The venture market downshifts further in 2023, with dealmaking and funding totals falling to 6-year lows.

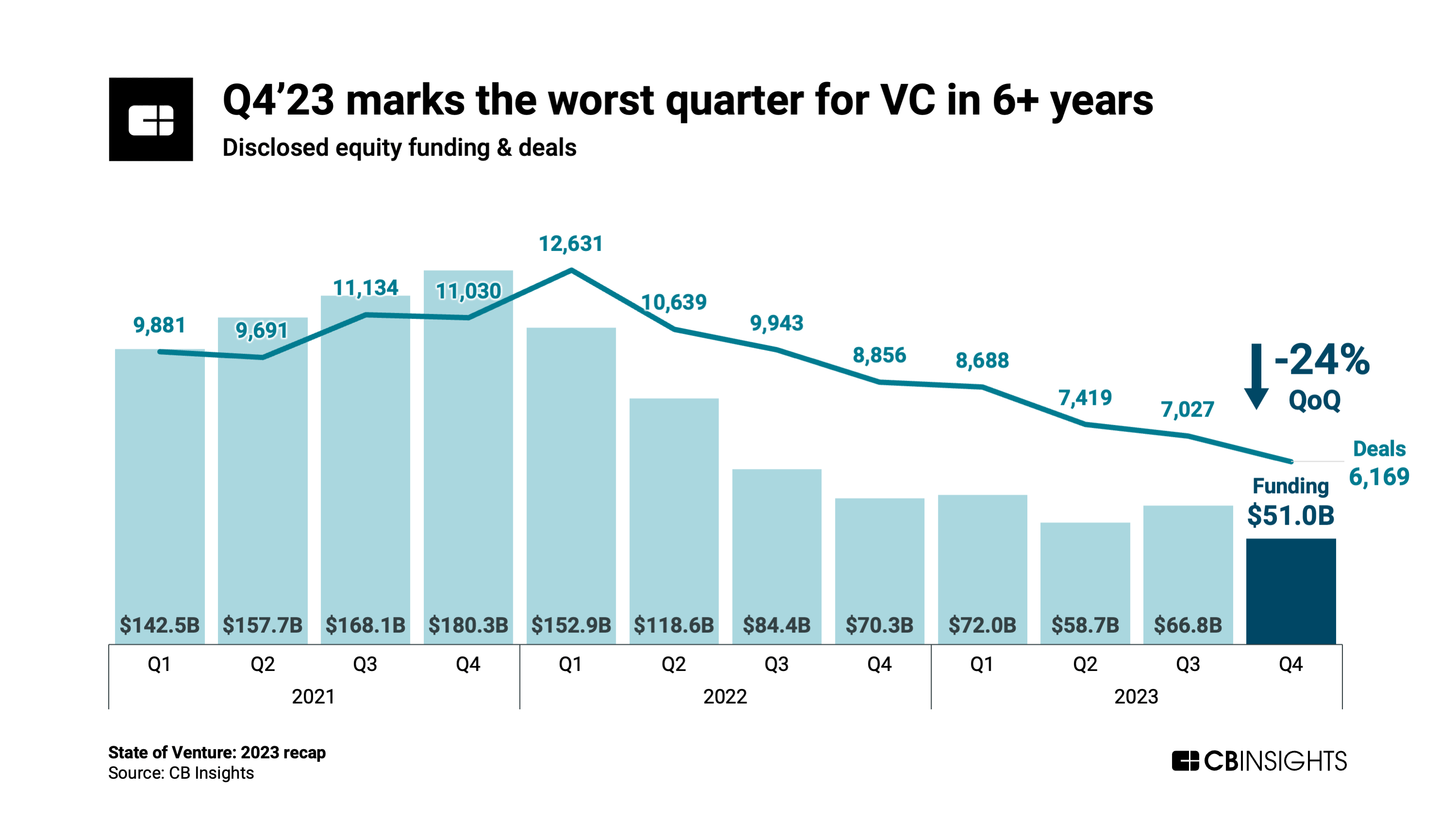

Q4’23 was the harshest quarter for global VC in 6 years.

However, the down market has revealed a handful of areas that remain notably resilient, from AI- and sustainability-focused startups to M&A deal flow in Europe.

Based on our deep dive below, here is the TLDR on the state of venture:

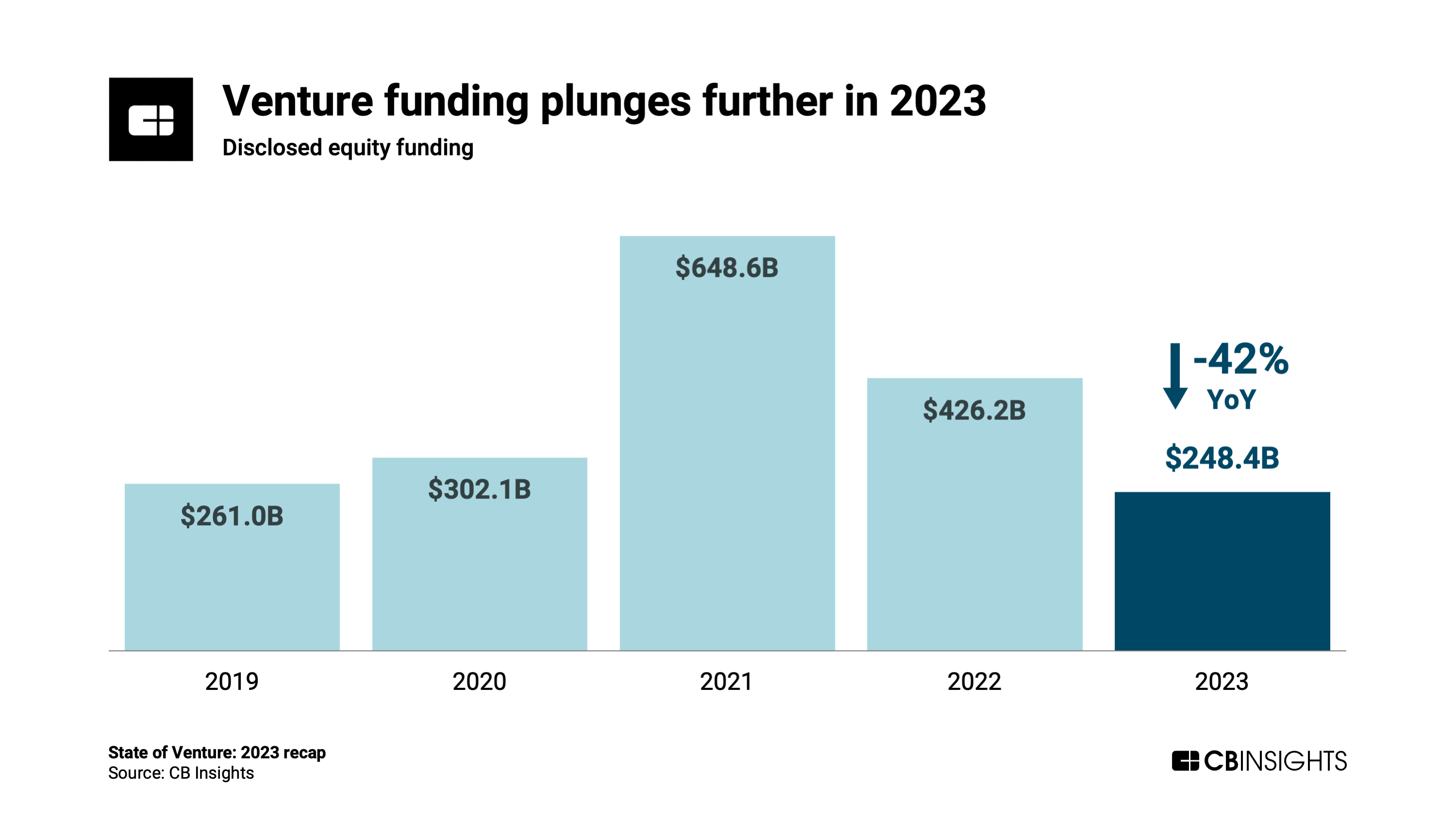

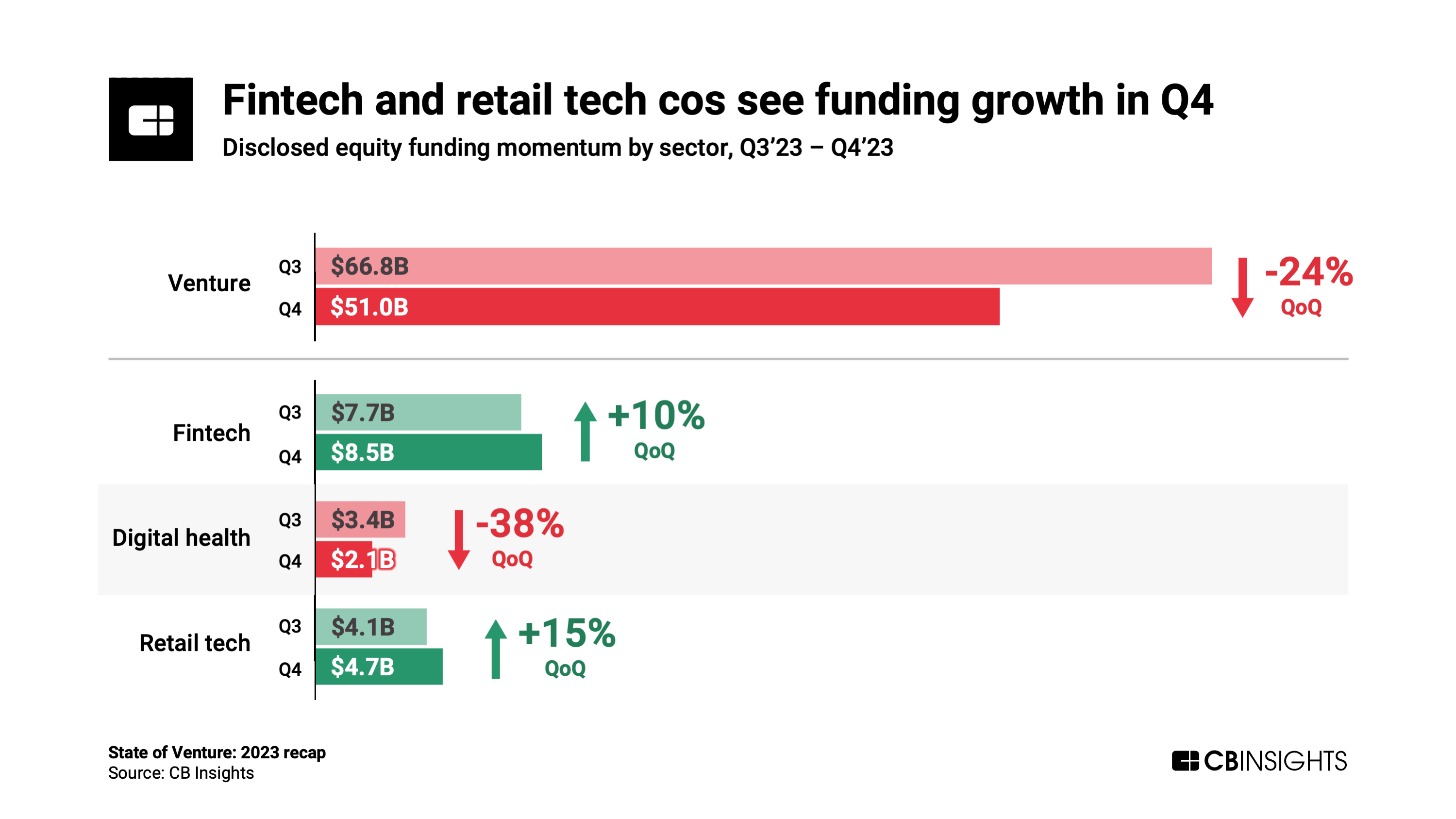

- Venture funding falls to $248.4B in 2023, the lowest since 2017. Global deal volume also tumbled 30% YoY to 29,303 in 2023, a 6-year low. The declines were felt across most major global regions and sectors. However, the fintech and retail tech sectors saw modest gains in funding in Q4’23.

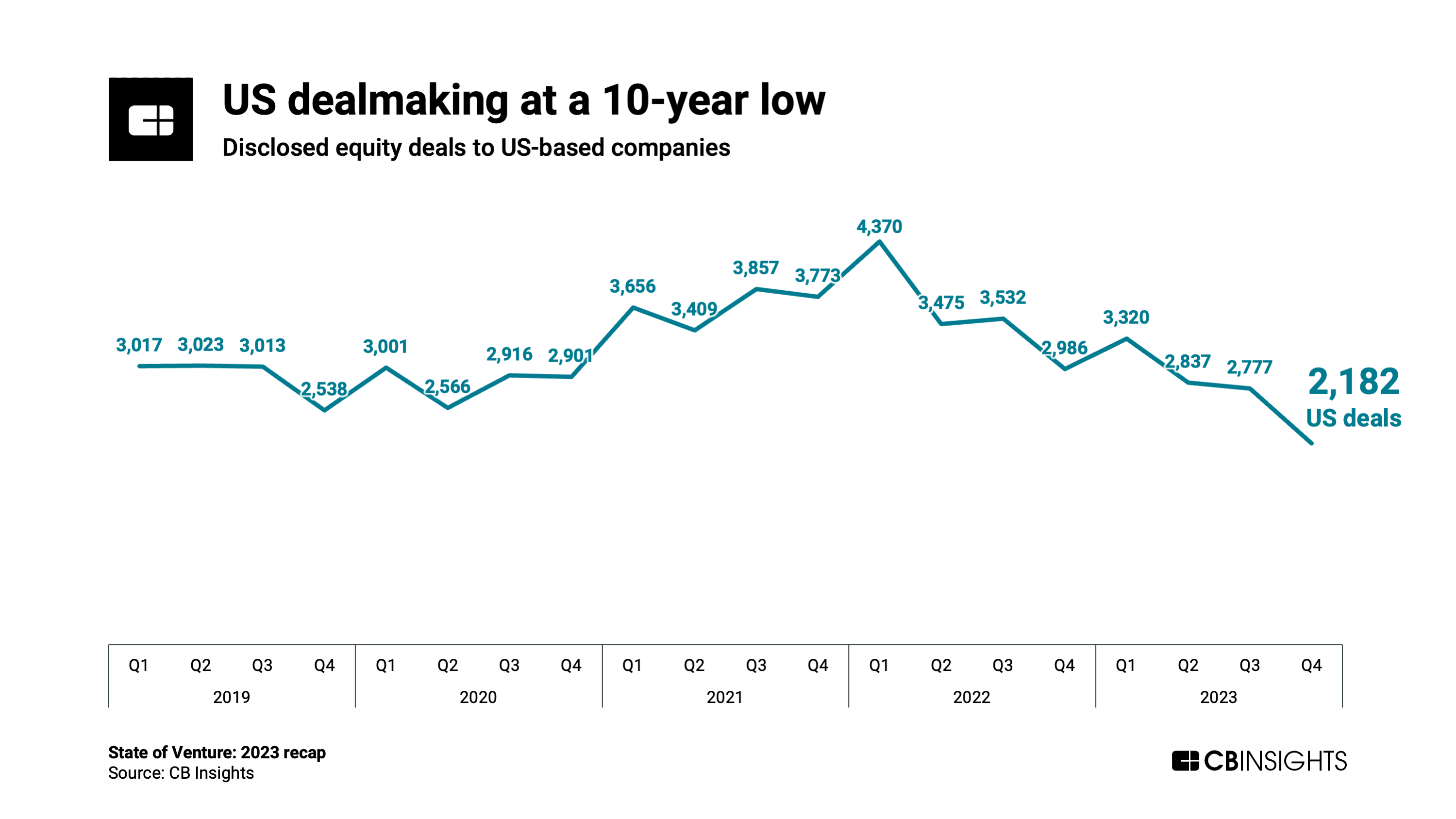

- US deal volume at a 10-year low. The venture downturn has had a chilling effect on the US tech ecosystem. US-based companies raised just 2,182 equity deals in Q4’23 — down 21% QoQ to the lowest quarterly level since 2013.

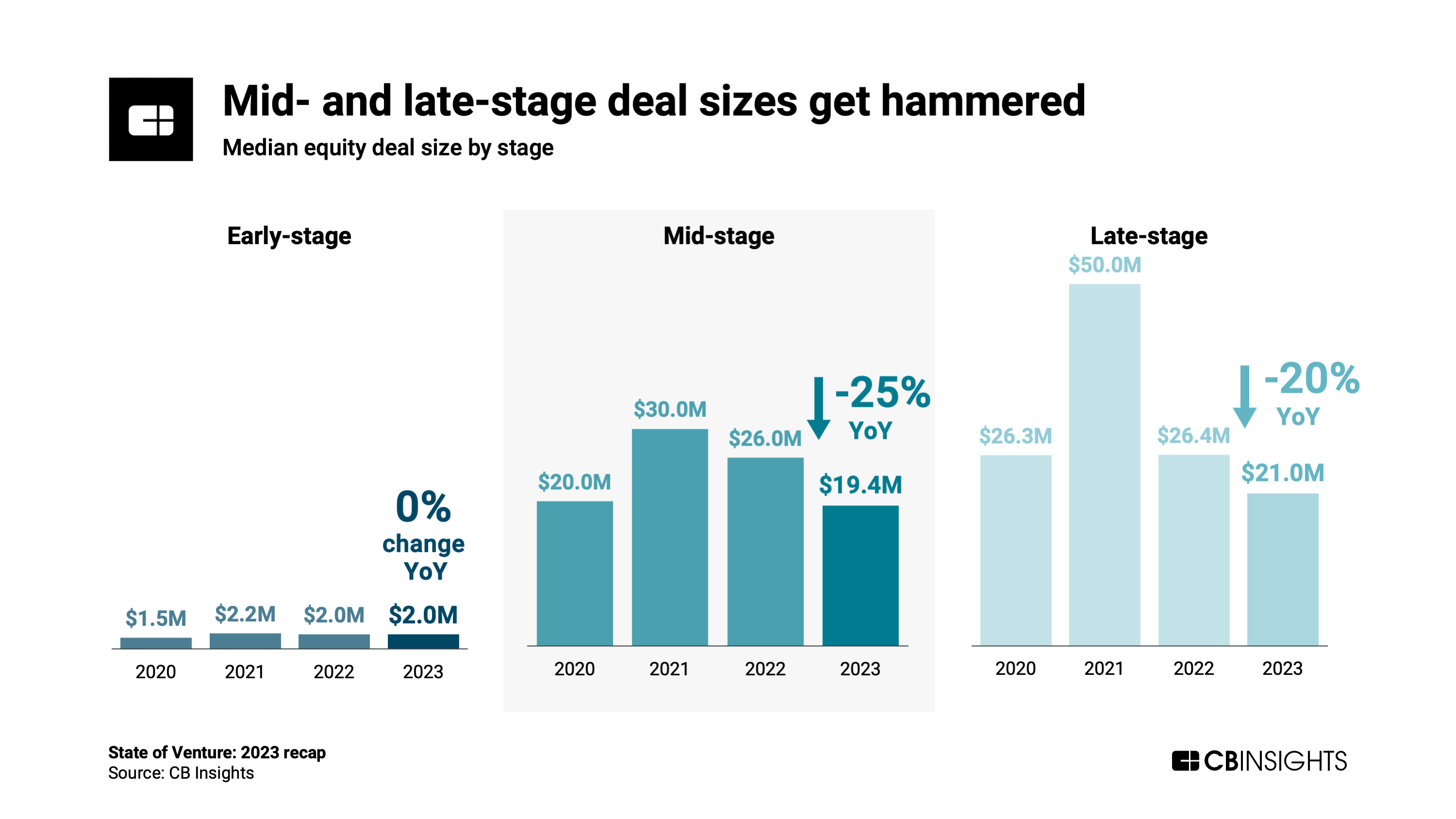

- Late-stage deal size has fallen more than 50% since 2021. Investors have become more selective and are shying away from large, late-stage rounds. The median late-stage deal size is now $21M, a far cry from 2021’s $50M. Similarly, the number of mega-rounds (deals worth $100M+) in Q4’23 fell to its lowest level since 2017.

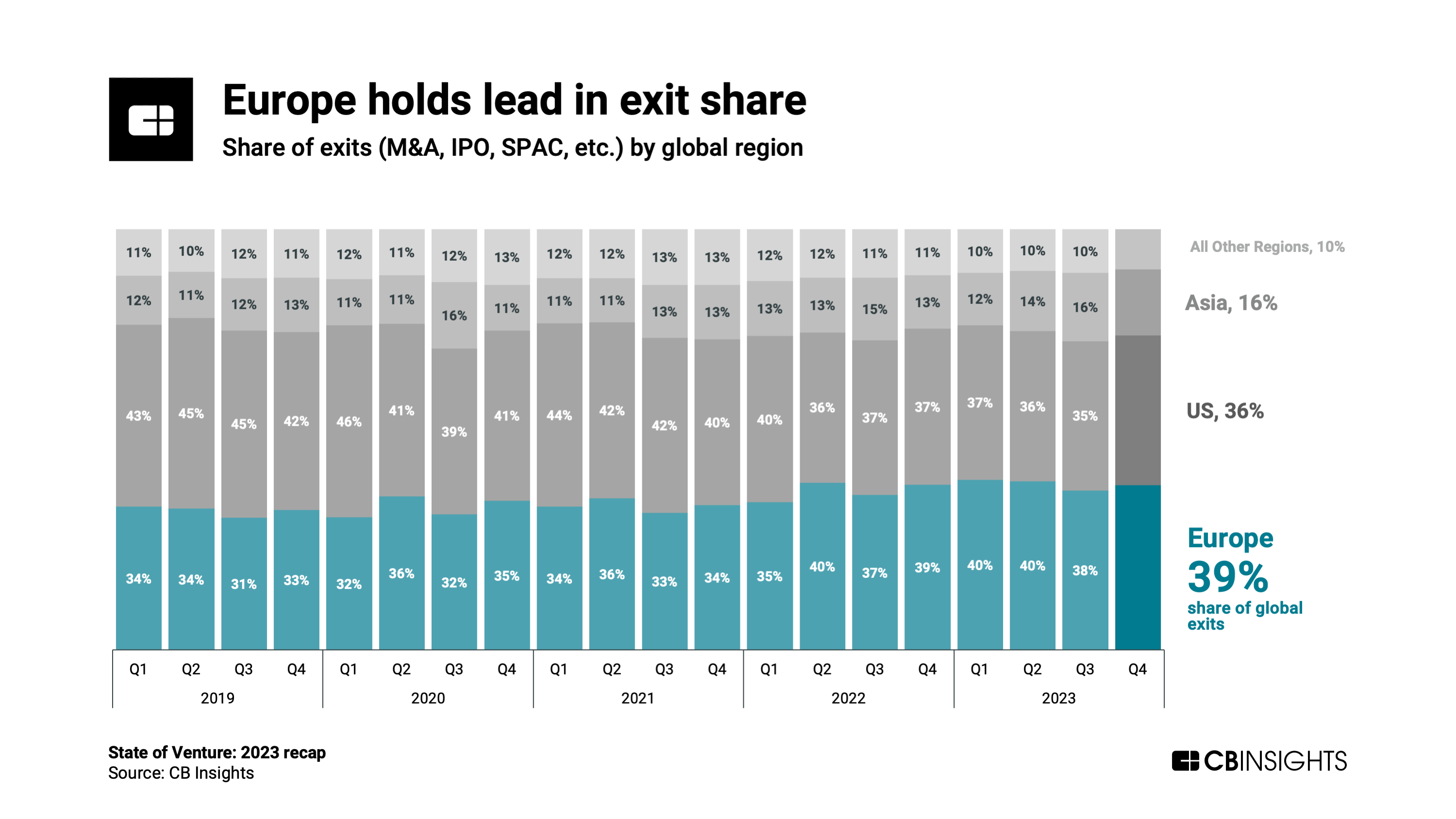

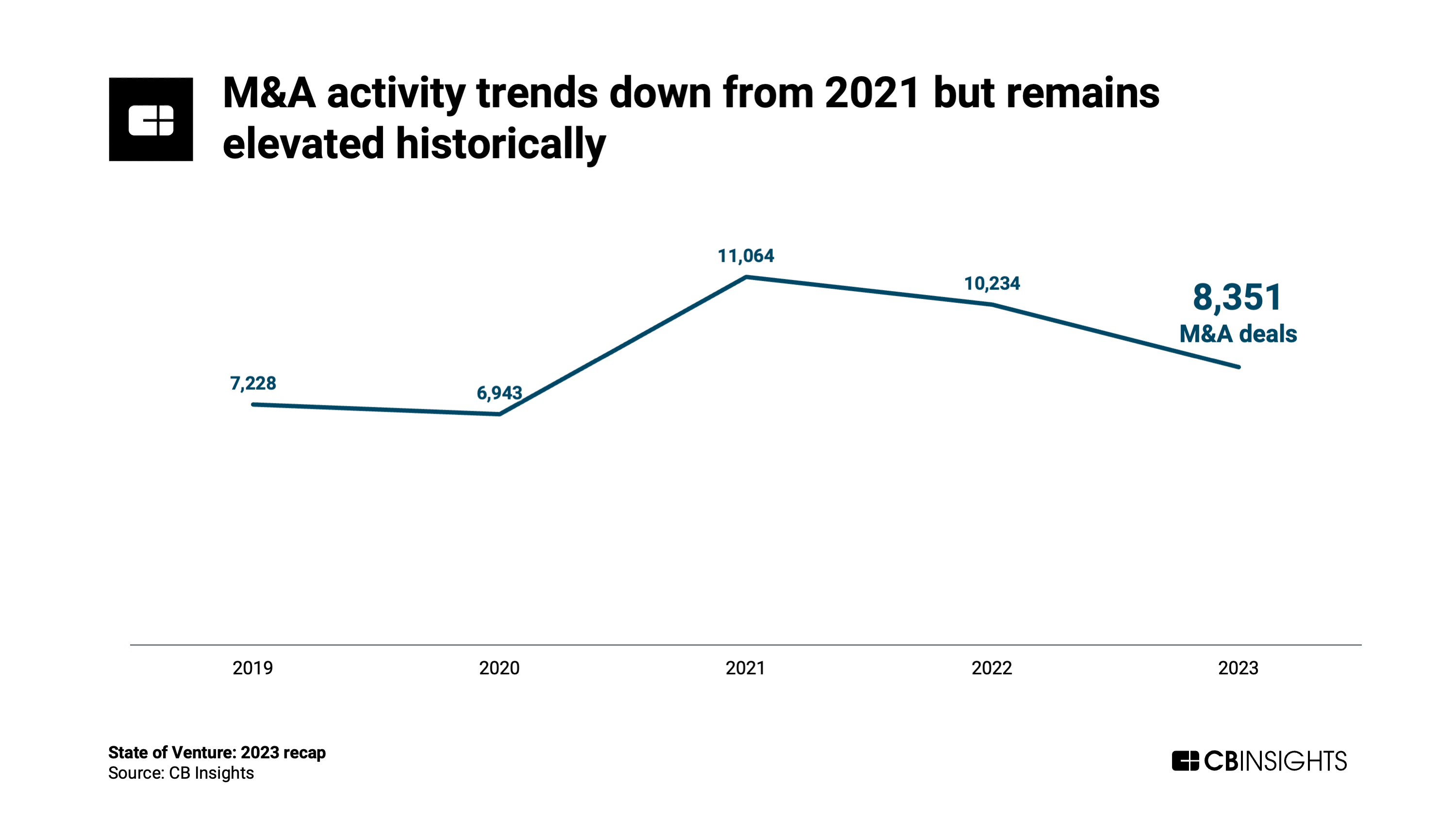

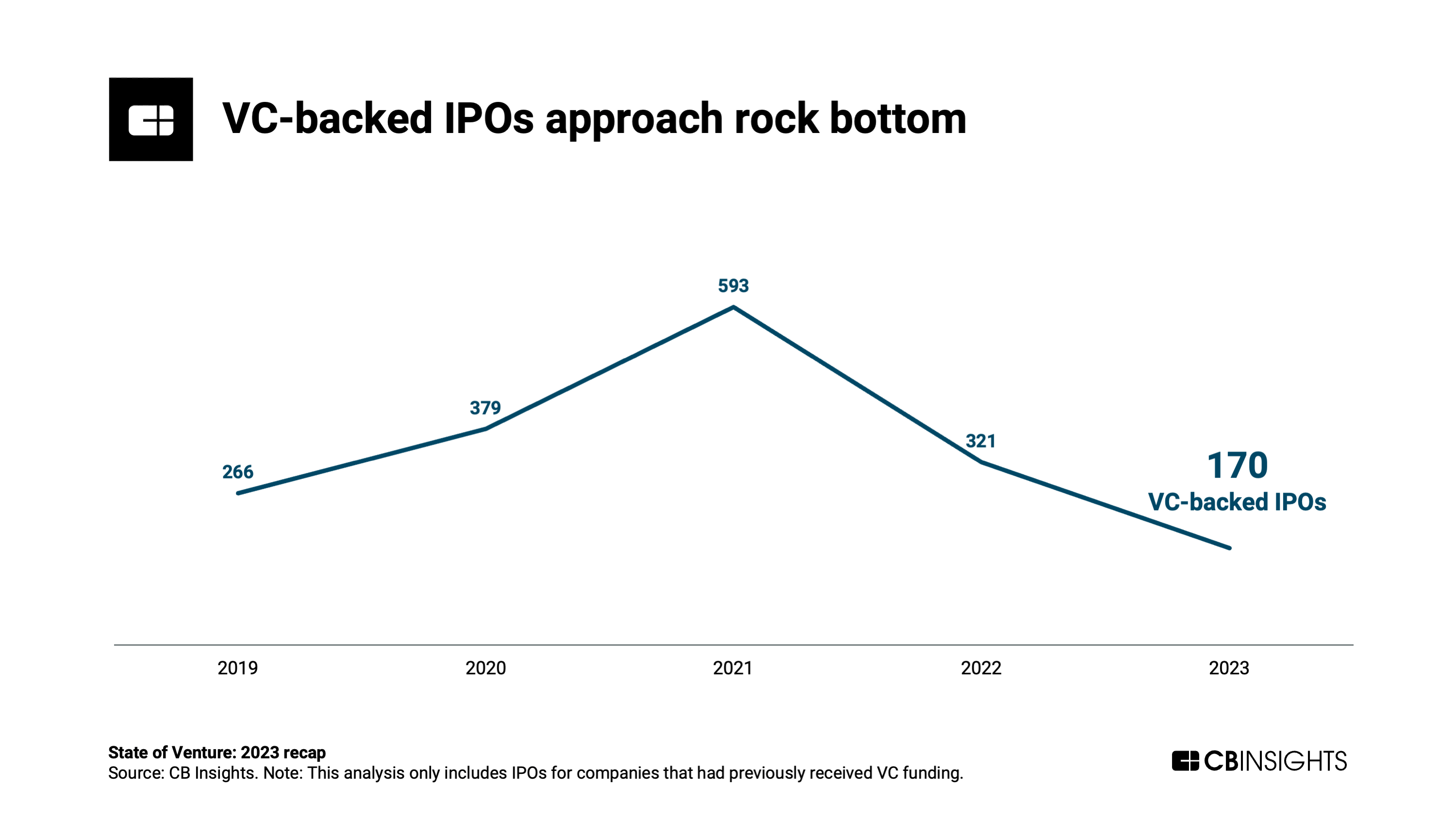

- Fewest annual VC-backed IPOs since 2013. With less than 200 VC-backed IPOs globally in 2023, the market for VC-backed IPOs remains mostly closed, especially in the US. Meanwhile, at 8,351 deals in 2023, M&A volume has fallen from a 2021 peak but remains elevated historically.

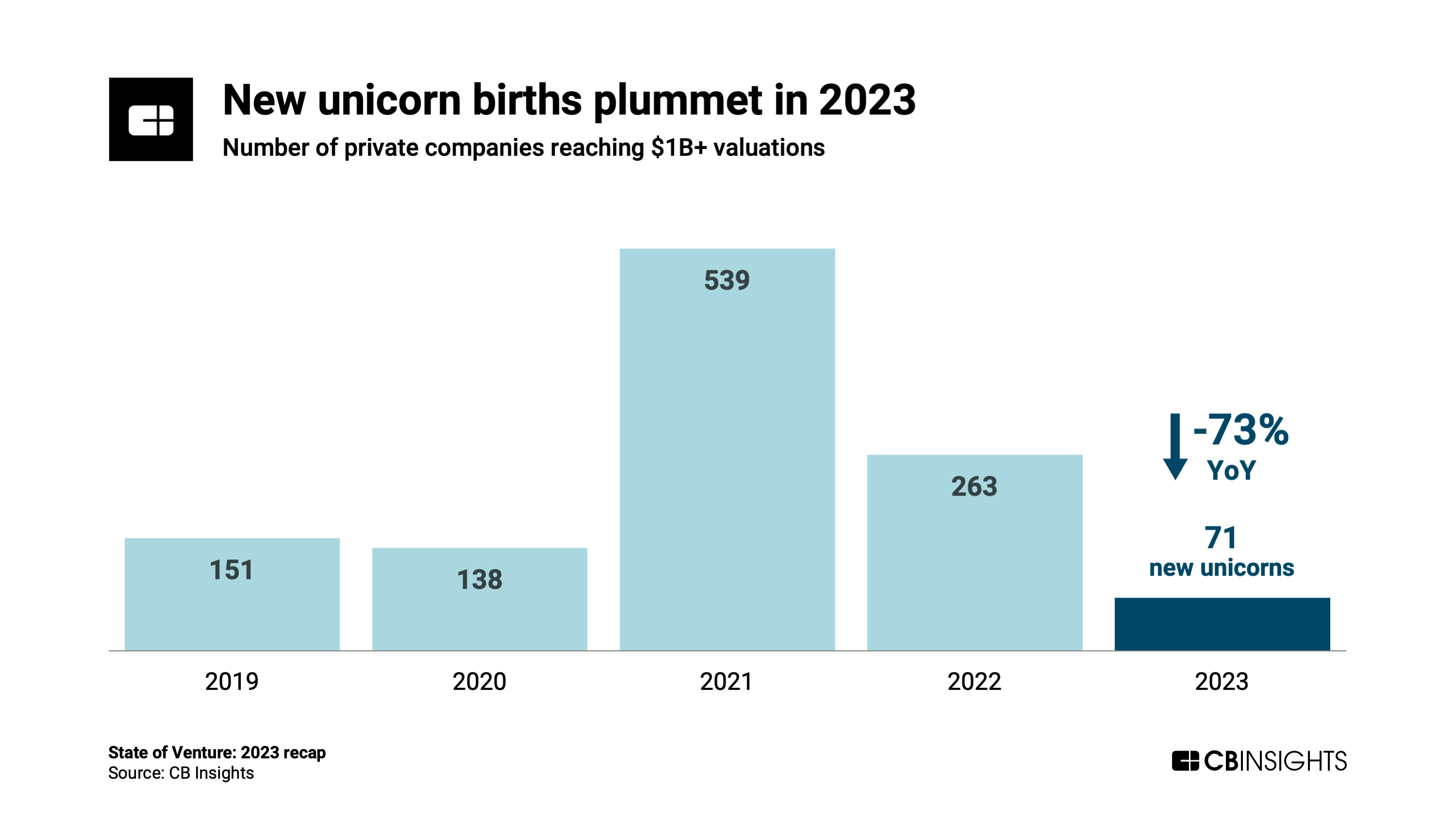

- 2023 sees 71 new unicorns — a 7-year low, and down 73% from 2022. The number of private companies reaching $1B+ valuations remains well below where it was even before the pandemic. However, 23 hit that mark in Q4’23, a rebound from the previous quarter’s 14. Among 2023’s new unicorns, roughly half (35) came from the US. Asia and Europe contributed 18 and 12, respectively.

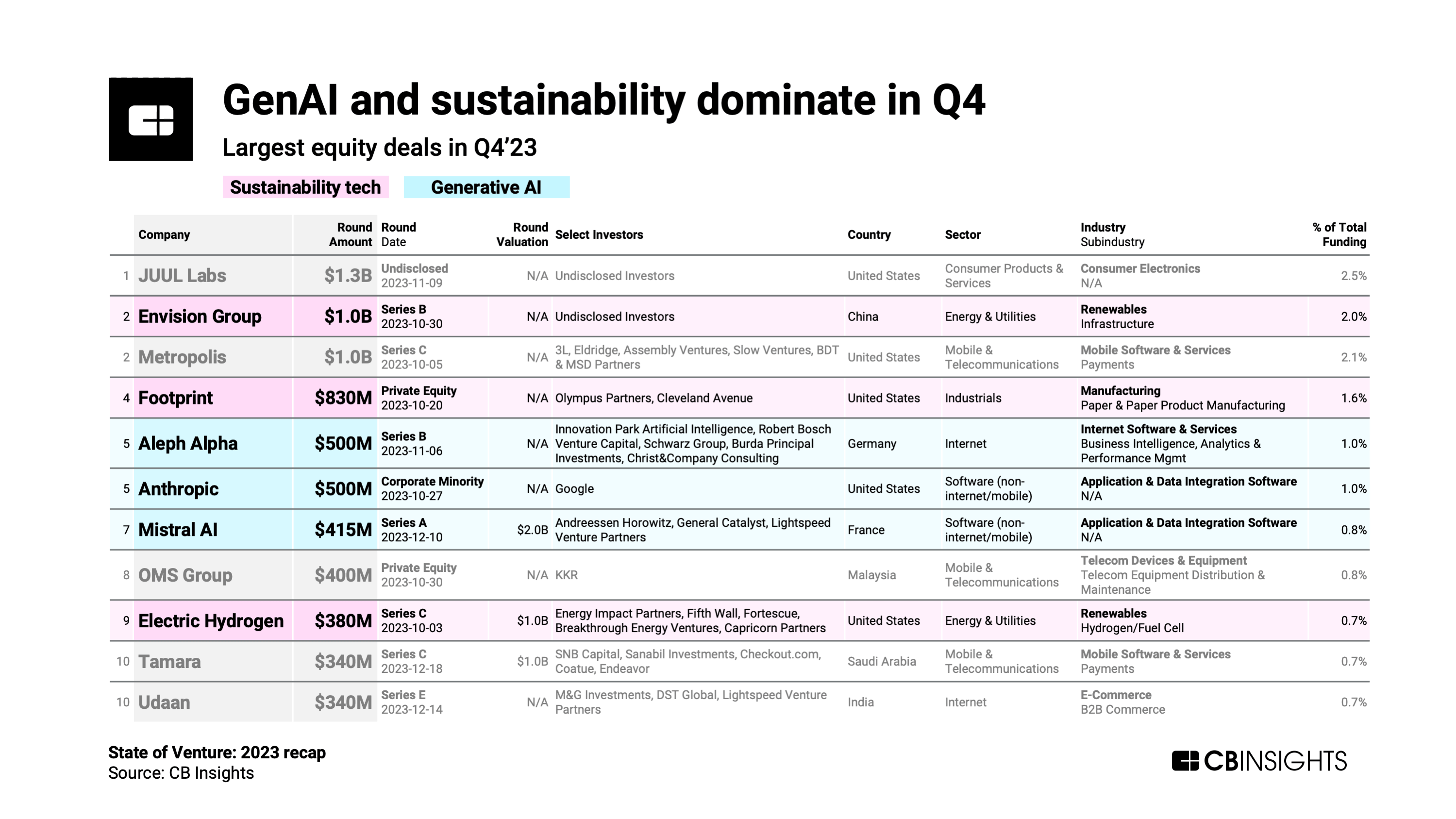

- Generative AI and sustainability tech companies take the majority of top deals in Q4’23. Investors are looking to ride the AI wave to potentially substantial long-term returns. This is fueling a funding frenzy among generative AI developers, which dominated the list of top equity deals in Q4’23, alongside sustainability tech players.

Below, we’ll explore these themes across 15 charts.

The venture downturn accelerated in 2023, with global VC funding falling 42% — 8 percentage points more than the previous year’s decline — to $248.4B. This marked the first time annual venture-backed funding slipped below the $250B mark since 2017.

Venture deals faced similar headwinds. Deal count fell 30% YoY to reach 29,303 in 2023 — a 6-year low.

The onslaught is even more apparent on a quarterly basis. Q4’23 saw $51B in equity funding across 6,169 deals — the lowest quarterly figures since Q1’17 and Q4’16, respectively.

Globally, deal volume is now less than half what it was at its peak in Q1’22, as macroeconomic uncertainty continues to rattle investors.

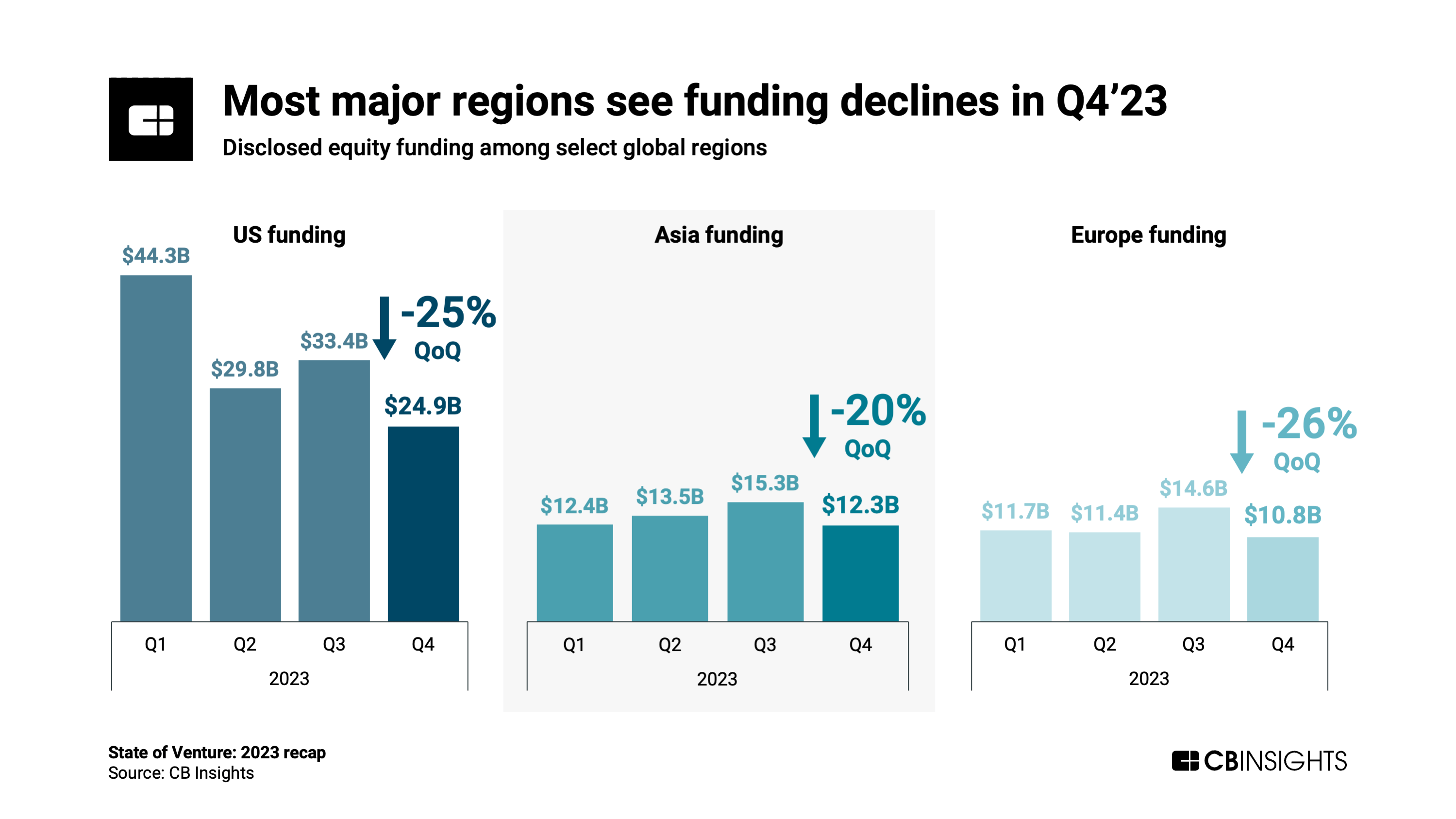

The US, Asia, and Europe all saw double-digit percentage declines in quarterly funding in Q4’23. However, funding in the US has fallen further than in other major regions since the start of Q1’23.

Additionally, while the US led in global deal share with 35% in Q4’23, it lost several percentage points compared to the prior quarter, while Asia (33%) and Europe (25%) each picked up a few points.

Elsewhere in Q4’23:

- Canada funding grew 20% QoQ to $1.2B

- LatAm funding fell 33% QoQ to $0.8B

- Oceania funding held steady at $0.7B

- Africa funding slipped to $0.3B, down 40% QoQ

Venture investors are now being much more sparing with their dry powder than they were in the FOMO-driven tech boom of 2021/early 2022. They’ve also doubled down on due diligence, which is driving up the time it takes to close any one deal.

All this has taken a toll on the US venture market. In Q4’23, total deals to US-based companies slipped to a 10-year low of 2,182 deals.

Investors are also shifting their portfolios toward early-stage companies. Across 2023, early-stage deal share hit a recent high of 65% in the US. In Silicon Valley, that level was up to 74%, or roughly 3 in 4 deals.

Among US metros, Silicon Valley still reigns supreme, consistently accounting for 20%+ of US deals every year for the past decade. This figure has trended down slightly over time, but Silicon Valley’s share is still over 7 percentage points higher than that of New York, the next-largest metro for deal volume.

It’s not all doom and gloom. Among the sectors we analyzed, retail tech and fintech saw equity funding increase by double-digit percentages in Q4’23.

Fintech also saw 8 new unicorns in Q4’23 — more than retail tech (3) and digital health (2) combined.

However, alongside digital health, fintech and retail tech both saw a double-digit percentage drop in deal volume in Q4’23, pointing to a broader pullback in investor attention.

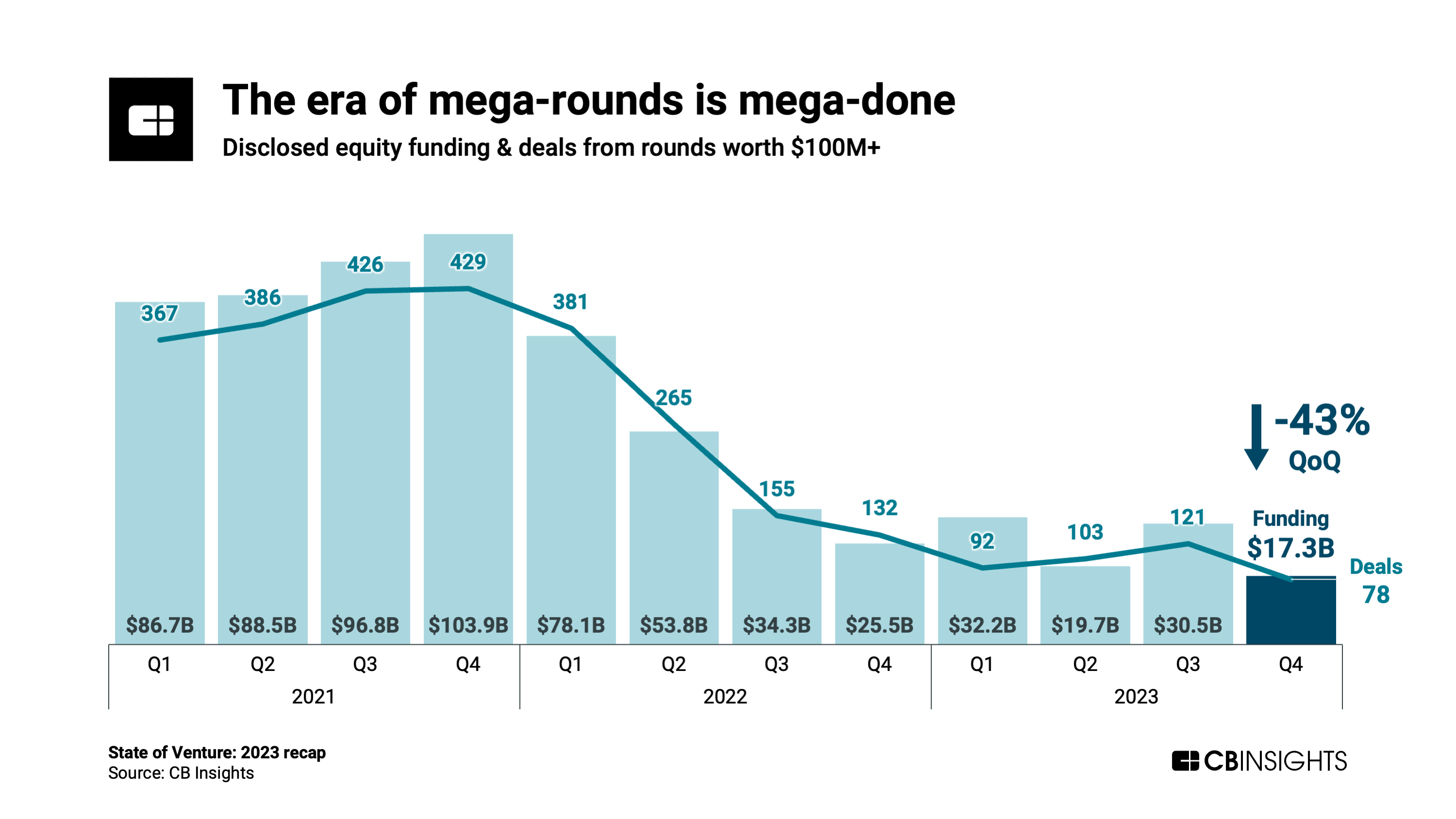

One of the biggest shocks to the venture system has been the decline of massive funding rounds. Mega-rounds (deals worth $100M+) were a hallmark of 2021, with 350+ occurring each quarter.

In Q4’23, that figure fell to just 78 — the lowest level since 2017. Unsurprisingly, mega-rounds now account for a significantly smaller share of overall funding. In Q4’23, this came in at 34%, tied for the lowest level since 2014.

Notably, investors like Tiger Global Management and SoftBank, which plied late-stage startups with mega-rounds in 2021, have pulled back dramatically on their dealmaking.

The drop in mega-rounds, which have historically gone to later-stage companies, has also had the effect of vastly reducing the median late-stage deal size. This has fallen by over 50% since 2021 to reach just $21M in 2023.

Mid-stage median funding hasn’t fallen as much since 2021, though it did see a greater drop YoY (down 25%).

Meanwhile, the median early-stage deal size was relatively resilient in 2023, holding steady at $2M.

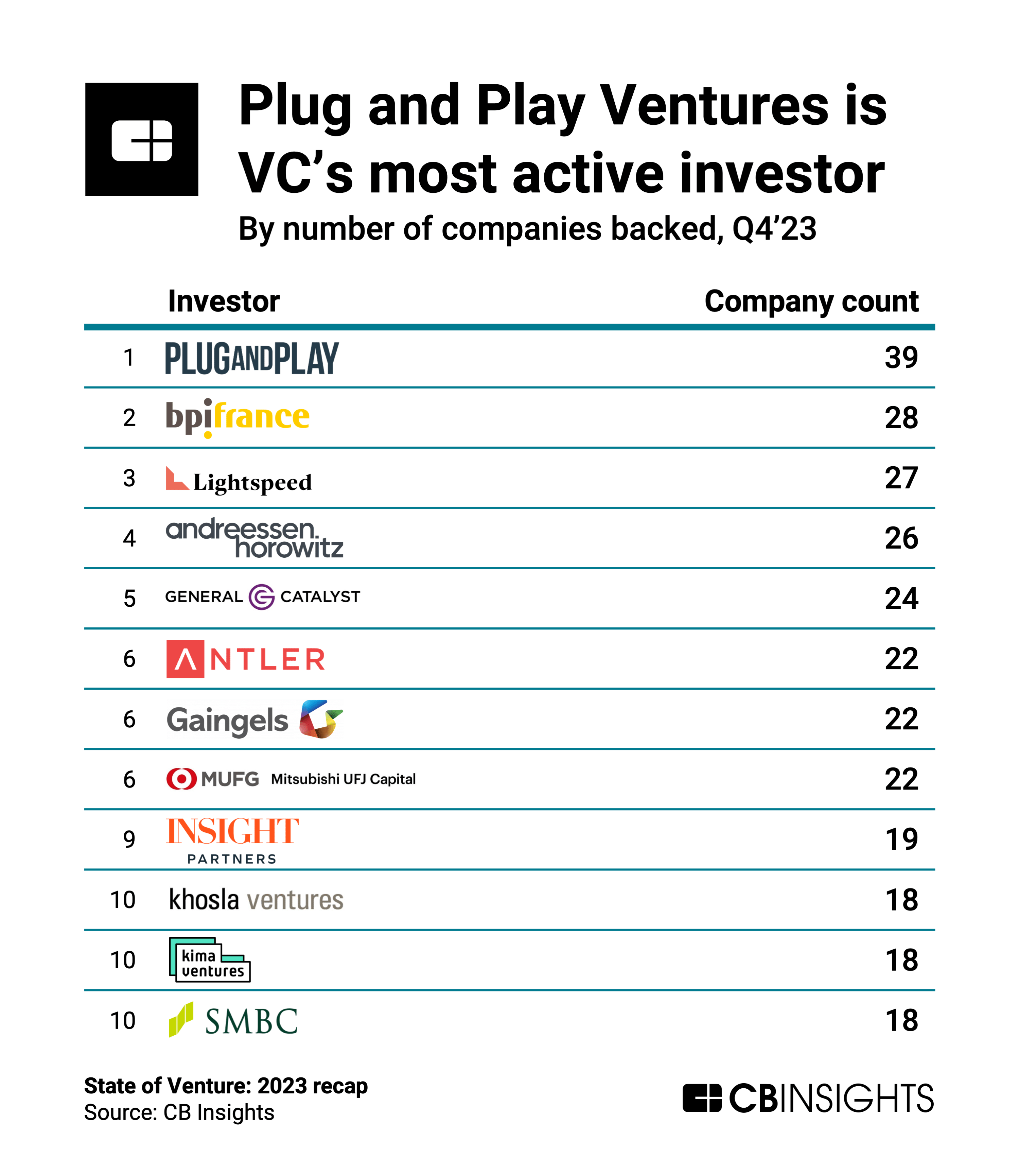

Plug and Play’s venture arm, Plug and Play Ventures, topped the list of most active investors in Q4’23, backing 39 unique companies. It was followed by France-based asset manager Bpifrance with 28.

Meanwhile, two corporate VCs (CVCs) made the top 10: Mitsubishi UFJ Capital (22 companies) and SMBC Venture Capital (18). Both are venture arms of Japanese banks.

There are also some notable absences from the list of most active investors, such as Tiger Global and SoftBank. These 2 crossover investors were everywhere in 2021, when they backed over 500+ equity deals between the two of them. In all of 2023, they did less than one-tenth of that, backing 46 deals.

At 70%, early-stage rounds (seed/angel and Series A) in 2023 tied the previous year for the highest deal share in over a decade.

In the past 2 years, some investors have pivoted to focus more on early-stage companies, which are arguably more protected from market volatility than late-stage companies closer to the point of exiting.

Meanwhile, other investors have doubled down on an existing early-stage focus. Several of the top investors in Q4’23 — including Plug and Play Ventures (No. 1 ranking), Antler (No. 6), and Gaingels (No. 6) — work primarily with early-stage companies.

Parallel to this, we’re seeing YoY growth in activity from the world’s top accelerators.

Europe edged out the US to maintain its lead in exit share (39%) for a fifth straight quarter. The continent primarily sees M&A deals worth less than $1B, while deals any larger than that are concentrated in the US or Asia.

Europe also reached a recent high in its quarterly share of global equity deals, at 25%.

The steady stream of M&A deals continued in 2023, which saw over 8,000 deals — the third-highest level on record, following each of the previous 2 years. This comes as many startups run out of cash runway and as tech buyers with stronger balance sheets look to capture market share.

However, billion-dollar M&A deals are few and far between, with just 8 such exits in Q4’23. The top 2 deals went to pharma incumbent Roche, which acquired therapeutics developers Telavant ($7.3B valuation) and Carmot Therapeutics ($3.1B).

Notably absent from the top M&A deals table is big tech. Increasing regulatory scrutiny has quieted many of the historically acquisitive tech giants, with the recently scrapped Adobe-Figma deal throwing on even more cold water. Overall, the pullback has restricted a potential exit route for startups.

Globally, 2023 saw just 170 VC-backed IPOs — the fewest in a decade. The vast majority of these came from Asia, with around half of them going to China-based companies.

Even for those companies that did make their debut, it sometimes came at a cost. The top-valued IPO in Q4’23, for instance, went to Indonesia-based J&T Express, which was previously backed by Boyu Capital, Tencent, and Temasek, among others. It grabbed a $13.5B valuation, down from its $20B valuation in 2021.

Just a fraction of 2023 IPOs went to US companies. Many investors hoped the September IPOs of former tech unicorns Instacart and Klaviyo would trigger a rush of other IPO filings, but these stocks’ underwhelming performance may have intimidated hopeful candidates in the near term.

However, a recent stock rally for chip designer Arm, which also went public in September, could encourage others to follow, especially as tech stocks continue to post strong results more broadly.

The largest equity deals in Q4’23 reflect 2 central focus areas for venture investors at the moment: generative AI and sustainability-focused tech.

In sustainability, the focus is on renewable energy (Envision Group’s $1B Series B; Electric Hydrogen’s $380M Series C) and sustainable packaging (Footprint’s $830M round).

In genAI, all 3 top deals went to large language model (LLM) developers, with 2 of these (Aleph Alpha and Mistral AI) building European competitors to OpenAI.

2023 saw just 71 new unicorns (private companies reaching the $1B+ valuation mark) — a precipitous drop from the year prior.

On a quarterly basis, Q4’23 saw 23 new unicorns, reflecting a 64% increase QoQ from Q3’s 14. Even so, this figure remains far below even pre-pandemic levels.

In Q4’23, the US contributed 10 of the 23 new unicorns, followed by Asia with 7. Notably, MENA saw an uptick in new unicorns, with Saudi Arabia-based fintech companies Tabby and Tamara, as well as UAE-based blockchain platform Andalusia Labs, all hitting $1B+ valuations.

We dig into the future of the unicorn club here.

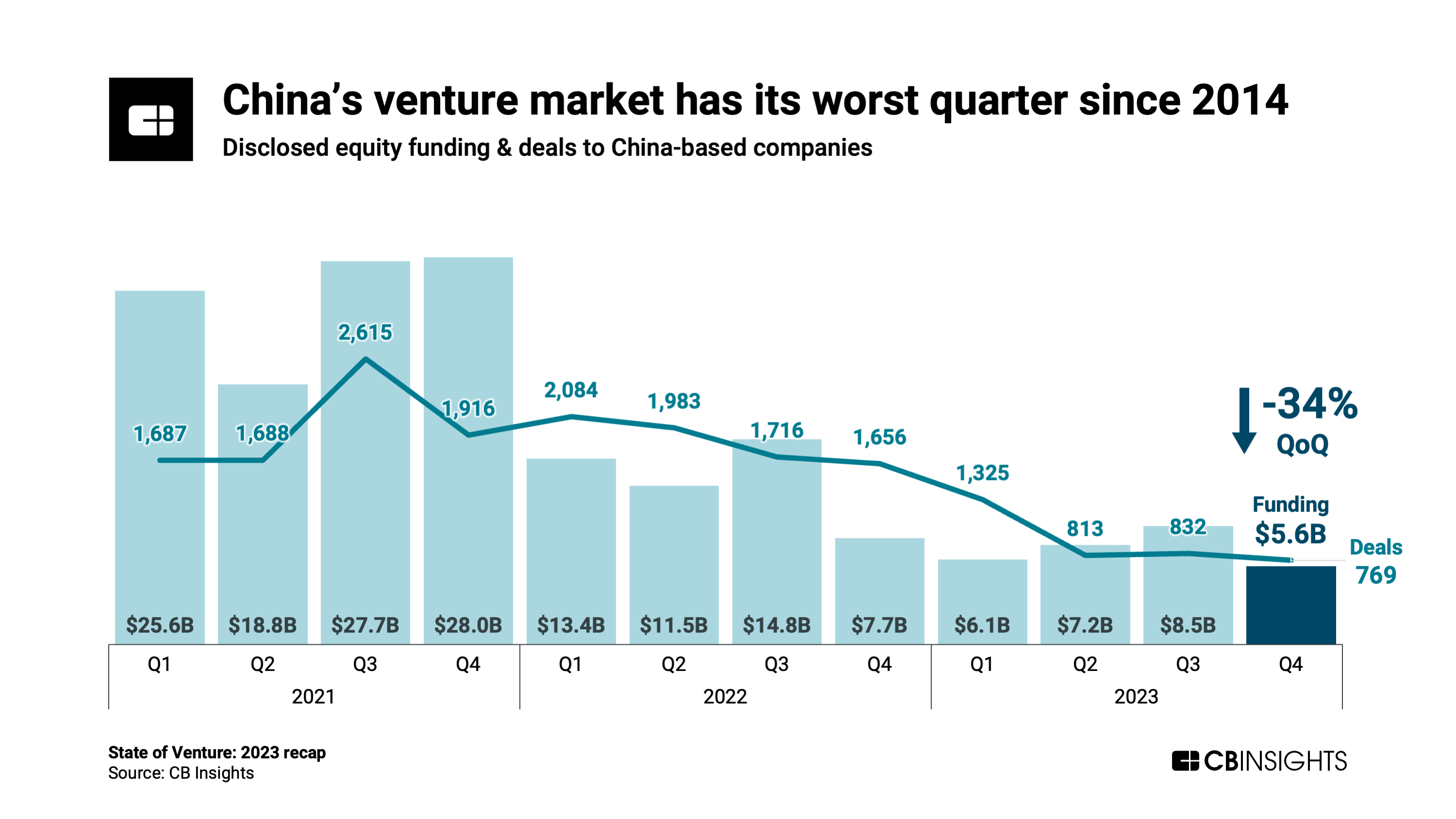

Despite a $1B round for Envision Group, quarterly funding to China-based companies reached its lowest figure since 2014 in Q4’23. The same was true of deal volume.

In the past couple of years, China’s tech market has been squeezed by stringent domestic regulations, escalating geopolitical tensions, and a pessimistic economic outlook.

However, China’s tech firms are betting big on generative AI to give them a competitive edge.

Tech firm Baidu announced last week that its Ernie chatbot, a competitor to ChatGPT, had reached 100M users. And China saw 2 generative AI companies reach unicorn status in Q4’23: 01.AI and Baichuan AI. Both companies are large language model (LLM) developers that have released open-source models.

If you aren’t already a client, sign up for a free trial to learn more about our platform.