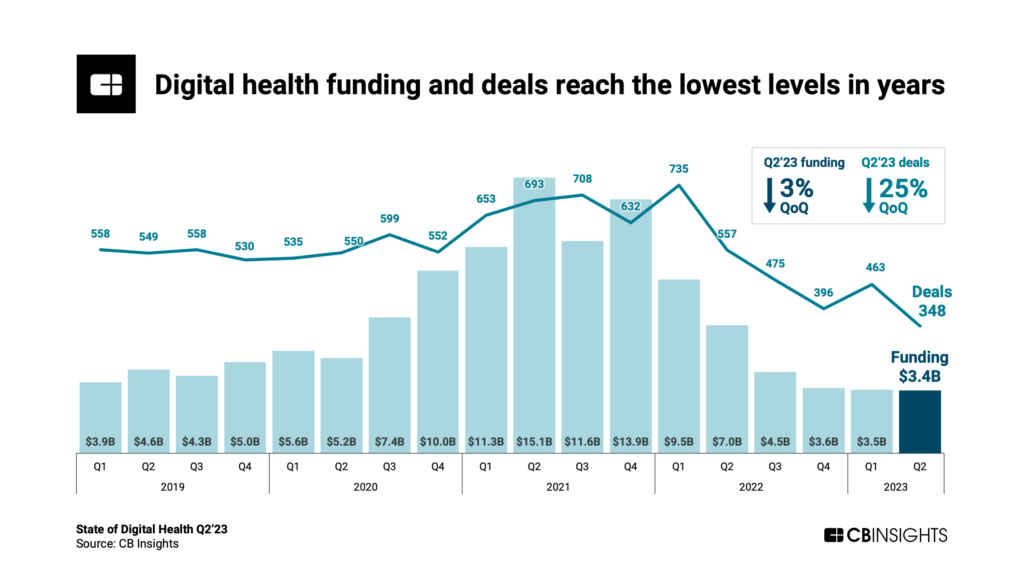

Global digital health funding ticks down to $3.4B, its lowest quarterly level since Q3’17.

In Q2’23, global digital health funding slipped for the sixth straight quarter, while deals reached an 8-year low. However, investors continue to back promising startups, with Q2 seeing upticks in early-stage deal sizes and mega-round deals.

Using CB Insights data, we highlight key takeaways from our State of Digital Health Q2’23 Report, including:

- Global digital health funding and deals fall to their lowest levels in years.

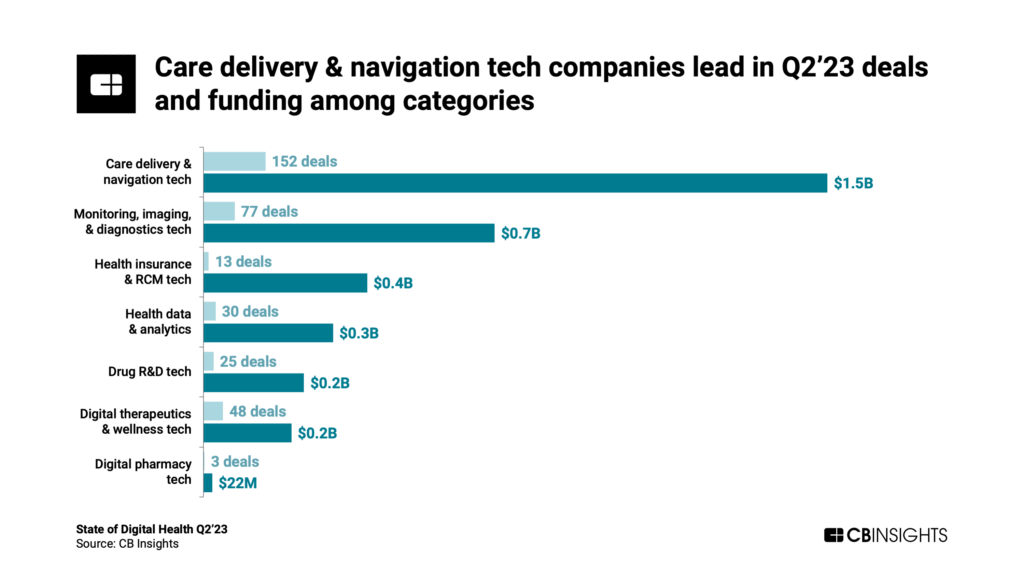

- Care delivery & navigation tech companies lead among categories in both deals and funding.

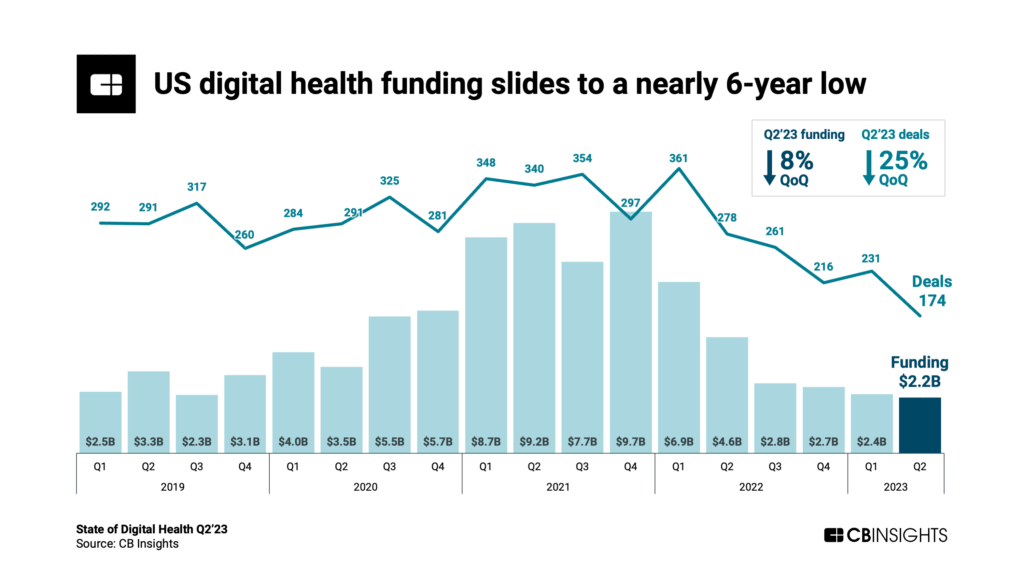

- US digital health funding drops to its lowest point since Q3’17.

- The median deal size for early-stage rounds ticks up.

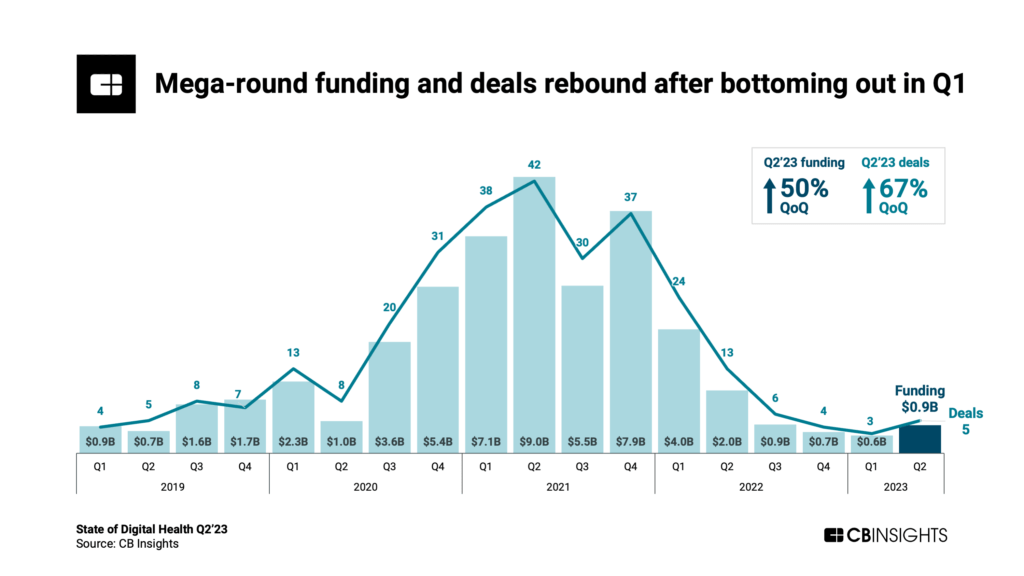

- Mega-round funding and deals increase for the first time since Q4’21.

CB Insights clients can sign in and download the full report to see all the latest funding trends in digital health.

Let’s dive in.

Global digital health funding ticked down 3% QoQ, from $3.5B in Q1’23 to $3.4B in Q2’23. Although digital health funding has remained relatively flat over the past 3 quarters, Q2’23 still saw funding reach its lowest level since Q3’17.

For comparison, global venture funding fell 13% QoQ. Other sectors saw more significant declines: Retail tech funding fell 24% QoQ, while fintech funding fell 48% QoQ.

Digital health deals dropped 25% QoQ, from 463 in Q1’23 to 348 in Q2’23. Deal count reached its lowest level since Q2’15, 8 years ago.

Care delivery and navigation tech companies accounted for 44% of funding and the same proportion of deals in Q2’23. Six of the quarter’s top 10 deals went to companies in the care delivery and navigation tech category.

Additional category highlights include:

- Health insurance and RCM tech saw the largest Q2 digital health deal: Aledade‘s $260M Series F.

- Digital therapeutics and wellness tech saw the lowest average disclosed deal size ($6.1M). 71% of the category’s deals were early-stage — more than any other category.

US digital health funding fell to its lowest level since Q3’17, dropping 8% QoQ from $2.4B in Q1’23 to $2.2B in Q2’23. Deal count fell below 200 for the first time in years.

Despite the funding drop, US-based digital health startups continued to account for the majority (65%) of global funding in Q2’23.

The top investors for the quarter — Andreesen Horowitz, Flare Capital Partners, Frist Cressey Ventures, and SOSV — are all based in the US. Each invested in 4 digital health companies in Q2’23.

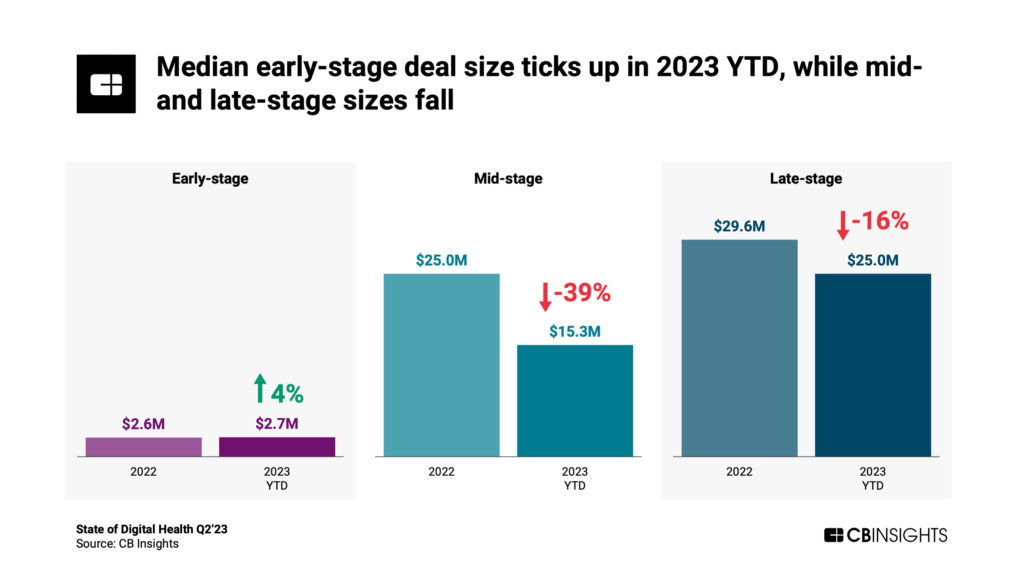

The median digital health deal size is down 10% this year, from $4M in full-year 2022 to $3.6M in 2023 YTD.

Although the median deal size for early-stage rounds has ticked up 4% in 2023 YTD, median mid- and late-stage deal sizes have seen double-digit percentage declines.

Median deal sizes are also down across all investor groups in 2023 so far, with the largest drops among asset and investment managers (down 42%) and corporate venture capital firms (down 35%).

Mega-round deals and funding increased for the first time since Q4’21 — a stark contrast to the broader venture environment, where mega-round funding decreased 27% QoQ.

Q2’23 saw $906M in digital health mega-round funding across 5 deals: Aledade ($260M), HeartFlow ($215M), Strive Health ($166M), Saluda Medical ($150M), and Author Health ($115M). All 5 of these companies, with the exception of Australia-based Saluda Medical, are based in the US.

These 5 deals accounted for 26% of the sector’s total funding in Q2’23 — the highest percentage since Q2’22.

CB Insights clients can see all the latest investment data by signing in and downloading the full State of Digital Health Q2’23 Report using the sidebar.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.