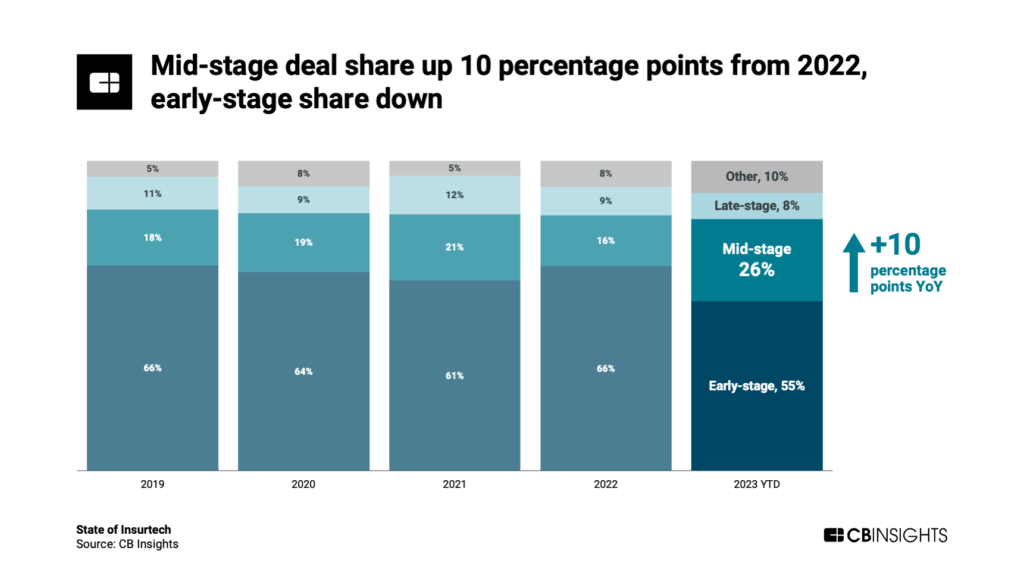

- Mid-stage deal share up 10 percentage points from 2022, early-stage deal share down 11 percentage points.

CB Insights clients can see all the latest investment data and key takeaways by signing in and downloading the full State of Insurtech Q1’23 Report using the sidebar.

Let’s dive in.

After dropping to a 4-year low in Q4’22, global insurtech funding jumped 40% QoQ to hit $1.4B. While deal count fell by 5% over the same period, it performed well relative to the broader venture ecosystem, where deal count fell 12% QoQ.

Despite the jump in funding, Q1’23 marked the second-lowest quarterly insurtech funding level in the last 4 years. In fact, funding in Q1’23 amounted to around 25% of Q4’21’s record high. However, growth in Q1’23 shows that investors still see opportunities in the insurtech market.

Insurtech M&A activity continued to fall from last year’s record-high levels. Insurtech M&A exits dropped 58% YoY to hit 11 in Q1’23 — the lowest count since Q2’20.

The spike in M&A exits in 2022, particularly over the first 3 quarters, was likely driven by acquirers taking advantage of dropping tech valuations. However, this flurry of activity has not been sustained as valuations continue to slide.

While early-stage deals continued to account for the majority of insurtech deals in Q1’23, their share was down by 11 percentage points from 2022. Mid-stage deal share, on the other hand, was up 10 percentage points from 2022 in Q1’23.

Three of Q1’23’s largest mid-stage deals included Superscript‘s $55M Series B, Ushur‘s $50M Series C, and Fairmatic‘s $46M Series B.

Late-stage insurtech deal share remained relatively stable — it was down 1 percentage point from 2022.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.